Accounting policies encompass specific principles, bases, conventions, rules, and practices applied by an entity when preparing and presenting its financial statements. If an IFRS specifically addresses a particular transaction or event, the entity’s accounting policy should be in accordance with that standard (IAS 8.7). Nevertheless, not all transactions or events are covered by IFRS. In such instances, entities must develop their own accounting policies using the hierarchy prescribed by IAS 8.

Accounting policies should be consistently applied to similar items throughout all reporting periods. That being said, entities might occasionally change their accounting policies, either voluntarily or in response to new standards.

Let’s dive deeper into accounting policies.

Absence of applicable IFRS

If a specific transaction or event isn’t governed by an existing IFRS standard, entities must develop an accounting policy that addresses the economic decision-making needs of financial statement users. The financial statements produced should:

- Faithfully represent the entity’s financial position, performance, and cash flows (CF.2.12-19).

- Reflect the economic substance of transactions, events, and conditions, rather than just their legal form.

- Remain neutral and prudent (CF.2.15-16).

- Be complete in all material respects.

When developing an accounting policy, entities should first determine whether any IFRS standards address similar issues and apply these standards to the fullest extent possible (IAS 8.11). If there’s no IFRS addressing similar matters, the next step is to consider the definitions, recognition criteria, and measurement concepts from the Conceptual Framework for Financial Reporting (or simply, the Conceptual Framework). It is important to acknowledge, though, that the Conceptual Framework itself is not an IFRS Standard. Additionally, it is essential to understand that nothing within the Conceptual Framework has the authority to supersede any requirement of an IFRS Standard (CF SP1.2).

Complex transactions may pose several issues to consider. For some of those issues, entities may be able to identify similarities to issues addressed in other IFRSs. However, others might not have a clear analogy. The IASB’s Guide to Selecting and Applying Accounting Policies suggests that entities might refer to the requirements in an IFRS Standard for certain issues while turning to the Conceptual Framework for others. This approach is exemplified in the IFRS Interpretations Committee’s agenda decision regarding deposits relating to taxes other than income tax.

Moreover, as per IAS 8.12, entities can also refer to pronouncements from other standard-setting bodies with similar conceptual frameworks, like the US GAAP, or even other accounting literature and widely accepted industry practices. However, these sources must not contradict IFRSs dealing with similar issues or the Conceptual Framework. It’s worth noting that certain local jurisdictions may mandate the application of local GAAP for transactions not covered by IFRS.

Even if there’s no specific IFRS for a transaction or event, which likely means no explicit disclosure obligations, the general disclosure requirements under IAS 1 still apply. These include:

- Introducing additional line items in the primary financial statements (IAS 1.55/85).

- Disclosing significant income or expense items separately (IAS 1.97).

- Providing information relevant to understanding the financial statements (IAS 1.112(c)).

- Disclosing material accounting policy information (IAS 1.117).

- Disclosing assumptions and other major sources of estimation uncertainty (IAS 1.125).

Are you tired of the constant stream of IFRS updates? I know it's tough! That's why I created Reporting Period – a once-a-month summary for professional accountants. It consolidates all essential IFRS developments and Big 4 insights into one readable email. I personally curate every issue to ensure it's packed with the most relevant information, delivered straight to your inbox. It's free, with no spam, and you can unsubscribe with just one click. Ready to give it a try?

Consistency in application

Entities must apply accounting policies consistently for similar transactions or events (IAS 8.13). This principle also pertains to policies formed in the absence of applicable IFRS. Additionally, consolidated financial statements of a group should be prepared using consistent accounting policies for all group entities (IFRS 10.19, B86-B87).

However, some IFRS standards permit the categorisation of items, allowing for different policies to be applied. For instance, IAS 27.10 allows different measurement methods for various investment categories. Similarly, IAS 2.25 acknowledges that inventories might have different cost formulas based on their nature or purpose.

Changes in accounting policies

Changes in accounting policies can arise due to:

- The adoption of a new, revised, or amended IFRS; or

- A voluntary change by the entity.

Adoption of a new, revised, or amended IFRS

Whenever an entity adopts a new, revised or amended IFRS, it must adhere to the transitional provisions within that standard. Such transitional provisions override the general requirements of IAS 8 (IAS 8.19(a)). For instance, the transitional provisions might offer an exemption from a fully retrospective application of new accounting policies and might suggest alternative disclosure requirements explaining the impact of adopting the new policy.

If no specific transitional provisions exist, the new, revised or amended IFRS should be applied retrospectively, mirroring the process for a voluntary accounting policy change.

Voluntary change

Voluntary changes in accounting policy are only permissible if they ensure that financial statements provide more relevant and reliable information (IAS 8.14). Such changes can be attributed to:

- Agenda decisions issued by the IFRS Interpretations Committee.

- Pronouncements from other standard-setting authorities used in developing an accounting policy in the absence of applicable IFRS (IAS 8.21).

- An entity’s internal assessments.

It’s important to note that:

- Choosing to apply an IFRS earlier than required is not considered a voluntary change in policy (IAS 8.20).

- Using a new accounting policy for events or transactions that either didn’t occur before or were immaterial is not deemed a change in accounting policy (IAS 8.16(b)).

- The initial application of a policy to revalue assets in line with IAS 16 or IAS 38 should be accounted for as a revaluation and not under IAS 8 (IAS 8.17-18).

Retrospective application

Any voluntary policy change must be applied retrospectively. This means adjusting the opening balance of each affected component of equity for the earliest presented period, and the other comparative amounts, as though the new policy had always been in place (IAS 8.22).

IAS 8.23-27 concedes that, at times, it might be impracticable to determine either the period-specific impacts of the change or its cumulative effect. In such scenarios, the entity should apply the new accounting policy to the carrying amounts of assets and liabilities as at the beginning of the earliest period for which retrospective application is practicable. This period could even be the current one. Adjustments related to this should be applied to the opening balance of retained earnings or other relevant equity components of that period.

When it’s impracticable to determine the cumulative effect across all previous periods, the entity should prospectively apply the policy from the earliest feasible period, disregarding the cumulative adjustment to assets, liabilities, and equity that arose before this date.

For further details on comparative information, refer to the requirements set out in IAS 1.

Immaterial impact of accounting policy change

Occasionally, the effect of a change in accounting policy might be immaterial. IAS 8 doesn’t address such cases, since IFRSs typically don’t concern themselves with immaterial items. Specifically, if the application of a new policy doesn’t have a material effect, there’s no need to apply it retrospectively. However, when this new policy affects the recognition or measurement of assets or liabilities, entities must decide how to treat assets or liabilities previously measured under the old policy at the start of the current year. There are two potential approaches:

Approach 1: Assets and liabilities in the opening balance are adjusted to match the new accounting policy.

With this approach, any resultant impact is recognised in the current period’s profit or loss, categorised based on the asset’s nature, like operating income for trade receivables. The change in the accounting policy remains immaterial as long as the cumulative effect on the current period’s P/L is also immaterial. Notably, the US GAAP SAB Topic 5.F Accounting Changes Not Retroactively Applied Due to Immateriality (ASC 250-10-S99-3) officially supports this approach.

Approach 2: The opening balance of assets and liabilities isn’t adjusted in accordance with the new policy.

This means no one-time P/L impact is recognised. The downside here is that the new policy won’t be entirely implemented until assets and liabilities recognised before the change are derecognised under the old policy. Here, the materiality of the change is determined by considering the potential consequences of adjusting all assets and liabilities per the new policy. Essentially, it asks: what’s the significance of what’s left out? This strategy resembles the impracticable restatement where, as per IAS 8.27, the cumulative adjustment to assets, liabilities, and equity up to a specific date is ignored.

Disclosure

Accounting policy information

Entities are mandated by IAS 1.117 to disclose their material accounting policy information. IAS 1.117B lists situations where an accounting policy is likely considered material, such as:

- A current-period accounting policy change with material impact.

- Available options permitted by IFRSs, like the option to measure investment property at historical cost or fair value.

- The absence of an applicable IFRS, for instance, regarding business combinations under common control.

- Significant judgements or assumptions made in applying an accounting policy, such as determining control over a structured entity as per IFRS 10.

- Complex accounting scenarios where multiple IFRSs apply to a singular transaction.

IAS 1.117C emphasises the higher utility of entity-specific accounting policy information over generic information or details that merely copy or summarise IFRS requirements. For further insights on making materiality judgements concerning accounting policy disclosures, refer to paragraphs 88A-G of IFRS Practice Statement 2: Making Materiality Judgements.

Below is an excerpt from ArcelorMittal’s annual report, showcasing entity-specific accounting policies related to revenue:

Judgements

Applying accounting policies demands various judgements beyond estimations, and IAS 1.122 mandates the disclosure of significant ones. These judgements refer to the conclusions made by the management in the context of applying accounting policies to specific transactions or events. For instance, judgements are exercised by the management while identifying performance obligations within a contract under IFRS 15 or determining whether certain arrangements qualify as a lease under IFRS 16. Even though some IFRSs explicitly require disclosure of judgements in their domains, significant judgements must always be disclosed per IAS 1.122, irrespective of whether other IFRSs include specific provisions. The subsequent extracts from CRH’s and Tesco’s annual reports serve as examples:

Moreover, it’s valuable to affirm when no significant judgements have been involved, as shown below:

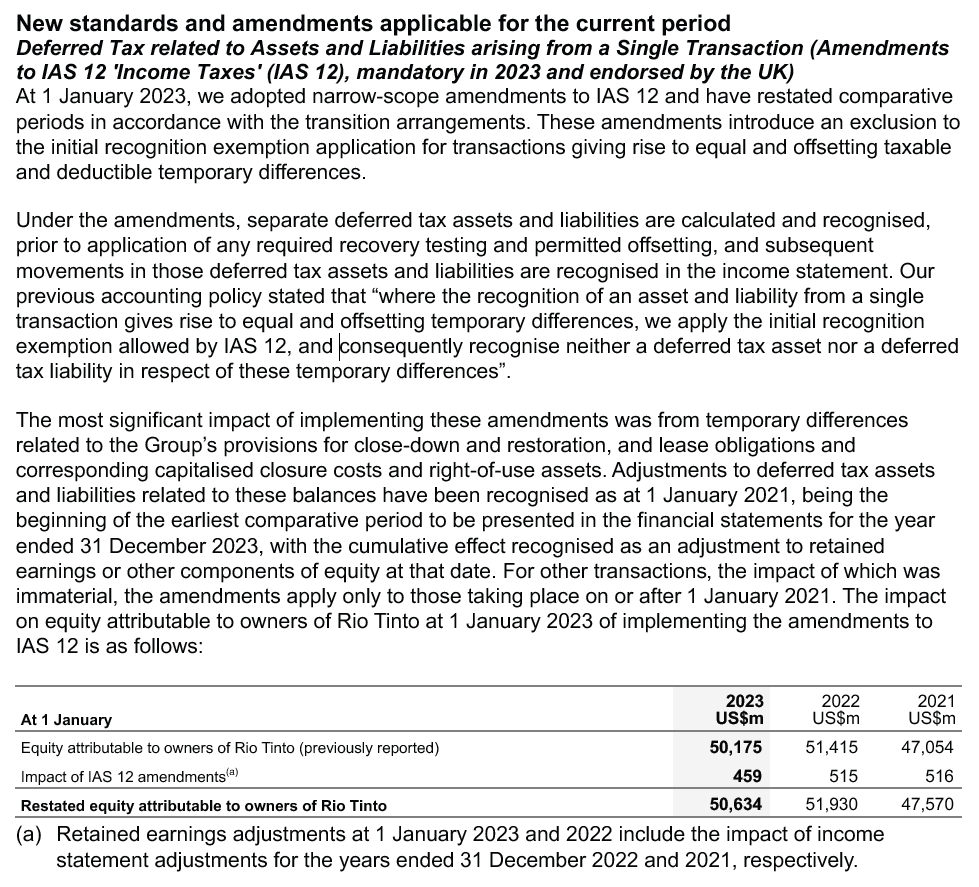

Initial application of an IFRS

Should an entity adopt a new IFRS that affects the current period, a preceding period, or might influence upcoming periods, disclosures laid out in IAS 8.28 must be provided in the application year. This PDF file showcases the disclosure made by Orange upon adopting IFRS 15, and the extract beneath exemplifies a disclosure concerning amendments to IAS 12:

Expected application of an IFRS

If an entity hasn’t applied a recently issued IFRS that isn’t yet effective, it should disclose this fact. Additionally, any available or reasonably estimable information about the possible impact of this IFRS on its financial statements should be provided (IAS 8.30-31).

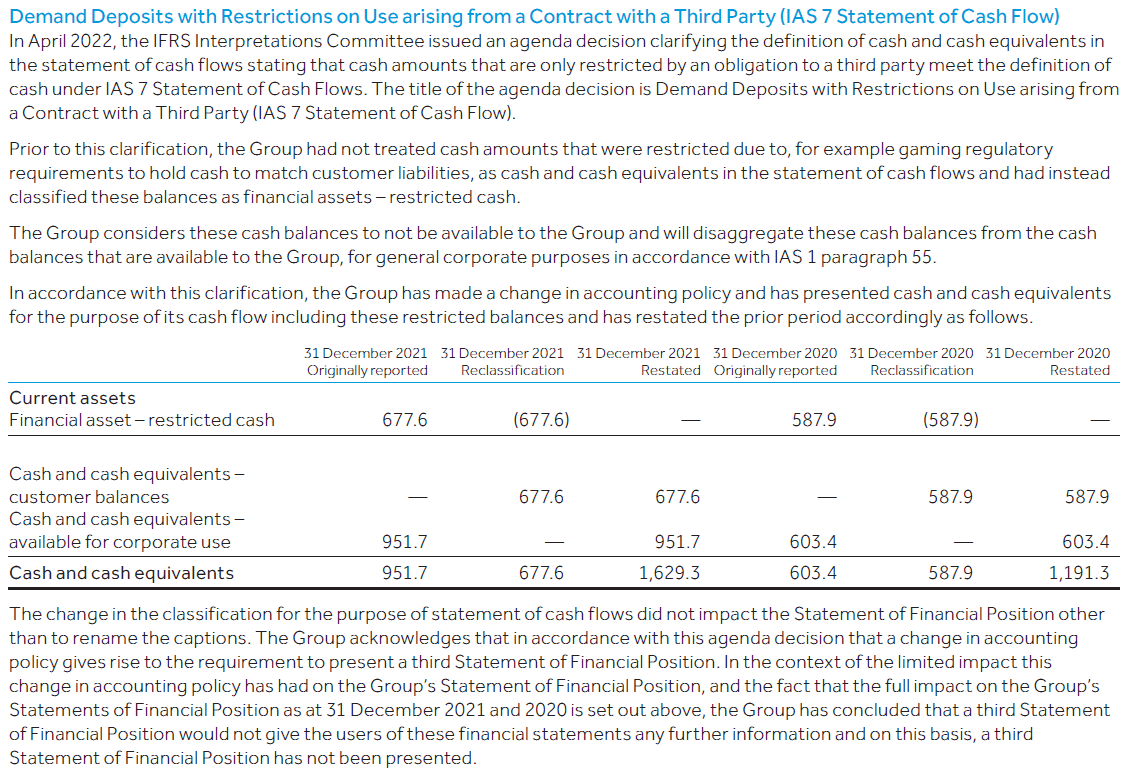

Voluntary change in accounting policy

In the event an entity voluntarily changes its accounting policy, the nature of the change should be disclosed, accompanied by reasons explaining why the newly adopted policy provides reliable and more relevant information. The impact of this change should also be quantified (IAS 8.29).

The subsequent example illustrates a voluntary change in accounting policy stemming from an agenda decision:

A voluntary change in accounting policy might also pertain to the presentation of financial statements, without influencing the recognition or measurement of assets, as illustrated in the extract that follows: