Accounting policies often necessitate estimating certain amounts in financial statements, as these amounts can’t be directly observed. The use of estimates is integral to financial statement preparation and does not undermine their reliability (IAS 8.33). In fact, even highly uncertain estimates often remain the most accurate representation of certain transactions or events.

Let’s delve deeper into accounting estimates.

Definition of accounting estimates

Accounting estimates represent monetary amounts in financial statements that are subject to measurement uncertainty. The development of these estimates involves using judgements or assumptions based on the most recent and reliable information (IAS 8.5, 32). Examples of accounting estimates are:

- The value in use of a cash-generating unit (IAS 36).

- The variable portion of a transaction price (IFRS 15).

- The residual value of an item of PP&E (IAS 16).

- An allowance for expected credit losses (IFRS 9).

- The fair value of an investment property (IFRS 13).

- The expenditure necessary to settle a disputed obligation (IAS 37).

Estimates are developed using:

- Estimation techniques (e.g., measuring a loss allowance),

- Valuation techniques (e.g., measuring fair value), and

- Data inputs (e.g., a risk-free rate).

Identifying changes in estimates

Entities often modify an accounting estimate due to changes in the circumstances upon which the estimate was founded. By nature, changes in accounting estimates don’t pertain to prior periods and aren’t corrections of errors. The differentiation between errors and changes in estimates is discussed further here.

Changes in accounting estimates arise from:

- Acquiring new information,

- Recent developments, or

- Experience.

IAS 8.34A explicitly states that changes in inputs or measurement techniques are treated as changes in accounting estimates, unless they are corrections of prior period errors. Similarly, IFRS 13.66 mentions that a change in the valuation technique should be accounted for as an estimate change. In contrast, changes in the measurement basis are viewed as changes in accounting policies, not estimates. If distinguishing between them proves challenging, they are treated as changes in estimates (IAS 8.35). A change in the depreciation method stemming from revised expectations of how economic benefits will be utilised exemplifies such a situation. Consequently, any effect of this modification is regarded as an estimate change (IAS 16.BC33).

Example: Changing measurement techniques

To illustrate the difference between a change in an accounting estimate and an accounting policy, consider Lux Estates. They own an investment property and adopt the fair value model as per IAS 40. From the property’s acquisition, its fair value has been determined using the income approach, primarily by discounting future cash inflows. However, due to ongoing inflation and the rapid appreciation in real estate values, Lux Estates concludes that the market approach would better reflect the property’s fair value. Hence, they adjust the property’s carrying amount using a new fair value measurement technique, referencing transactions for comparable properties.

In this instance:

- Lux Estates’ accounting policy is to measure the investment property at fair value, in line with IAS 40.

- The fair value, which is a monetary amount subject to measurement uncertainty, is an accounting estimate used to implement the accounting policy.

- To determine the fair value of the investment property, Lux Estates employs judgements and assumptions, such as choosing the valuation technique and determining inputs like discount rates and market prices from analogous asset transactions.

Transitioning from the income approach to the market approach represents a change in the measurement technique for estimating fair value. This implies that while the accounting policy (i.e., the fair value model) remains unchanged, the accounting estimate (i.e., the fair value measurement) is changed, with the effect accounted for prospectively.

--

Are you tired of the constant stream of IFRS updates? I know it's tough! That's why I created Reporting Period – a once-a-month summary for professional accountants. It consolidates all essential IFRS developments and Big 4 insights into one readable email. I personally curate every issue to ensure it's packed with the most relevant information, delivered straight to your inbox. It's free, with no spam, and you can unsubscribe with just one click. Ready to give it a try?

Accounting for changes in estimates

When there’s a change in an accounting estimate, its impact is recognised prospectively, meaning it’s recognised in the period of the change and, if applicable, in future periods. Prospective recognition indicates that the change in estimate is applied to transactions and events from the date of its implementation.

For instance, an adjustment in a loss allowance for expected credit losses affects only the present period’s profit or loss. Conversely, a revision of the estimated useful life of a depreciable asset impacts the depreciation expense for the current period and for each subsequent period throughout the asset’s remaining life (IAS 8.36-38)

Disclosure

Entities should disclose the nature and amount of any change in an accounting estimate that either impacts the current period or is expected to impact future periods. If the amount of the effect in future periods is not disclosed because estimating it is impracticable, that fact should be disclosed (IAS 8.39-40).

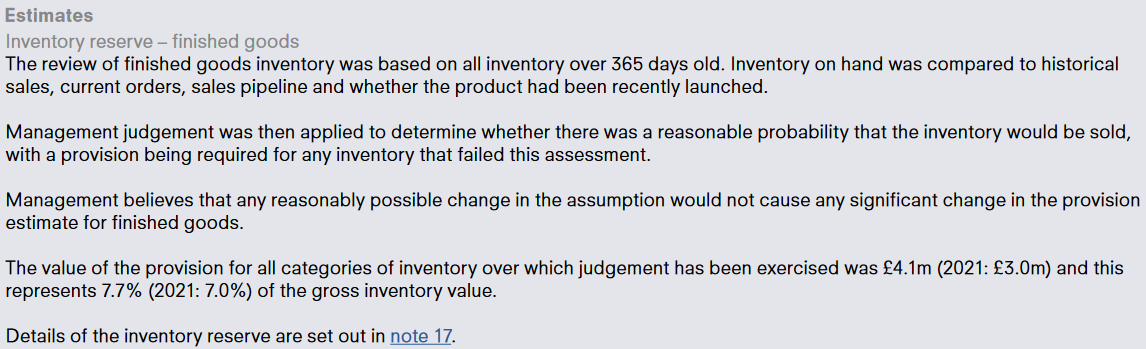

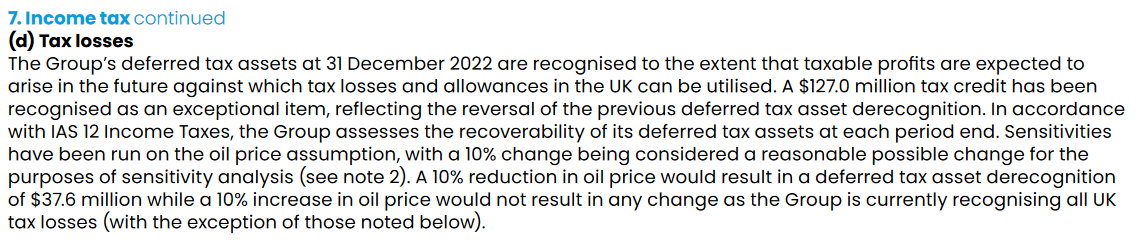

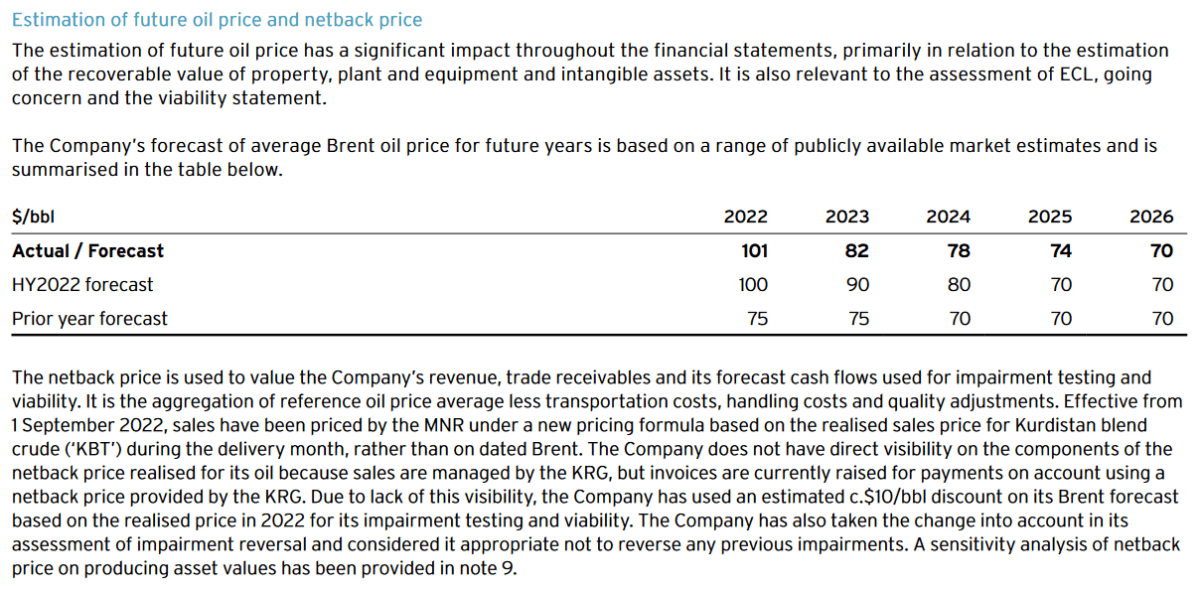

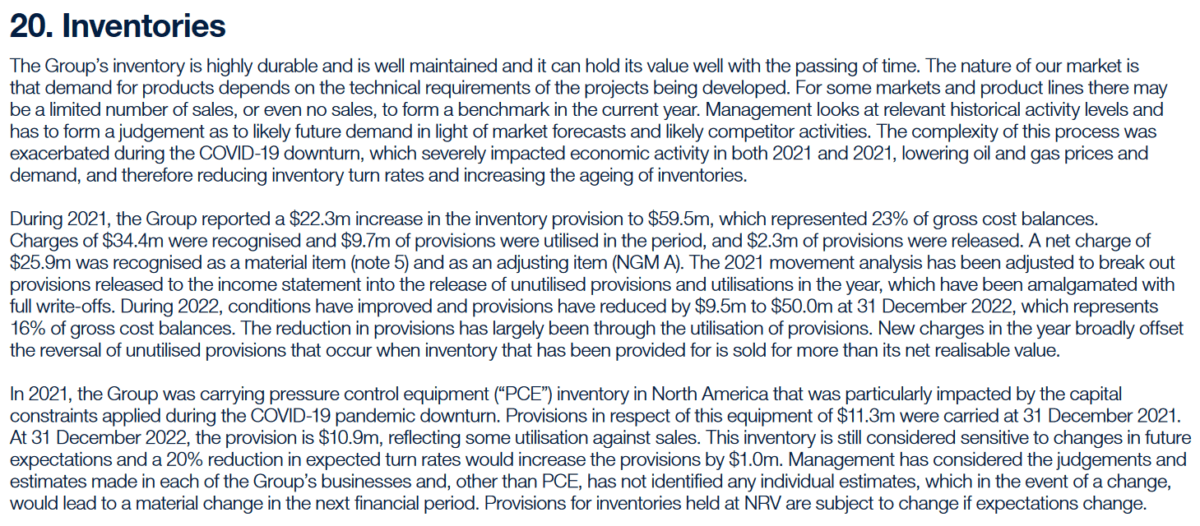

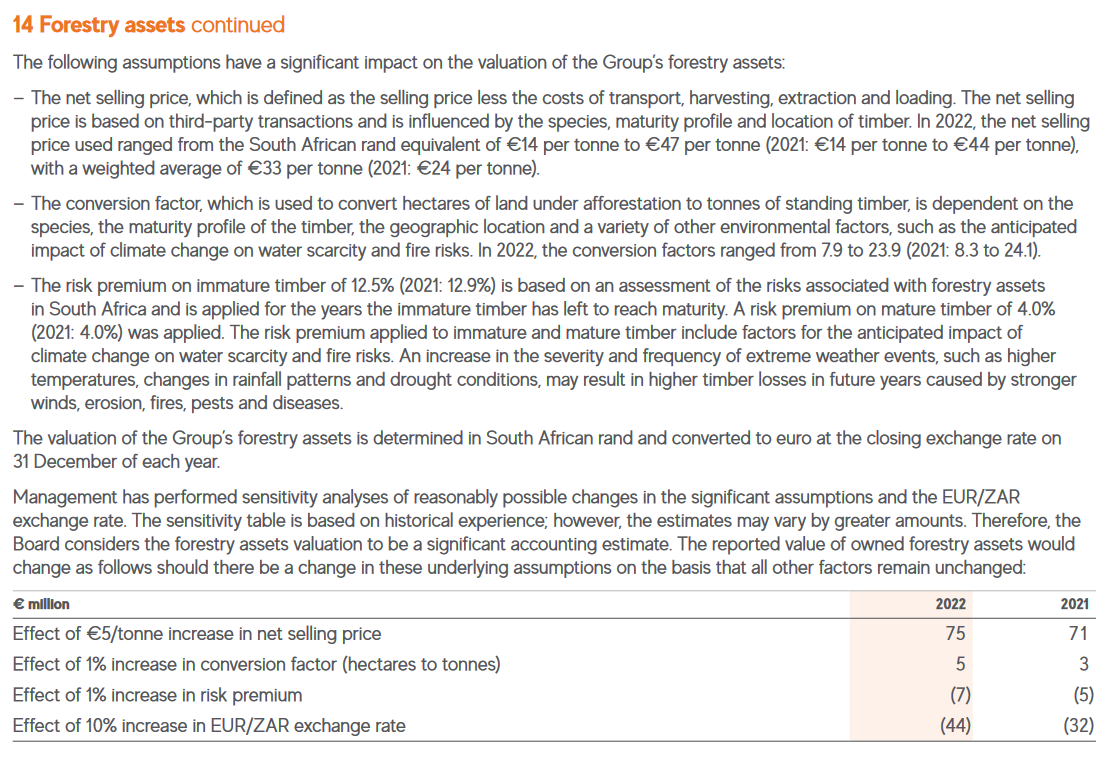

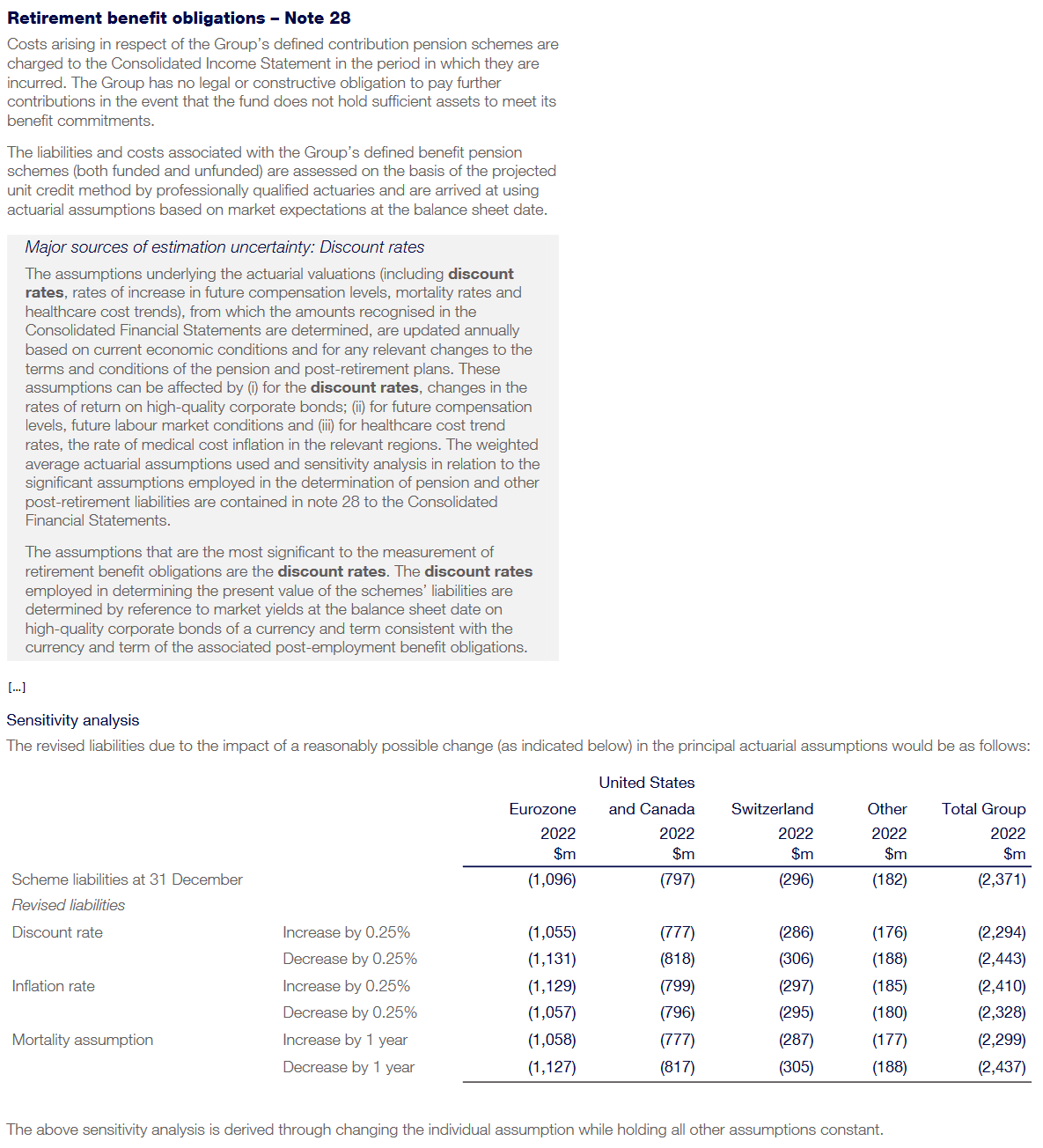

Moreover, as per IAS 1.125, entities are required to disclose assumptions and major sources of estimation uncertainty that carry a significant risk of material adjustments to the carrying amounts of assets and liabilities in the forthcoming financial year. The details about the nature and carrying amounts of these assets and liabilities should also be provided.

While certain other IFRS require the disclosure of some of the assumptions that would otherwise be required in accordance with IAS 1.125 (e.g., impairment disclosures), all sources of estimation uncertainty should be disclosed. Guidance on the kind of disclosures that entities might consider is provided in IAS 1.129. It encompasses sensitivity analyses and explanations for any changes made to prior assumptions concerning unresolved uncertainties.

To illustrate, the subsequent examples showcase disclosures provided by public companies: