In a share-based payment transaction, an entity acquires goods or services from a counterparty. In return, the entity provides either equity instruments or cash equivalent to the value of these equity instruments. This value can be based on the entity’s own equity instruments or those of another entity within the same group.

There are three main types of share-based payment transactions within the scope of IFRS 2. These include:

- Equity-settled share-based payment transactions,

- Cash-settled share-based payment transactions, and

- Share-based payment transactions with cash alternatives.

IFRS 2 is also applicable to group arrangements where the entity receiving the goods or services is different from the one settling the transaction.

The majority of share-based payment transactions aim to improve compensation packages of employees, particularly those in senior positions. Nonetheless, external parties, such as vendors, can also be counterparties in these transactions. When awarding employees, the value of a share-based payment transaction is measured at the date the transaction was agreed upon, a principle known as ‘grant date accounting’. In contrast, transactions with non-employees are measured at the date when the entity receives the corresponding goods or services.

The timing for recognising the cost of goods or services in a share-based payment transaction depends on the notion of ‘vesting’. A share-based payment transaction becomes vested when the counterparty’s entitlement is no longer contingent on fulfilling any vesting conditions, such as service or performance requirements. The cost is recognised over the vesting period, which is the timeframe required to fulfil all vesting conditions related to the share-based payment arrangement.

Let’s delve deeper.

--Are you tired of the constant stream of IFRS updates? I know it's tough! That's why I created Reporting Period – a once-a-month summary for professional accountants. It consolidates all essential IFRS developments and Big 4 insights into one readable email. I personally curate every issue to ensure it's packed with the most relevant information, delivered straight to your inbox. It's free, with no spam, and you can unsubscribe with just one click. Ready to give it a try?

Principles for recognising share-based payment transactions

Entities recognise goods or services acquired in a share-based payment transaction as and when they are received. The application of other IFRS determines whether the entities should recognise an expense or an asset as a result of goods or services received (IFRS 2.7-9).

Recognising equity-settled share-based payment transactions

Defining equity-settled share-based payment transactions

Equity-settled share-based payment transactions involve an entity receiving goods or services in return for its own equity instruments, such as shares or options. Transactions settled by another entity (e.g., a parent) are also considered as equity-settled from the perspective of the entity that receives goods or services (see Group arrangements).

General recognition principles

Goods or services received in equity-settled share-based payment transactions are measured at their fair value unless it can’t be reliably estimated (for example, in arrangements with charities). In such instances, the fair value of goods or services is determined with reference to the fair value of the equity instruments granted. Specifically, IFRS 2 presumes that employee services received in a share-based payment transaction should be recognised based on the fair value of the equity instruments granted, as it isn’t possible to reliably estimate and differentiate services received in exchange for equity instruments from services received for other types of remuneration (IFRS 2.10-13A). IFRS 2 uses the term ’employees and others providing similar services’ to also include individuals who work for the entity in a manner akin to legally or tax recognised employees (IFRS 2 Appendix A).

From a profit or loss standpoint, it doesn’t matter whether an entity issues new equity instruments or repurchases them on the market to fulfil its obligations from share-based payment arrangements. The credit entry is further discussed below.

Measurement date and grant date

The measurement date is the date at which an entity acquires goods or services or, specifically for transactions with employees, the grant date. It is the date where the fair value of the equity instruments granted is measured (refer to detailed definitions in Appendix A to IFRS 2). The grant date exhibits the following features:

- Both parties have agreed to a share-based payment arrangement and its terms (at times, the agreement may be implicit, meaning no documents need signing), and

- All necessary approvals have been obtained (e.g., endorsement by shareholders or the supervisory board).

Arrangements with employees often have a mandatory service period spanning a few years, but the fair value of equity instruments is fixed at the grant date and remains unchanged thereafter. It’s crucial to note that:

- Goods or services acquired in a share-based payment transaction should be recognised as they are received, and

- The grant date is solely the measurement date.

Thus, it’s possible that the grant date might be established after employees have commenced rendering services in exchange for equity instruments, as illustrated below (IFRS 2.IG4).

Example: Grant date

On 1 January 20X1, the management board of Entity A announced a share award plan to its employees, providing all terms and conditions. The vesting period for this plan is 3 years. The announcement also clarified that this share award plan required approval by the supervisory board, which it received on 20 February 20X1.

In this example, although the grant date is 20 February, the expense is recognised starting from 1 January 20X1. The fair value of equity instruments, used as the basis for recognising the relevant expense, is estimated on 1 January before it is known (and updated) on 20 February.

Credit entry and allocation within equity

For equity-settled share-based payment transactions, the credit entry is made to equity. While IFRS 2 does not specify which part of equity should receive this credit, it allows for transfers within equity. The method adopted by an entity often depends on national laws, which may establish rules regarding the presentation of items within equity (e.g., separate presentation of share capital equal to the face value of issued shares).

Some entities create a specific reserve within equity, labelled ‘share-based payments’, where all credit entries are made. Alternatively, some entities record the credit entry directly in retained earnings. This latter approach is often more practical in the long term, as entities won’t be left with a separate equity item relating to arrangements that concluded many years prior to the reporting period:

If actual shares are issued, or previously acquired treasury shares are passed on to employees, reclassification within share capital, treasury shares, and a separate share-based payment reserve will be necessary.

Regardless, IFRS 2.23 mandates that the total equity cannot change after the vesting date. This approach may seem counter-intuitive in some cases, such as share options that were granted to employees and vested, but were never exercised. However, the expiry of share options does not alter the fact that they are financial instruments that were issued to employees in exchange for their services. Therefore, a related expense cannot be reversed at a later date (IFRS 2.BC218-219).

Treatment of reload features

When estimating the fair value of granted options, reload features are not considered. If a reload option is granted, it is treated as a new option grant (IFRS 2.22).

Vesting and non-vesting conditions in equity-settled share-based payment transactions

Summary of vesting conditions – decision tree

The provisions for treatment of vesting conditions in equity-settled share-based payment transactions are summarised in the decision tree below (further discussion follows).

Furthermore, IFRS 2.IG24 provides a useful table that categorises various vesting and non-vesting conditions, supplemented with examples.

Vesting conditions and vesting period – definitions

Before delving into vesting and non-vesting conditions, let’s briefly revisit the definitions provided in Appendix A to IFRS 2:

To vest: To become an entitlement. In a share-based payment arrangement, a counterparty’s right to receive cash, other assets or equity instruments of the entity vests when the counterparty’s entitlement is no longer conditional on the satisfaction of any vesting conditions.

Vesting condition: A condition that determines whether the entity receives the services that entitle the counterparty to receive cash, other assets, or equity instruments of the entity under a share-based payment arrangement. A vesting condition can either be a service condition or a performance condition.

Vesting period: The period during which all specified vesting conditions of a share-based payment arrangement need to be satisfied.

Performance condition: A vesting condition that requires:

- the counterparty to complete a specified period of service (i.e., a service condition), which can either be explicit or implicit, and

- the achievement of specified performance targets while the counterparty is delivering the required service.

A performance target can be defined with reference to:

- the entity’s own operations (or activities) or the operations or activities of another entity in the same group (i.e., a non-market condition), or

- the price (or value) of the entity’s equity instruments or the equity instruments of another entity in the same group, including shares and share options (i.e., a market condition).

Service condition: A vesting condition that requires the counterparty to complete a specific service period during which services are provided to the entity. If the counterparty stops providing service during the vesting period, for any reason, the condition has not been satisfied. A service condition does not require meeting a performance target.

Immediate vesting

When equity instruments vest immediately, entities should presume (unless there’s contrary evidence) that all services have been received. As a result, on the grant date, entities should recognise the services received with a corresponding increase in equity (IFRS 2.14).

Non-market vesting conditions

When vesting conditions are present, solely as service conditions, the share-based payment transaction is recognised gradually over the vesting period. Service conditions do not impact the fair value of the granted instruments. Rather, they’re factored in by adjusting the number of equity instruments included in the measurement of the transaction, with this estimate being revised at every reporting date. Essentially, an entity makes an informed estimate of the number of equity instruments expected to vest, updating this estimate with each reporting date. As a result, by the end of the vesting period, the cumulative expense only relates to instruments for which non-market vesting conditions have been met (IFRS 2.19-20).

If vesting conditions are performance-based, the recognition approach depends on whether these are market or non-market targets. Non-market performance conditions (e.g. a minimum revenue growth target for the entity over the next 3 years) are treated similarly to service conditions. The vesting period is sometimes apparent, but there are instances where entities need to estimate it based on the performance target (i.e. the duration required to achieve a target). Such an estimate is then revised based on actual data. Importantly, a performance condition must coexist with a service condition that lasts until the end of the performance period. For example, a condition requiring the entity’s profits to grow by 15% over a 2-year period, without a stipulation for the employees to remain employed throughout that 2-year period, constitutes a non-vesting condition.

Like in service conditions, the cumulative expense is recognised only for those instruments where non-market performance conditions have been met (IFRS 2.19-20).

Market vesting conditions

Performance targets that are market conditions (e.g. the entity’s share price will surpass $100 by a specified year) are considered when estimating the fair value of the granted equity instruments. As a result, they’re disregarded when estimating the number of equity instruments expected to vest. The fair value cannot be subsequently adjusted if the likelihood of fulfilling market conditions increases or decreases. Goods or services are recognised either immediately or during the vesting period (if there are other vesting conditions), regardless of whether the market condition is eventually fulfilled. Consequently, a scenario might arise where an entity recognises an expense related to share-based payments, even if no instruments ultimately vested because the market condition was not met (IFRS 2.21). This approach to market conditions might seem counterintuitive, but it originates from the ‘grant date approach’ adopted by IFRS 2, which stipulates that equity instruments cannot be remeasured after initial recognition.

Examples of market and non-market vesting conditions

Example: Share-based payment with service vesting condition and market condition

On 1 January 20X1, Entity A grants 100 shares to each of its 200 employees under two vesting conditions:

- Service condition lasting three years, and

- Company’s share price must increase by at least 20% compared to the grant date after the three-year period.

At the grant date, the fair value of the granted shares is estimated at $30 each. This value does not account for the three-year service condition, but it does consider the market vesting condition relating to share price. Entity A estimates that 90% of the 200 employees will fulfil the service condition. To summarise:

- Total employees: 200

- Number of shares per employee: 100

- Fair value of shares at grant date (accounting for market vesting condition): $30

- Duration of service condition: 3 years

- Estimated percentage of employees expected to meet the service condition: 90%

All calculations used in this example are available for download in an Excel file.

Year 20X1

During the first year, Entity A recognises the share-based payment transaction as follows:

| DR | CR | |

| Employee benefits expense | 180,000 | |

| Equity | 180,000 |

Please note that the market vesting condition is not considered when estimating the number of share options expected to vest. Instead, it affects the fair value of the share options.

Year 20X2

On 31 December 20X1, the shares of Entity A experience a price drop in the stock market, and the fair value of share options reduces to $20. However, the decrease in the fair value of share options does not affect the recognition of the share-based payment transaction as it is a market vesting condition. It was already factored into the estimated fair value of share options at the grant date, which isn’t subsequently remeasured.

Moreover, only 2% of employees left during 20X1. Therefore, Entity A adjusts its original estimate, predicting that now 190 employees (95% of the initial 200) are expected to meet the service condition.

Entries for year 20X2 are as follows:

| DR | CR | |

| Employee benefits expense | 200,000 | |

| Equity | 200,000 |

Year 20X3

This year marks the end of the service condition period. Only 186 employees (93% of the original 200) remain with the company after three years. The share price on 31 December 20X3 was only 15% higher compared to the grant date, so employees didn’t receive any shares. Nonetheless, the expenses recognised during years 20X1 and 20X2 aren’t reversed since the condition related to the 20% share price increase was considered when estimating the fair value at the grant date (being a market condition). The fair value of granted instruments isn’t remeasured after the grant date, and the recognition of share options isn’t reversed.

Entity A recognises the expense for the third year, updated with the actual number of employees who met the service condition:

| DR | CR | |

| Employee benefits expense | 178,000 | |

| Equity | 178,000 |

In summary, the cumulative expense recognised over these three years totals $558,000 and can be calculated as follows:

186 employees that met the service condition x 100 instruments per employee x $30 of fair value of instruments at grant date = $558,000

Example: Share-based payment with non-market performance vesting condition and flexible vesting period

On 1 January 20X1, Entity A commits to issuing 100 shares each to its 200 employees once their new product X reaches 1 million customers. However, if this target isn’t achieved by 31 December 20X4, no shares will be issued. Additionally, to qualify for the shares, employees must remain employed with Entity A when the target is achieved.

The fair value of one share is estimated at $30. This estimation doesn’t consider the vesting conditions, as they’re non-market conditions.

Entity A predicts on 1 January 20X1 that they will reach the 1 million customer target by 31 December 20X3. They also estimate that 170 employees (i.e., 85%) will still be with the company at this time.

Here’s a summary:

- Number of employees: 200

- Number of shares per employee: 100

- Fair value of shares at grant date: $30

- Estimated vesting period: 3 years

- Estimated percentage of employees likely to meet the service condition: 85%

You can download all the calculations used in this example in an Excel file.

Year 20X1

During the first year, Entity A accounts for this share-based payment transaction as follows:

| DR | CR | |

| Employee benefits expense | 170,000 | |

| Equity | 170,000 |

Year 20X2

The customer base grows slower than expected, so Entity A now forecasts that they’ll reach the target a year later, on 31 December 20X4. There are no changes to the employee turnover projections. The entry for the year 20X2 is as follows:

| DR | CR | |

| Employee benefits expense | 85,000 | |

| Equity | 85,000 |

Year 20X3

No changes occur in the assumptions in the third year. Entity A recognises the expense for this year as follows:

| DR | CR | |

| Employee benefits expense | 127,500 | |

| Equity | 127,500 |

Year 20X4

The vesting condition relating to the number of customers is met on 31 December 20X4, resulting in employees receiving their shares. There was very little employee turnover in 20X4, so a total of 180 employees (90% of those employed at the grant date) received shares. The entries for the final year are as follows:

| DR | CR | |

| Employee benefits expense | 157,500 | |

| Equity | 157,500 |

Please note that any changes in the fair value of shares after the grant date have no effect on the recognised expense. This is because the fair value of equity instruments is not recalculated subsequently.

In conclusion, the cumulative expense recognised over these four years totals $540,000 and can be summarised as follows:

180 employees that met the service condition x 100 instruments per employee x $30 of fair value of instruments at grant date = $540,000.

Example: Share-based payment with market performance vesting condition and flexible vesting period

On 1 January 20X1, Entity A pledges to award 100 shares to each of its 200 employees, contingent on the share price of Entity A reaching $50. If this target is not met by 31 December 20X4, no shares will be allocated. To qualify for the share grant, employees must still be in employment with Entity A when this target is achieved.

According to the fair value valuation prepared by Entity A, the likely date when the price target will be achieved is 31 December 20X3. The estimated fair value of each granted share is $30, which factors in the market vesting condition, i.e., the vesting share price target. Entity A anticipates that 180 employees (i.e., 90%) will remain employed at 31 December 20X3.

In summary:

- Employee count: 200

- Share allocation per employee: 100

- Share fair value at grant date: $30

- Estimated vesting period: 3 years

- Estimated percentage of employees meeting the service condition: 90%

All calculations in this example are available for download in an Excel file.

Years 20X1-2

During the first two years, no changes in assumptions occur and Entity A recognises this equity-based compensation as follows:

| DR | CR | |

| Employee benefits expense | 180,000 | |

| Equity | 180,000 |

Please note that the aforementioned entry is recognised each year (i.e., the amount shown relates to one year only).

Year 20X3

The share price target is not achieved during 20X3. However, this does not impact the recognition, as the estimate of the expected vesting period duration, based on the market performance condition, cannot be subsequently revised (IFRS 2.15b). Furthermore, the actual number of employees who met the service condition during the estimated vesting period was 184 (92%).

Entity A recognises the final year of the expected vesting period (even though the share price target was not achieved), adjusting only for the number of employees who fulfilled the service condition during the estimated vesting period. As a result, the accounting entry for year 20X3 is as follows:

| DR | CR | |

| Employee benefits expense | 192,000 | |

| Equity | 192,000 |

Year 20X4

The share price target is also not achieved during 20X4. Hence, no shares will be granted to employees. On 31 December 20X4, 176 employees (88%) remain in the company’s employ. However, these developments do not impact the recognition, as the estimate of the expected vesting period duration, based on the market performance condition, cannot be subsequently revised (IFRS 2.15b). Thus, regardless of the happenings in 20X4, Entity A will not make any entries for this year.

Interestingly, it is unclear what the procedure should be in the opposite scenario, i.e., when the $50 share price target is met earlier than estimated, for instance, in year 20X2.

On one hand, IFRS 2 dictates that the estimate of the expected vesting period duration, based on the market performance condition, cannot be subsequently revised. On the other hand, expenses related to fully vested awards should be recognised immediately. In my view, if the market vesting condition is fulfilled sooner than originally estimated, it should result in accelerated recognition of the expense.

Example: Share-based payment with variable awards based on market vesting conditions

On 1 January 20X1, Entity A commits to awarding 100 shares each to its 200 employees if the company’s share price surpasses $10 by 31 December 20X2, or 150 shares if the share price exceeds $15 at the same date. To receive these shares, the employees must remain in the employ of Entity A until 31 December 20X2. The fair value of a share with a market vesting condition of a target price of $10 is $7, which decreases to $4 with a target price of $15.

In summary:

- Number of employees: 200

- Number of shares per employee if the share price reaches $10 or more: 100

- Number of shares per employee if the share price reaches $15 or more: 150

- Fair value of a share with a market vesting condition of a target share price at $10 or more: $7

- Fair value of a share with a market vesting condition of a target share price at $15 or more: $4

- Estimated percentage of employees meeting the service condition: 90%

The recognition of such equity-based compensation with variable rewards is based on 150 shares per employee. However, the first 100 shares have a fair value of $7 each and the remaining 50 shares a fair value of $4 each.

All calculations used in this example are available for download in an Excel file.

Year 20X1

In the first year, Entity A recognises this share-based compensation as follows:

| DR | CR | |

| Employee benefits expense | 81,000 | |

| Equity | 81,000 |

Year 20X2

As the share price is $9 by 31 December 20X2, no shares are awarded to employees. 92% of employees remain with the company as of 31 December 20X2. The failure to meet the market vesting condition (i.e., target share price) does not affect the recognition of the equity-based compensation. This was factored into the estimated fair value of share options at the grant date, which is not subsequently remeasured. The entity adjusts the recognition to account only for the percentage of employees who meet the service condition. The entries recognised during 20X2 are as follows:

| DR | CR | |

| Employee benefits expense | 84,600 | |

| Equity | 84,600 |

Non-vesting conditions

Non-vesting conditions are treated similarly to market vesting conditions, meaning they are included in the fair value of equity instruments granted and goods or services are recognised immediately or during the vesting period (if vesting conditions are present) regardless of whether the non-vesting condition is ultimately met (IFRS 2.21A). Notably, IFRS 2 does not provide a definition of a non-vesting condition. However, IFRS 2.BC364 does state that a non-vesting condition is any condition that does not determine whether the entity receives the services that entitle the counterparty to receive cash, other assets, or equity instruments of the entity under a share-based payment arrangement. Examples of non-vesting conditions include targets based on a commodity index, specified payments towards a savings plan during the vesting period, continuation of the plan by the entity, non-compete clause, and transfer restrictions.

As discussed below, if an entity or a counterparty can choose whether to meet a non-vesting condition, the failure to meet that non-vesting condition during the vesting period is treated as a cancellation (IFRS 2.28A).

Modifications, cancellations and settlements

The procedures for modifications, cancellations, and settlements are outlined in paragraphs IFRS 2.26-29, B42-B44. In essence, the cumulative expenses recognised for equity-settled share-based payment transactions cannot be reduced following adjustments, cancellations, or settlements. Put simply, entities can only increase expenses, which typically occurs when modifications, cancellations, or settlements are advantageous to employees (or another counterparty).

In the event of a modification that increases the fair value of granted equity instruments, as measured immediately before and after the modification, the quantity of these instruments, or both (including substituting old instruments with new ones), there is an increased expense. This is recognised over the remaining vesting period, in addition to the original expense. If the modification takes place after the vesting date, any additional expense is recognised instantly.

A change in vesting conditions that benefits employees should be treated as a revision to the number of instruments set to vest. If the change is linked to market conditions, it should be accounted for as a change in the fair value of the granted instruments.

A decrease in the fair value of the granted instruments (including the replacement of old ones with new ones) or a detrimental change in vesting conditions should be disregarded. The entity should then recognise expenses based on the conditions prior to the modification.

If a grant of equity instruments is cancelled (including a reduction in their number) or settled during the vesting period, it should be accounted for as an acceleration of vesting, necessitating the immediate recognition of expenses. Any payment made by the entity at the time of cancellation or settlement is treated as a deduction from equity, unless the payment exceeds the fair value of the granted equity instruments, as assessed at the repurchase date. Any such excess is recognised as an expense. A similar approach should be employed for repurchases of vested instruments.

If an entity or counterparty has the choice of whether to fulfil a non-vesting condition, the failure to meet that condition during the vesting period is regarded as a cancellation (IFRS 2.28A). Examples of such non-vesting conditions include the counterparty’s payment of contributions towards the exercise price, or the entity’s continuation of the plan.

The IFRS 2 approach to modifications, cancellations, and settlements that decrease the benefits may initially seem counterintuitive. However, it stems from the ‘grant date’ approach – once the equity instruments have been granted, their fair value must be recognised over the vesting period (subject to the fulfilment of non-market vesting conditions). This is explained further in Basis for Conclusions paragraphs IFRS 2.BC230-BC235.

Example: Modification of a share-based payment through repricing of options

On 1 January 20X1, Entity A grants 100 share options to each of its 200 employees, with the provision that they remain in its employ until 31 December 20X3. The estimated fair value of these share options stands at $30, excluding the service condition as it is a non-market condition.

In summary:

- Number of employees: 200

- Share options per employee: 100

- Fair value of share options at the grant date: $30

- Vesting period: 3 years

- Estimated percentage of employees expected to fulfil the service condition: 90%

All calculations used in this example can be downloaded in an Excel file.

Year 20X1

Throughout the initial year, Entity A recognises this share-based payment transaction as follows:

| DR | CR | |

| Employee benefits expense | 180,000 | |

| Equity | 180,000 |

Year 20X2

In light of a significant decrease in its share price on the stock market, with the fair value of share options now standing at $15, Entity A decides to reprice the granted share options in order to keep its employees motivated. The fair value of these repriced options is $20, with the estimated percentage of employees expected to fulfil the service condition remaining unchanged.

Entity A continues to recognise the original fair value of the granted share options ($30 per option) as the reduction in fair value cannot be reflected in the accounts (equity instruments issued are not subsequently remeasured). Furthermore, Entity A recognises the additional fair value of $5 ($20 – $15) per option granted in 20X2, over the remaining vesting period.

The entries during the year 20X2 are as follows:

| DR | CR | |

| Employee benefits expense | 225,000 | |

| Equity | 225,000 |

Please note, if Entity A chose to reprice the options downwards, there would be no impact on recognition. That is, Entity A would continue to recognise expenses based on the original fair value of $30 per option.

Year 20X3

With no further repricing, 88% of the employees remain in employment. The entries for the year 20X3 are as follows:

| DR | CR | |

| Employee benefits expense | 211,000 | |

| Equity | 211,000 |

Modifications of share-based payment schemes are seldom a one-way process. More often, they involve a change in the number of equity instruments, complemented by a counterbalancing effect of changes in their fair value. The following example will shed more light on this.

Example: Modification of a share-based payment through repricing of options and changes in their number

On 1 January 20X1, Entity A awards 100 share options to each of its 200 employees, with the condition that they remain employed with Entity A until 31 December 20X3. The fair value of the share options is estimated at $30, excluding the service condition.

In summary:

- Number of employees: 200

- Share options per employee: 100

- Fair value of share options at grant date: $30

- Vesting period: 3 years

- Estimated percentage of employees likely to fulfil the service condition: 90%

All calculations used in this example can be downloaded in an Excel file.

Year 20X1

During the first year, Entity A recognises the share-based payment transaction as follows:

| DR | CR | |

| Employee benefits expense | 180,000 | |

| Equity | 180,000 |

Year 20X2

With its share price significantly reduced on the stock market, fair value of share options falls to $15. To maintain employee motivation, Entity A reprices the granted share options, raising their fair value to $25. Concurrently, Entity A decreases the number of share options to 60 per employee, ensuring the total fair value per employee remains unchanged ($15 x 100 at the modification date = $25 x 60 after modification). The percentage of employees likely to fulfil the service condition remains the same.

There are two potential methods for handling such a modification as illustrated below.

Approach #1 treats a single share option as a unit of account, emphasising the language of paragraphs IFRS 2.B43a and B44b referring to a single equity instrument. In contrast, Approach #2 views the share-based payment arrangement as a unit of account, placing more emphasis on the phrasing in paragraph IFRS 2.27 referring to the total fair value of the share-based payment arrangement.

Approach #1

Entity A recognises:

- A decrease in the number of share options by 40 (from 100 to 60) as a cancellation, speeding up the associated expense recognition.

- The ongoing recognition of the original fair value of $30 per share option for the remaining 60 options over the vesting period.

- Additional expenses for the 60 repriced options, where the fair value increased by $10 (from $15 at the modification date to $25). These expenses are recognised over the remaining vesting period.

The entries made under Approach #1 during the year 20X2 are as follows:

| DR | CR | |

| Employee benefits expense | 144,000 1 | |

| Employee benefits expense | 108,000 2 | |

| Employee benefits expense | 54,000 3 | |

| Equity | 306,000 |

- Acceleration associated with 40 share options.

- Ongoing recognition of the original fair value of $30 per share option for the remaining 60 options over the vesting period.

- Recognition over the remaining vesting period (2 years) of the additional expense for the 60 options that were repriced and their fair value at the modification date increased by $10 (from $15 at the modification date to $25).

Approach #2

Entity A proceeds to recognise the share-based arrangement as if no changes occurred, given the total fair value per employee remained the same at the modification date.

Year 20X3

No further modifications occurred. 88% of employees stayed with the company and fulfilled the service condition. Entries for year 20X3 under Approach #1 are as follows:

| DR | CR | |

| Employee benefits expense | 100,800 1 | |

| Employee benefits expense | 51,600 2 | |

| Equity | 152,400 |

- Continued recognition of the original fair value of $30 per share option for the remaining 60 options over the vesting period.

- Recognition over the remaining vesting period (2 years) of the additional expense for the 60 options that were repriced and their fair value at the modification date increased by $10 (from $15 at the modification date to $25).

As a result, the total expense under Approach #1 equals $638,400, which can be broken down as follows:

- $216,000: Expense related to 40 share options per employee cancelled during the second year (based on the estimated percentage of employees likely to meet the service condition at the cancellation/modification date).

- $316,800: Continued recognition of the original fair value of $30 per share option for the remaining 60 options over the vesting period.

- $105,600: Recognition of the additional expense for the 60 repriced options, where their fair value at the modification date increased by $10 (from $15 at the modification date to $25).

IFRS 2.44A-C provides specific guidance on modifying a share-based payment transaction that changes its classification from cash-settled to equity-settled.

Cash-settled share-based payment transactions

Defining cash-settled share-based payment transactions

Cash-settled share-based payment transactions refer to agreements where an entity acquires goods or services by assuming a liability to transfer cash or other assets. The amount of this liability is determined by the price or value of the entity’s equity instruments or those of another group entity. Share appreciation rights (SARs) and phantom stocks or options are typical examples of such transactions.

Recognising cash-settled share-based payment transactions

The recognition of cash-settled share-based payment transactions is detailed in IFRS 2.30-33D. The criteria for recognition are broadly similar to those for equity-settled share-based payment transactions, but here the credit entry is recognised as a liability rather than as equity. Unlike in equity-settled transactions, this liability, based on the fair value of the instruments granted, is subject to remeasurement at each reporting date. The expense and associated liability are recognised over the vesting period.

The treatment of vesting conditions closely mirrors that of equity-settled transactions. However, given that the liability’s fair value is remeasured at each reporting date, so too is the impact of market vesting conditions and non-vesting conditions. Consequently, the cumulative amount ultimately recognised for goods or services received in a cash-settled share-based payment matches the cash finally paid to the employee (or other goods or services provider). This does not always hold true for equity-settled share-based payment transactions, such as in situations of cancellations or failure to satisfy market vesting conditions.

Share-based payment transactions with cash alternatives

The counterparty has a choice of settlement

Share-based payment transactions, where the terms of the agreement give the counterparty an option to choose between cash and equity settlements, are covered in paragraphs IFRS 2.35-40. Such transactions are quite common, especially in share-based payment arrangements with employees. In these instances, the entity must recognise both debt and equity components separately, observing the respective requirements for cash-settled and equity-settled share-based payment transactions.

For transactions involving parties other than employees, where the fair value of goods or services is measured directly, the entity measures the equity component as the difference between the fair value of the goods or services received and the fair value of the debt component (i.e., the cash alternative), at the date when the goods or services are received.

In transactions where the fair value of goods or services is measured with reference to the issued instruments (usually to employees), entities need to measure the fair value of two components. The measurement process starts with the debt component (i.e., the cash alternative). Then the equity component’s fair value is measured, considering that the counterparty won’t receive cash if they opt for the equity instrument.

Upon settlement, the liability needs to be remeasured to match the payment amount. If the entity issues equity instruments instead of cash payment, the remeasured liability is transferred directly to equity. All previously recognised equity components stay within equity (transfers within equity are permitted).

Example: Share-based payment transaction with cash alternative

On 1 January 20X1, Entity A grants 100 shares to each of its 200 employees, contingent on their continued employment until 31 December 20X3. The shares will be locked-in for an additional two years, meaning employees can’t sell them until 31 December 20X5. Employees also have an option to receive cash instead of shares, referred to as ‘phantom shares’. The payment will be based on the market price of the shares as of 31 December 20X3 and will be made immediately. However, the cash alternative will be based on 80 shares only.

At the grant date, it’s estimated that 90% of 200 employees will meet the service condition. The fair value of the phantom shares granted is $30 (cash alternative), and the fair value of the granted shares is $28 (share alternative).

The measurement of this arrangement begins with the debt component (i.e., cash alternative). Then the fair value of the equity component is measured, considering that the counterparty won’t receive cash if they opt for the equity instrument. The liability component at the grant date is $432,000, while the equity component is $72,000 (all calculations used in this example can be downloaded in an Excel file).

Year 20X1

Entity A starts recognising the expense relating to both components over the vesting period. The entries for year 20X1 are as follows:

| DR | CR | |

| Employee benefits expense | 168,000 | |

| Equity | 24,000 | |

| Liability | 144,000 |

Year 20X2

The market price of Entity A’s shares increases. This change is reflected only in the liability component, which rises to $32. The fair value of equity instruments isn’t subsequently remeasured. The entries for year 20X2 are as follows:

| DR | CR | |

| Employee benefits expense | 187,200 | |

| Equity | 24,000 | |

| Liability | 163,200 |

Year 20X3

By 31 December 20X3, 85% of employees (170) remained in employment. 120 employees chose the share alternative, and 50 employees chose the cash alternative. The market price of shares increased further, so the fair value of cash alternative is now $35.

First, Entity A recognises the expense for year 3, taking into account the actual number of employees who fulfilled the service condition and the final market price of shares (the latter impacts the liability component only). The recognition for year 20X3 is as follows:

| DR | CR | |

| Employee benefits expense | 188,800 | |

| Equity | 20,000 | |

| Liability | 168,800 |

The payment to 50 employees who chose the cash alternative is recognised as follows:

| DR | CR | |

| Cash | 175,000 | |

| Liability | 175,000 |

The issuance of shares to 120 employees who chose the share alternative moves the remaining liability balance to equity:

| DR | CR | |

| Equity | 301,000 | |

| Liability | 301,000 |

The entity has a choice of settlement

The guidelines set forth in IFRS 2.41-43 address share-based payment transactions where the reporting entity has the flexibility to choose the settlement method. In these cases, the entity needs to decide whether to utilise the general equity-settled or cash-settled provisions of IFRS 2. A transaction is treated as cash-settled if any of the following conditions is met:

- Settlement in equity instruments lacks commercial or economic substance.

- Legal or other constraints render settlement in equity instruments unfeasible.

- The entity has a history or declared policy of choosing cash settlement whenever possible.

- The entity has established a constructive obligation to settle in cash.

In all other instances, the transaction is accounted for as equity-settled.

When actual equity instruments are issued, no changes in equity are recognised, except for any necessary transfer within equity. If the entity opts for cash settlement, despite the initial settlement method, the payment is treated as a reduction of equity. However, if at settlement, the entity chooses an alternative with a higher fair value, the difference between the fair values at the settlement date is recognised as an extra expense.

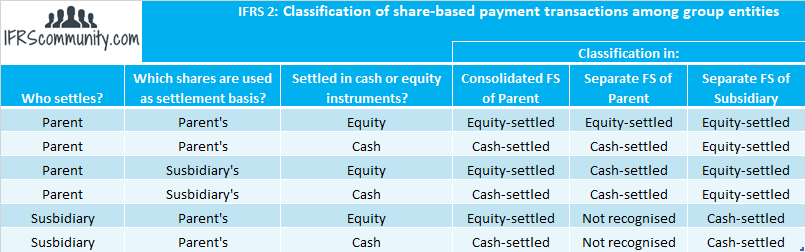

Share-based payment transactions among group entities

IFRS 2.43A-D and B45-B61 provide guidance for share-based payment transactions among group entities, which usually involve a parent company and a subsidiary. The entity receiving goods or services should recognise expenses related to them, even if another group entity conducts the payment or equity instrument transfer. The receiving entity should classify such an arrangement as either cash-settled or equity-settled, based on its economic substance. Specifically, if the receiving entity has no obligation to settle the share-based payment transaction, such a transaction is treated as equity-settled.

The following table summarises the classification of group employee share-based payment transactions where a subsidiary is the receiving entity:

When the parent settles the share-based payment transaction, the debit entry in its separate financial statements typically increases the cost of investment in the subsidiary.

IFRS 2 specifically notes (B45-B46) that it doesn’t cover the treatment of intra-group repayment arrangements. If the repayment is directly tied to the share-based payment arrangement, it is standard practice to offset the original entries. This means the subsidiary debits the equity and the parent credits the investment in the subsidiary.

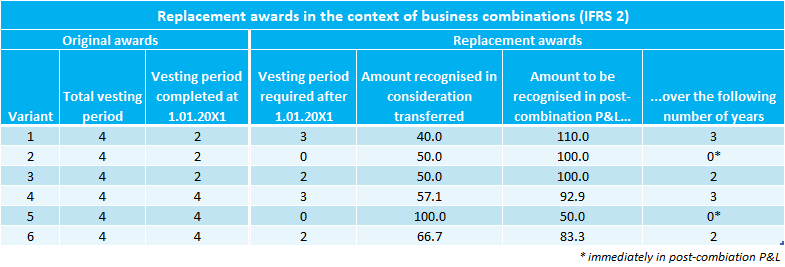

Share-based payment arrangements in the context of business combinations

It’s common for an acquiring company to replace existing awards within the target company. IFRS 3 outlines specific rules for accounting such replacements (IFRS 3.B56-B62B). The fair value of the original awards is divided between consideration transferred and post-acquisition profit or loss, based on the completed vesting period percentage. This percentage is computed using both the original and modified terms (if any), with the lesser percentage being allocated to the transferred consideration. The difference between the fair value of the replacement awards and the amount attributed to the transferred consideration is treated as a post-combination service expense, following the general requirements of IFRS 2.

Regardless of whether a replacement award is classified as a liability or as an equity instrument in accordance with IFRS 2, the same criteria apply when determining the portions of a replacement award attributable to pre-combination and post-combination service. Changes in the estimated number of replacement awards expected to vest are reflected in the remuneration cost for the periods when the changes or forfeitures happen, rather than as adjustments to the consideration transferred in the business combination.

Example: Replacement awards in the context of business combinations

The following are examples illustrating the approach to replacement awards in the context of business combinations. The basic scenario is as follows:

On 1 January 20X1, the acquiring company (AC) purchases the target company (TC). At the date of acquisition, TC operates a share-based payment award with a total fair value (determined under IFRS 2 requirements at 1 January 20X1) of $100 million. AC replaces this award with a new one, valued at $150 million. These amounts consider the estimated number of instruments expected to vest. Further details are divided into variants as shown below (vesting period given in years). All calculations presented in the table can be downloaded in an Excel file.

However, if TC’s original awards would expire due to a business combination, and if AC replaces these awards without an obligation to do so, the full fair value of replacement awards should be recognised as a post-combination service expense and accounted for using general IFRS 2 requirements. IFRS 3.B56 deems that AC is obliged to replace awards if such a replacement is required by the acquisition agreement, the terms of TC’s awards, or the law itself.

It’s crucial to note that TC should account for any modifications or replacements in its separate financial statements following the general IFRS 2 requirements for modifications and cancellations. Paragraphs IFRS 3.B62A-B62B cover unreplaced equity-settled share-based payment transactions of the acquired entity.

Fair value of equity instruments granted

Paragraphs IFRS 2.B2–B41 provide an in-depth discussion on the measurement of the fair value of shares and share options granted in a share-based payment arrangement. The paragraphs BC129-BC199 and BC306-BC310 in the Basis for Conclusions are also relevant to this topic. Additionally, IFRS 2.24-25 addresses scenarios where the fair value of equity instruments cannot be reliably estimated. Such instances are rare since even unquoted equities can be valued.

Current and deferred tax arising from share-based payment transactions

The treatment of current and deferred tax arising from share-based payment transactions is discussed in IAS 12.68A-C.

Withholding tax obligations

IFRS 2.33E-H provides specific guidance on share-based payment transactions with a net settlement feature for withholding tax obligations.

Disclosure

Disclosure requirements are detailed in paragraphs IFRS 2.44-52. These encompass information about the nature and extent of share-based payment transactions, their impact on financial statements, and fair value disclosures.