IAS 36 outlines the disclosure requirements in paragraphs 126-137. The primary requirements are detailed in IAS 36.134, which focus on the disclosure of how an entity determines the recoverable amount during its impairment test. However, these detailed disclosures are mandated only for CGUs that have goodwill or intangible assets with indefinite useful lives. Although IAS 36 does recommend such disclosures for other CGUs, it isn’t obligatory. However, under IAS 1.125, this might be necessary if estimating the value in use becomes a significant source of estimation uncertainty.

A common issue is that entities frequently provide generic disclosures, which might not give the financial statement users a clear understanding of how the recoverable amount, such as the value in use, was derived. It’s a misconception among entities that merely disclosing the WACC and PGR, accompanied by a broad overview of anticipated business developments, suffices. It does not.

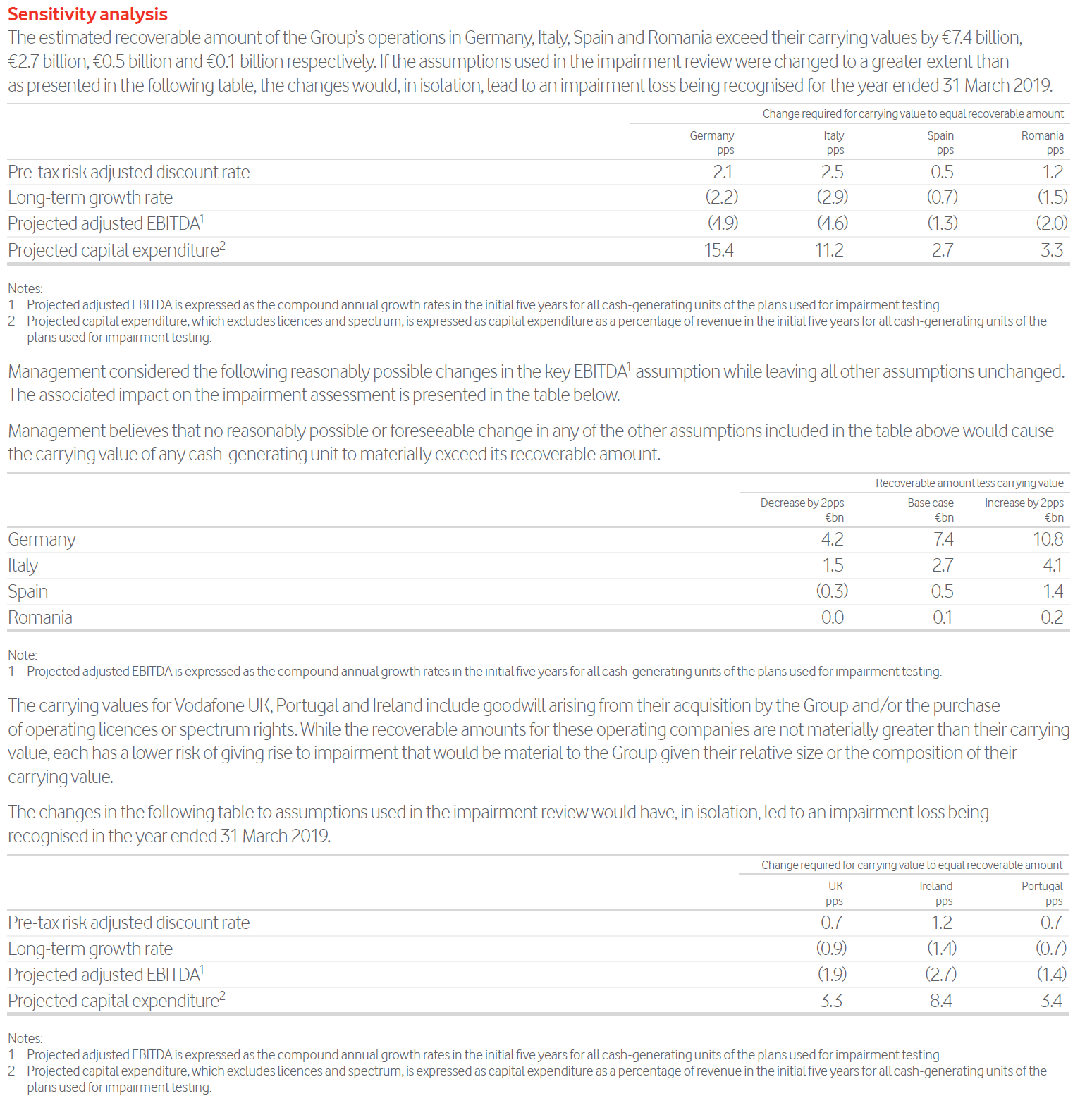

Entities should be especially careful about disclosures if a ‘reasonably possible’ change in a key assumption can lead to the CGU’s carrying amount exceeding its recoverable amount. This condition is invariably met when an impairment loss has been recognised. In such scenarios, details like the safety margin, values associated with key assumptions (beyond just WACC and PGR), and a sensitivity analysis must be disclosed under IAS 36.134(f).

Impairment test disclosures also intersect with climate-related disclosures. If climate-related factors play a significant role in determining a CGU’s recoverable amount, they must be disclosed.

Whenever an impairment loss is either recognised or reversed during a period, paragraphs IAS 36.126-131 introduce further disclosure requirements, including the recoverable amount.

Given the focus of national regulatory bodies on IAS 36-related disclosures, and their propensity to introduce additional requirements for companies in their jurisdiction, entities should remain updated with any new pronouncements (such as FRC’s Thematic Review on IAS 36).

--Are you tired of the constant stream of IFRS updates? I know it's tough! That's why I created Reporting Period – a once-a-month summary for professional accountants. It consolidates all essential IFRS developments and Big 4 insights into one readable email. I personally curate every issue to ensure it's packed with the most relevant information, delivered straight to your inbox. It's free, with no spam, and you can unsubscribe with just one click. Ready to give it a try?

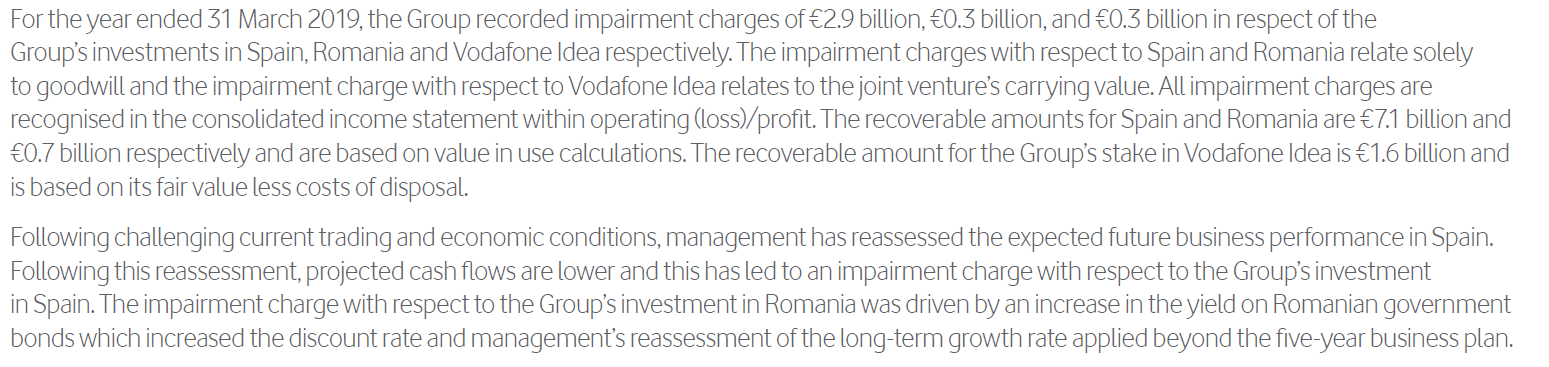

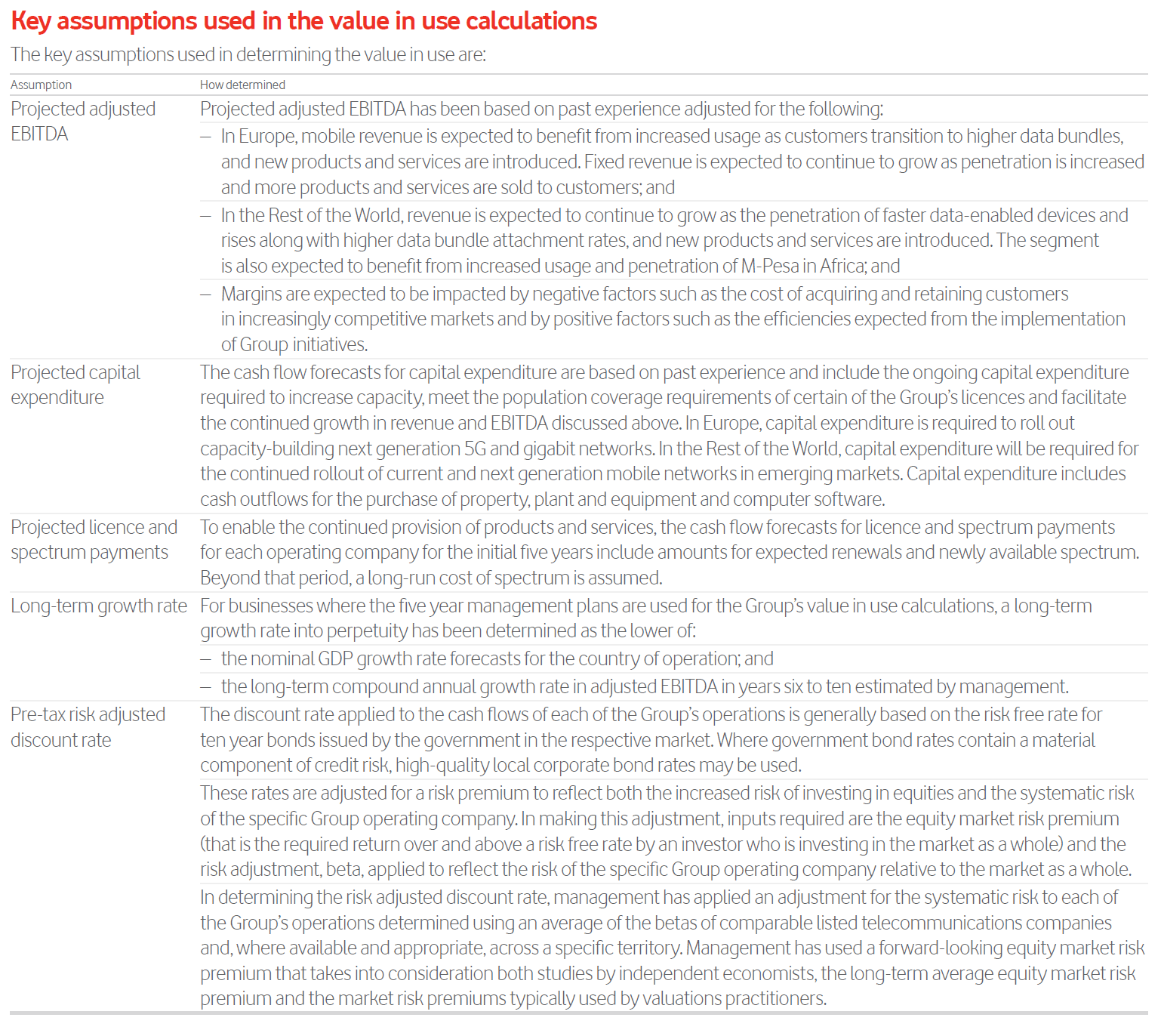

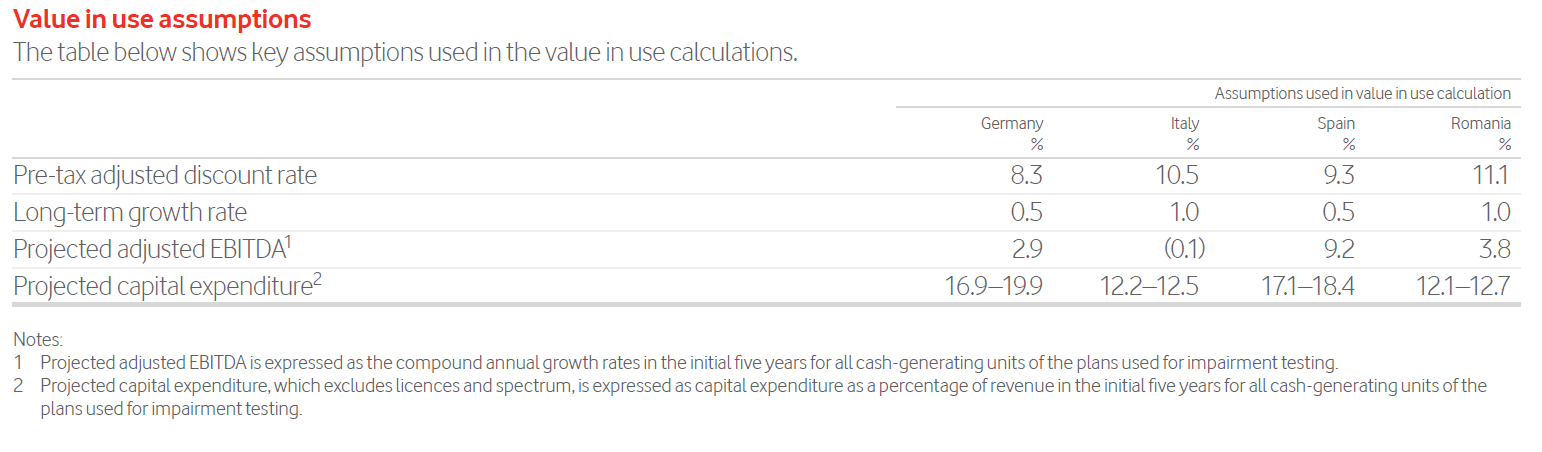

To illustrate, here are example disclosures from Vodafone Group Plc:

More about IAS 36

See other pages relating to IAS 36:

Impairment Framework for Non-Financial Assets

Cash-Generating Units (CGUs)

Value in Use as the Recoverable Amount