Accounting errors may arise due to a range of factors inherent in the complex and intricate nature of the accounting processes. As businesses manage countless transactions, these errors can stem from simple data entry mistakes, mathematical inaccuracies, misunderstandings of applicable IFRS, oversights or misinterpretations of facts. Other causes include technological glitches in accounting software or miscommunication within finance teams. While most errors are unintentional, arising from human error or process inefficiencies, some might be the result of fraud.

Definition of errors

According to IAS 8.5, prior period errors are omissions or misstatements in the entity’s financial statements for one or more previous periods. These errors result from either a failure to use or a misuse of reliable information that:

- was available at the time the financial statements were authorised for issue; and

- should have reasonably been obtained and taken into account during the preparation of those statements.

Errors can arise not only in respect of recognition and measurement of assets or liabilities, but also in presentation or disclosure of elements of financial statements (IAS 8.41).

It’s worth noting that the IASB has clarified that agenda decisions by the IFRS Interpretations Committee often provide valuable insights. Thus, if an entity’s application of IFRSs doesn’t align with an agenda decision, it doesn’t necessarily imply an error.

Distinguishing between error corrections and changes in accounting estimates or policies

Error corrections are distinct from changes in accounting estimates or policies. By definition, accounting estimates are approximations that may evolve as more information emerges. For example, releasing a provision through profit or loss because the actual outcome of a contingency differs from the previously recognised provision is not an error correction but rather a change in accounting estimate (IAS 8.48).

However, what may seem like changes in accounting policies or estimates might actually be error corrections. This includes scenarios such as:

- Adjusting an estimate (e.g., fair value measurement) due to a prior oversight or misinterpretation.

- Modifying an accounting policy because it didn’t adhere to IFRS requirements.

- Reclassifying amounts in the primary financial statements because the prior classification wasn’t in line with IFRS.

In all these cases, it’s crucial to assess if prior estimates were influenced by any omission or misinterpretation of facts or circumstances that should have reasonably been considered. If relevant information was available in the prior period but not utilised, then the change is deemed an error correction, necessitating retrospective restatement and relevant disclosure. Moreover, when changing an accounting policy or reclassifying amounts, it’s essential to evaluate if the prior policy or presentation was in accordance with IFRS. If it wasn’t, such changes also count as error corrections.

Example: Gross vs net revenue presentation

Game World offers an innovative online platform for gaming enthusiasts. This platform functions as a marketplace where games from various third-party sellers are available. Game World handles the payment transactions between sellers and buyers and earns a fee from each sale. Historically, Game World recognised the entire sales proceeds as revenue and payments made to sellers as costs.

However, a newly appointed chief accounting officer believes Game World should only recognise the commission they earn from sales as revenue, as the company acts as an agent between buyers and sellers. Consequently, the entire amount that customers spend on games shouldn’t be considered Game World’s revenue. This modification won’t affect the operating income.

In this context, even though the change in accounting policy was made voluntarily, it represents a correction of a prior period error since the initial policy did not conform to IFRS 15.

--

Are you tired of the constant stream of IFRS updates? I know it's tough! That's why I created Reporting Period – a once-a-month summary for professional accountants. It consolidates all essential IFRS developments and Big 4 insights into one readable email. I personally curate every issue to ensure it's packed with the most relevant information, delivered straight to your inbox. It's free, with no spam, and you can unsubscribe with just one click. Ready to give it a try?

Material errors

Material prior period errors must be retrospectively corrected in the first set of financial statements authorised post-discovery (IAS 8.42). This correction involves:

- Restating the comparative amounts for the prior periods in which the error occurred; or

- If the error took place before the earliest prior period presented, restating the opening balances of assets, liabilities, and equity for that period.

This process ensures that the correction does not impact the profit or loss of the period during which the error was identified. Any data from earlier periods, including historical financial summaries, should be restated as far back as possible (IAS 8.46). Entities aren’t required to re-issue its financial statements for prior years, however local regulations might require them to do so.

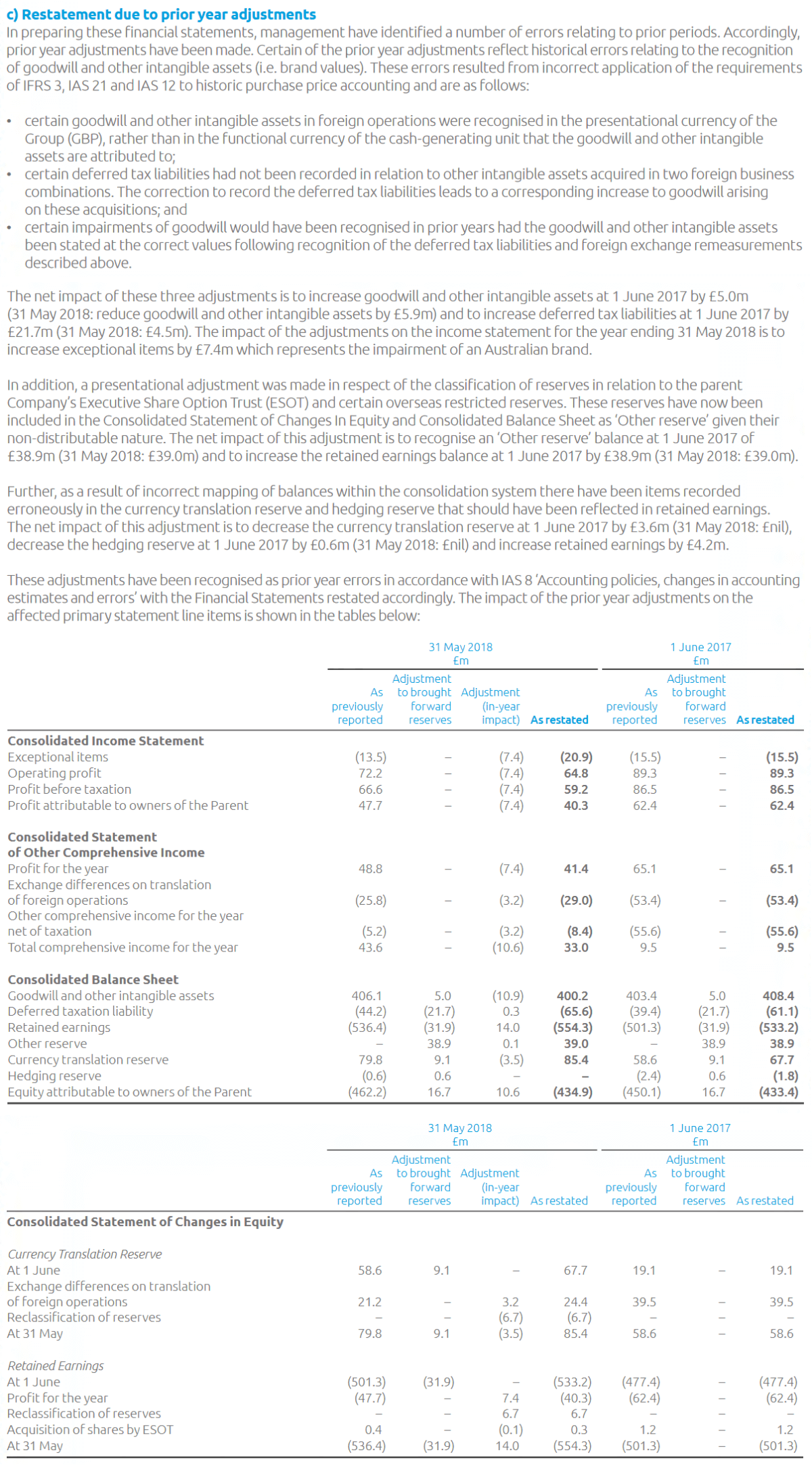

The implementation guidance to IAS 8 suggests marking the column of comparative data with a ‘restated’ label. Although IAS 8 doesn’t explicitly require this, such labelling is considered best practice and is frequently recommended by auditors.

Immaterial errors

IAS 8 doesn’t provide explicit instructions on correcting immaterial errors. Generally, these errors are addressed in the current year without restating comparative amounts or opening balances. It’s widely accepted that such errors should be corrected through the same financial statement lines where they first occurred. For instance, an overstated revenue from prior years should reduce the current year’s revenue, ensuring the cumulative revenue remains accurate. If making such a correction in the current year would influence financial statement users’ decisions, it indicates that the error is material for the current year’s results and needs retrospective correction.

Some accountants believe that immaterial errors can be corrected directly through equity as a current year movement. However, this conflicts with the provisions of IAS 1.109, which state that all equity changes within a period, except those arising from transactions with owners in their capacity as owners, must be included in total comprehensive income.

Impracticability of retrospective application or restatement

If it’s impracticable to determine the specific effects of an error on comparative data for one or multiple prior periods presented, the opening balance for the earliest feasible period should be restated, which might be the current period. When calculating the cumulative effect of an error on all prior periods becomes impracticable, entities must correct the error prospectively from the earliest practicable date (IAS 8.44-45).

Retrospective restatement constraints, detailed below, are relevant for both error corrections and accounting policy changes. According to IAS 8.5, a retrospective restatement to correct an error or apply a new accounting policy becomes impracticable when:

- The effects can’t be determined.

- It would necessitate assumptions about management’s intent during that time.

- Significant estimates are needed, and it’s impossible to objectively identify data providing evidence of the circumstances during the relevant period.

Difficulties emerge in retrospective restatements when historical data hasn’t been accumulated in a way that allows for adjustments to correct errors or adopt new accounting policies. These corrections require identifying information reflecting circumstances at the time of the transaction or event, and data that would have been accessible when the prior financial statements were authorised for issue. In some cases, obtaining such information isn’t feasible, making retrospective restatements unattainable.

It’s essential not to use hindsight when restating prior periods, ensuring assumptions and estimates reflect the conditions of that time. For example, when correcting an error linked to employee sick leave liabilities, subsequent occurrences, like an unexpected flu outbreak, should be disregarded. However, even with these difficulties, the need for significant estimates doesn’t impede the accurate restatement of prior periods (IAS 8.50-53).

Disclosure

Entities that correct a material prior period error in the current period should follow the disclosure requirements specified in IAS 8.49. The excerpt below showcases the application of these requirements.