In accounting for joint arrangements, the main consideration is the rights and obligations of each party, regardless of the arrangements’ legal form. A joint arrangement is one where two or more parties jointly control it, as defined in IFRS 11.4.

Such arrangements are commonly initiated for multiple reasons. For instance, they can help parties share costs and risks or provide access to new technology or markets. Although they might differ in structure and legal forms, all joint arrangements share two core characteristics as per IFRS 11.5:

- The involved parties are bound by a contractual agreement, and

- This agreement grants two or more of the parties joint control over the arrangement.

While most contractual agreements are in written form, their specifics might vary based on local law. In cases where joint arrangements are structured through a separate vehicle, this agreement might be reflected in the vehicle’s articles of association. For an arrangement to be recognised as a joint arrangement under IFRS 11, a contractual agreement is essential, particularly when decisions regarding relevant activities can be made by more than one combination of the parties agreeing together (IFRS 11.B8). For more insights on contractual agreements, see IFRS 11.B2-B4.

It’s worth noting that while ‘joint venture’ or ‘joint arrangement’ are common business terms, they don’t always align with the IFRS 11 criteria.

Let’s dive in.

Joint control

Joint control refers to the contractually agreed sharing of control over an arrangement. It exists only when decisions about the relevant activities require the unanimous consent of the parties sharing control. It’s possible for an arrangement to be considered a joint arrangement even if not all parties have joint control (IFRS 11.7-11). Joint control can also be implicit as highlighted in IFRS 11.B7 and illustrated in the following example. Furthermore, IFRS 11 employs the terms ‘control‘ and ‘relevant activities‘ as defined by IFRS 10. For more details on joint control, refer to IFRS 11.B5-B11.

Example: Assessing joint control

Scenario #1: Entity X is owned by three shareholders: Entities A and B each holding 45% shares, and Entity C with 10% shares. The articles of association of Entity X mandate a 100% vote for directing its key activities. Thus, Entities A, B, and C jointly control Entity X, as any decision regarding the relevant activities requires their unanimous consent.

Scenario #2: Entity X’s ownership is divided among Entity A (40%), Entity B (40%) and Entity C (20%). Entity X’s relevant activities are directed by a majority vote, and no agreements exist among the entities. Therefore, none of the shareholders have joint control as any two of them can make decisions without the third party’s consent.

Scenario #3: Entity X’s primary shareholders are Entities A and B, each possessing 45% voting rights, while the remaining 10% is scattered among multiple individual shareholders who rarely attend shareholder meetings. Majority votes guide the relevant activities of Entity X, and no agreements exist between Entities A and B. Despite their combined decision-making potential, Entities A and B don’t have joint control due to the absence of a contractual agreement.

Scenario #4: Entity X has two main shareholders, Entities A and B, each holding 40%. The other 20% is dispersed among numerous individual shareholders. Entity X’s articles of association stipulate that at least 75% of voting rights are required to direct its relevant activities. Though there’s no contractual agreement between Entities A and B, they jointly control Entity X. This is implicitly derived from the articles of association since decisions about the relevant activities can’t proceed without their mutual agreement.

--

Are you tired of the constant stream of IFRS updates? I know it's tough! That's why I created Reporting Period – a once-a-month summary for professional accountants. It consolidates all essential IFRS developments and Big 4 insights into one readable email. I personally curate every issue to ensure it's packed with the most relevant information, delivered straight to your inbox. It's free, with no spam, and you can unsubscribe with just one click. Ready to give it a try?

Types of joint arrangements

Joint arrangements fall into two types, as specified in IFRS 11.6/14:

- Joint operations, and

- Joint ventures.

The classification depends on the rights and obligations of the parties involved. If an entity has rights to the assets and obligations for the liabilities linked to the arrangement, it’s classified as a joint operation. Conversely, if an entity possesses rights to the arrangement’s net assets, it’s classified as a joint venture (IFRS 11.15-16).

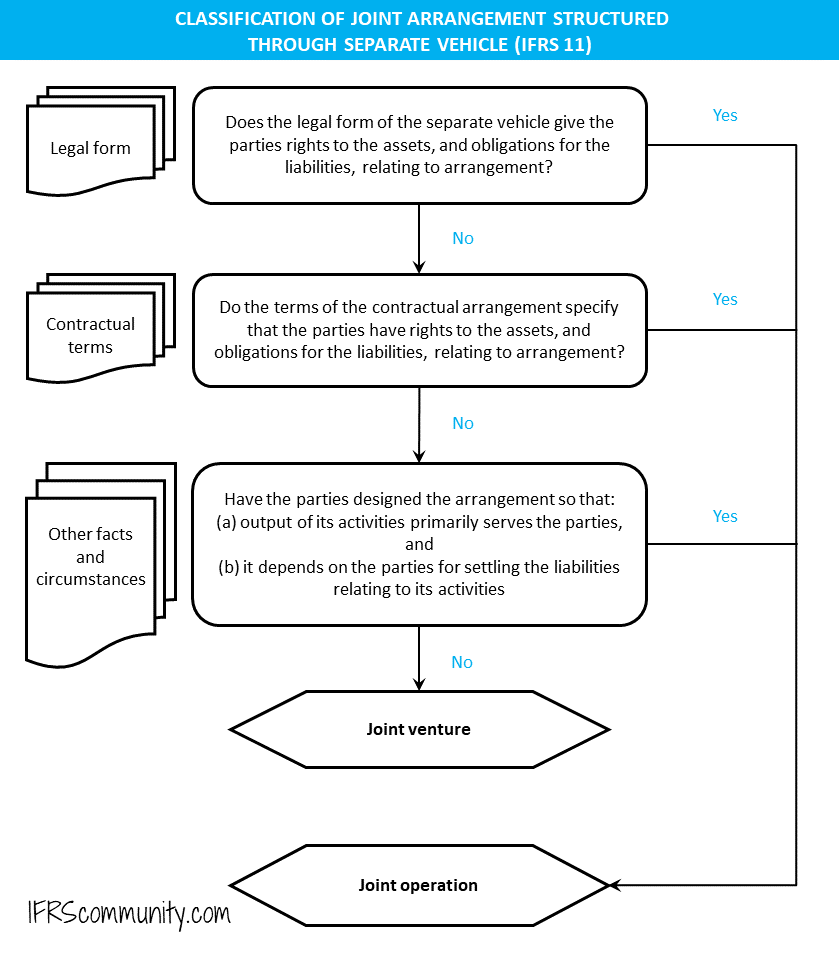

To determine whether an arrangement is a joint operation or a joint venture, entities must examine the structure of the arrangement. For those organised via a separate vehicle, considerations include its legal form, the specific terms of the arrangement, and other facts and circumstances (IFRS 11.B15). Importantly, the assessment of rights and obligations should be based on standard business operations, rather than outlier cases, such as the bankruptcy of the joint arrangement (IFRS 11.B14).

Joint arrangements without a separate vehicle

Whenever a joint arrangement isn’t structured through a separate vehicle, it’s invariably considered a joint operation (IFRS 11.B16-B18).

Joint arrangements with a separate vehicle

A joint arrangement, when structured using a separate vehicle, can be classified as either a joint venture or a joint operation (IFRS 11.B19). This classification depends on the legal form of the separate entity, the terms set out in the contractual arrangement, and other pertinent facts and circumstances (IFRS 11.B21). Specifically, the parties can have:

- Rights to the assets, and obligations for the liabilities, relating to the arrangement (a joint operation); or

- Rights to the net assets of the arrangement (a joint venture).

Refer to the decision tree below (more discussion follows):

To elaborate, if a separate vehicle’s legal form implies the assets and liabilities within are solely those of the separate vehicle, rather than those of the involved parties, it suggests the arrangement leans towards being a joint venture. However, the contractual terms and other factors can potentially overturn this preliminary conclusion. Conversely, when the legal form of a separate vehicle does not confer separation between the parties and the vehicle, indicating that assets and liabilities within the vehicle belong to the parties, it is a joint operation (IFRS 11.B23-B24).

It’s essential to note that a ‘separate vehicle’ refers to separately identifiable financial structure. This includes legally distinct entities or those recognised by statute, irrespective of whether they possess a legal personality (IFRS 11 Appendix A).

Assessing the terms of the contractual arrangement

At times, parties might enter into additional agreements that modify the rights and obligations resulting from the separate vehicle’s legal makeup, wherein the arrangement is structured (IFRS 11.B26). IFRS 11.B27 differentiates the usual contractual terms found in both joint operations and joint ventures. For further discussion, refer to Examples 1 – 6 accompanying IFRS 11.

Assessing other facts and circumstances

According to IFRS 11.B30, a joint arrangement may be structured through a separate vehicle that legally distinguishes between the involved parties and the vehicle itself. Even if the contractual terms don’t expressly specify the parties’ rights over assets or their obligations for liabilities, other facts and circumstances can lead to the classification of the arrangement as a joint operation.

It’s during this evaluation that many arrangements, initially perceived as joint ventures, are classified as joint operations. For instance, IFRS 11 clarifies that a joint arrangement mainly intended to deliver output to the parties (e.g., a shared service centre) qualifies as a joint operation, even if formed through a separate vehicle. For a deeper insight, refer to IFRS 11.B29-B32 and Examples 1 – 6 accompanying IFRS 11.

In March 2015, the IFRS Interpretations Committee released a series of insightful agenda decisions related to evaluating these additional facts and circumstances. Among the specific scenarios examined by the Committee, the most relevant are summarised as follows:

Sale of output at market price

The Committee analysed the implications of selling the joint arrangement’s output to its parties at a market price when evaluating the arrangement’s classification. It was observed that this mode of sale, in isolation, doesn’t conclusively determine the classification. The involved parties should evaluate whether the cash inflows, resulting from selling the output at market price along with any other committed funding, ensure the joint arrangement’s ability to consistently cover its liabilities. If so, the arrangement is likely to be identified as a joint operation.

Third-party financing

The Committee also deliberated on whether third-party financing could preclude a joint arrangement from being classified as a joint operation. They inferred that if cash inflows, resulting from output sales to involved parties and any other committed funding, cover the arrangement’s liabilities, then third-party financing doesn’t influence the classification as a joint operation. This holds true regardless of whether this financing is acquired at the start or during the arrangement’s lifespan. It was noted that while a joint arrangement might settle some liabilities using third-party financing, the eventual obligation to repay the external financier would be fulfilled using funds the involved parties are committed to provide.

Accounting for joint ventures

Parties with joint control account for their investments in joint ventures using the equity method in their consolidated financial statements, and follow IAS 27.10 for their separate financial statements. On the other hand, a party involved in a joint venture, without having joint control, accounts for its interest under IFRS 9. However, if the party holds significant influence over the joint venture, the equity method is employed too (IFRS 11.24-25).

Accounting for joint operations

Accounting for joint operations is similar to consolidation. As per IFRS 11.20, a joint operator, concerning its interest in a joint operation, should recognise:

- Its assets, including its share of any assets held jointly;

- Its liabilities, including its share of any liabilities incurred jointly;

- Its revenue from selling its share of the output from the joint operation;

- Its share of the revenue from the output sales of the joint operation; and

- Its expenses, including its share of any expenses incurred jointly.

Note that accounting for a joint operation isn’t as straightforward as applying a set percentage to all items presented by the joint operation. Some assets, revenue, etc., may be wholly integrated into the joint operator’s financial statements. In contrast, some items may be excluded entirely. The accounting largely depends on evaluating the rights and obligations of each joint operator. For further discussion, refer to Examples 7 and 8 accompanying IFRS 11 and the example presented below.

Example: Accounting for a joint operation representing a shared service centre

Entity A stands as a distinct legal entity and a joint operation of Entities X and Y. Both hold a 50% interest in Entity A, and any decisions regarding Entity A’s relevant activities require unanimous agreement. Even though X and Y are rivals in the taxi industry, they founded Entity A to streamline costs related to car repairs and maintenance. Entity A exclusively manages repairs and maintenance for the cars of taxi networks X and Y. Services to third parties are offered by Entity A only when there’s no servicing demand from taxi networks X or Y, and such third-party services are minor and incidental. Charges imposed on Entities X and Y are reflective of the work executed for each, and this is seldom an even split.

For the year 20X1, Entity A’s income statement is as follows:

| Revenue from Entity X | 100 |

| Revenue from Entity Y | 80 |

| Expenses incurred when performing services to Entity X: |

|

| Labour expense | (50) |

| Spare parts used | (20) |

| Allocation of other direct expenses | (10) |

| Expenses incurred when performing services to Entity Y: |

|

| Labour expense | (40) |

| Spare parts used | (15) |

| Allocation of other direct expenses | (9) |

| General administrative expenses (not allocated) | (30) |

| Net income | 6 |

To grasp the entire accounting spectrum, assume Entity A also apportioned its net income of $6 million among its owners via dividends. This distribution is evenly split between the joint operators, aligning with their stakes in Entity A.

The resulting figures reflected in Entity X’s financial statements for the joint operation are shown in the next table:

| Initially recognised in books | IFRS 11 adjustment | Accounting under IFRS 11 | |

|---|---|---|---|

| Invoices from Entity A | (100) | 100 | – |

| Dividends from Entity A | 3 | (3) | – |

| Labour expense | – | (50) | (50) |

| Spare parts used | – | (20) | (20) |

| Allocation of other direct expenses | – | (10) | (10) |

| General administrative expenses (1) | – | (17) | (17) |

| Net income | (97) | – | (97) |

(1) [30/(100+80) x 100]

Acquiring interest in a joint operation

When an entity acquires an interest in a joint operation, and the joint operation’s activity qualifies as a business (as defined in IFRS 3), the entity should apply business combination accounting principles in IFRS 3 and other relevant standards (IFRS 11.21A).

This rule is also applicable when a pre-existing business is contributed to the joint operation upon its formation by any of its participating entities. However, the rule does not extend to the formation of joint operations where all participants contribute only assets or groups of assets that aren’t businesses (IFRS 11.B33B).

If a joint operation doesn’t qualify as a business under IFRS 3 (e.g., it’s merely a single asset), then asset acquisition accounting must be applied. For further insights, refer to Examples 7 and 8 in IFRS 11 and the examples provided below.

Example: Acquisition of interest in a joint operation

Entity A invests $100 million to acquire 50% stake in Entity X, which qualifies as a business under IFRS 3. The original selling company owned 100% of the shares. Entity A identifies Entity X as a joint operation and determines that the fair value of Entity X’s net assets is $160 million. Additionally, Entity A incurs transaction costs of $3 million.

For its 50% interest in the joint operation, Entity A records the following entries:

| DR | CR | |

| Cash | $103m | |

| Fair value of net assets of X (50%) | $80m | |

| Goodwill | $20m | |

| Transaction costs | $3m |

Example: Contribution of assets to a joint operation

Entities A and B establish Entity X, a joint operation qualifying as a business under IFRS 3. Both have equal interest and rights over its assets. Entity A contributes property with a fair value of $100m (carrying amount of $90m) to Entity X, while Entity B contributes assets valued at $40m along with industry-experienced personnel. Transaction costs incurred by Entity A total $3m.

Entity A records the following entries:

| DR | CR | |

| Property (1) | 45 | |

| Gain on disposal of property (1) | 5 | |

| Other assets (2) | 20 | |

| Goodwill (3) | 30 | |

| Cash | 3 | |

| Transaction costs | 3 |

Notes:

- Entity A derecognises 50% of the property’s carrying amount (equivalent to Entity B’s interest), which is $90m x 50%. Subsequently, it recognises a gain from this deemed disposal calculated as the 50% of difference between the property’s fair and carrying values [($100m – $90m) x 50%].

- Entity A recognises its 50% stake in the assets that Entity B has contributed.

- Goodwill is determined as the difference between 50% of the property’s fair value that Entity A contributed and 50% of the assets it acquired [($100m – $40m) x 50%].

Transactions with a joint operation

Any gains or losses arising from transactions involving a joint operation are recognised only to the extent of other parties’ interests in the joint operation (IFRS 11.B34). If an entity acquires assets from its joint operation, its share of gains and losses are not recognised until those assets are sold to an external party (IFRS 11.B36).

Accounting for interest in a joint operation without joint control

If an entity participates in a joint operation without having joint control over it, but still retains rights to the assets and is obliged for the liabilities related to it, it should account for its assets, liabilities, etc. according to the standard rules designated for joint operations discussed above (IFRS 11.23). On the other hand, if the entity doesn’t possess rights to the assets, and lacks obligations for the liabilities of a joint arrangement, other IFRS standards are relevant in accounting for its involvement (e.g., IAS 28, IFRS 9).

Separate financial statements

The accounting for joint operations in separate financial statements largely mirrors that in consolidated financial statements (IFRS 11.26). This can cause practical challenges, especially when a joint operation is structured through a separate entity. This often mandates an additional ‘proportional consolidation’ involving solely the joint operator and its joint operations, with further manual consolidation adjustments.

Continuous reassessment and changes in classification

As stipulated in IFRS 11.13 and IFRS 11.19, entities must regularly reassess both the presence of joint control and the classification of the joint arrangement. This reassessment can arise from changes in ownership structure, modifications to contractual terms or the legal form of the joint arrangement, or shifts in other relevant facts and circumstances.

Joint ventures

When a former subsidiary or a standard equity investment (like a 5% interest) transitions to a joint venture, or when additional interest is acquired without changing its classification, the accounting remains consistent with the typical equity method accounting. However, if a joint venture transforms into a regular equity investment or if it’s fully divested, the equity method must be discontinued, and the relevant gain or loss should be recognised. Finally, when a joint venture becomes a subsidiary, IFRS 3 comes into play, addressing previously held interests.

Joint operation becoming a subsidiary

If an entity gains control over a joint operation that constitutes a business as defined by IFRS 3, the transaction should be accounted for as a business combination achieved in stages.

Subsidiary becoming a joint operation

A subsidiary can typically become a joint operation in two scenarios:

- The parent sells some of its interest.

- The parent contributes its subsidiary into a joint operation, thereby achieving joint control but surrendering control over the subsidiary.

Under IFRS 10, upon losing control of a subsidiary, entities are expected to remeasure the remaining interest at its fair value. However, the retained interest in a joint operation equates to the entity’s share in the former subsidiary’s assets and liabilities, already part of the consolidated financial statements. Consequently, I believe that while the assets and liabilities over which control was lost should be derecognised, the retained assets and liabilities shouldn’t be remeasured to fair value since they remain in the statement of financial position. Neither IFRS 10 nor IFRS 11 directly address this matter, except for the general criteria specified in IFRS 10 regarding the loss of control.

Joint operation transitioning to joint venture, associate, or financial asset

In cases where a joint operation becomes a joint venture, associate, or financial asset, no specific accounting provisions are outlined. Entities are, without doubt, required to derecognise their assets and liabilities, inclusive of their share in them. From my perspective, the new interest should be recognised in line with IAS 28 (for associates) or IFRS 9 (for financial assets), based on the fair value of the given consideration. Differences between the carrying amount of derecognised net assets, the received consideration’s fair value, and the retained interest’s fair value should be recognised profit or loss.

If a joint operation is reclassified as a joint venture purely based on classification changes (e.g., modifications to the contractual agreement between operators) without any shift in the held interest, there shouldn’t be any gain or loss recognised. The initial recognition of the interest in joint venture should equate to the previously recognised net assets related to the joint operation. Regrettably, this too isn’t specified in IFRS.

Disclosure

IFRS 12 is a comprehensive standard outlining all disclosure requirements relating to interests in other entities.