The equity method, governed by IAS 28, is a simplified form of consolidation used to account for investments in associates and joint ventures, with one key distinction: investee’s financials are not incorporated line-by-line into the investor’s financial statements. Instead, a solitary asset, representative of the equity-accounted investment, is recognised in the statement of financial position. Additionally, single lines are presented in the investor’s P/L and OCI statements. To achieve this outcome, the investment is initially recognised at cost, and subsequently adjusted for the post-acquisition change in the investor’s share of the net assets.

Currently, the IASB is working to clarify several application issues regarding the equity method that have been raised with the IFRS Interpretations Committee. More information can be found in this summary of the IASB’s tentative decisions and on the project page.

Now, let’s begin with an introductory example on applying the equity method:

Example: Simple illustration of the equity method application

On 1 January 20X1, Entity A acquired a 25% interest in Entity B for a total consideration of $50m and applies the equity method in accounting for it. Entity B’s net assets as per its financial statements totalled $150m. These assets include real estate with a carrying amount of $20m and a fair value of $35m, with a remaining useful life of 15 years. For other assets and liabilities, the carrying amount is roughly equivalent to their fair value. In this example, deferred tax is not considered. A corresponding Excel file is available for download.

Entity A recognises the investment in Entity B at cost, i.e., $50m, on the date of acquisition. This amount can be broken down as follows:

| $m | |

| 37.5 | 25% share in B’s net assets as per its financial statements |

| 3.75 | 25% share in fair value adjustment relating to real estate |

| 8.75 | Goodwill (not presented separately) |

| 50 | Investment in Entity B at cost |

|---|

Goodwill was calculated as shown below:

| $m | |

| 200 | Implicit consideration for 100% interest, based on a $50m payment for a 25% stake ($50m/25%) |

| 150 | Entity B’s net assets as per its financial statements |

| 15 | Fair value adjustment on real estate |

| 35 | Total implicit goodwill of Entity B ($200m-$150m-$15m) |

| 8.75 | 25% interest in implicit goodwill attributable to Entity A ($35m x 25%) |

|---|

During the year ended 31 December 20X1, Entity B generated net income of $10m and paid dividends of $7m. In addition, Entity A must account for the $0.25m of additional depreciation charge on the fair value adjustment on real estate when applying the equity method. This is calculated as the fair value adjustment on real estate divided by 15 years of remaining useful life, multiplied by Entity A’s 25% share (i.e., $15m/15 years x 25%).

The entries made by Entity A at 31 December 20X1 are as follows:

1. Recognition of 25% share of B’s net income of $10m less 25% share in depreciation of fair value adjustment:

| DR | CR | |

| Investments in associates | 2.25 | |

| Share of profit of associates | 2.25 |

2. Recognition of 25% share of $7m of dividends paid by Entity B:

| DR | CR | |

| Cash | 1.75 | |

| Investments in associates | 1.75 |

--

Are you tired of the constant stream of IFRS updates? I know it's tough! That's why I created Reporting Period – a once-a-month summary for professional accountants. It consolidates all essential IFRS developments and Big 4 insights into one readable email. I personally curate every issue to ensure it's packed with the most relevant information, delivered straight to your inbox. It's free, with no spam, and you can unsubscribe with just one click. Ready to give it a try?

Initial recognition

An investment accounted for using the equity method is initially recognised at cost. The term ‘at cost’ is not defined in IAS 28, and a discussion similar to that in IAS 27 applies here as well.

When an investment transitions from a consolidated subsidiary to an associate or joint venture, the cost for initial recognition purposes is the fair value of retained interest at the date when control is lost (IFRS 10.25(b)).

Initial recognition becomes more complex when a ‘regular’ equity investment (e.g. a 5% interest) becomes an associate or joint venture. In such a case, the same discussion on how to determine the cost of a subsidiary when control is achieved in stages applies.

When an investment in an associate becomes a joint venture (or vice versa), the entity continues to apply the equity method and does not remeasure the retained interest (IAS 28.24).

If additional interest is acquired in an entity that was, and remains, an associate or joint venture accounted for under the equity method, the best practice is to add the additional consideration to the carrying amount of the investment without recognising any additional gains or losses (this specific case is not covered in IFRS).

Goodwill and fair value adjustments

When acquiring an investment in an associate or joint venture, entities must recognise their interest at the fair value of the associate or joint venture’s net assets and goodwill. This is similar to the requirements under IFRS 10, except that all items are subsumed into one line (IAS 28.32). Similarities include additional depreciation of fair value adjustments on assets recognised only upon consolidation, such as an internally generated brand of the acquired entity. As goodwill is not recognised separately from the investment under the equity method, the mandatory annual impairment test requirements of IAS 36 do not apply (IAS 28.42).

Determining the fair value is typically more challenging for an associate since having significant influence can make it difficult to obtain all the necessary valuation inputs. Therefore, approximations and estimates are frequently used to a greater extent than usual. A simple example illustrating an investment in an associate or joint venture, accounted for under the equity method and broken down into the investor’s share in net assets, fair value adjustments and goodwill, is provided here.

Intercompany transactions with associates and joint ventures

Regular intercompany transactions

Associates and joint ventures do not form part of the group according to the IFRS 10 definition, as a group consists of a parent and its subsidiaries. Consequently, intercompany transactions with associates and joint ventures are not eliminated in consolidated financial statements. However, some accounting practitioners do eliminate regular intercompany transactions to the extent of the investor’s share in an associate or joint venture. These two methods are illustrated below. Fortunately, IAS 28 provides specific guidance on transactions involving assets.

Example: Revenue earned from an associate

Company P, with a 20% interest in Company A (its associate), provides consulting services to A for $100 during the year. As services are provided, P recognises revenue in its books:

| $m | DR | CR |

| Receivable | 100 | |

| Revenue | 100 |

Associate A recognises the corresponding expense:

| $m | DR | CR |

| Payable | 100 | |

| Expenses | 100 |

When applying the equity method in its consolidated financial statements, Company P does not eliminate the recognised revenue and receivable. However, it needs to recognise 20% of its share in A’s profit or loss:

| $m | DR | CR |

| Investments in associates | 20 | |

| Share of profit/loss of associates | 20 |

Overall, this transaction has the following impact on P’s consolidated financial statements:

| $m | DR | CR |

| Receivable | 100 | |

| Revenue | 100 | |

| Investments in associates | 20 | |

| Share of profit/loss of associates | 20 |

Alternative approach

As previously mentioned, a minority of practitioners eliminate even ‘regular’ intercompany transactions to the extent of the investor’s share in an associate or joint venture. Under this approach, when applying the equity method in its consolidated financial statements, Company P from the previous example eliminates 20% of the recognised revenue and correspondingly deducts this amount from its share in A’s profit or loss. The consolidation entries under this approach would appear as follows:

Initially, Company P recognises 20% of its share in A’s profit or loss:

| $m | DR | CR |

| Investments in associates | 20 | |

| Share of profit/loss of associates | 20 |

Subsequently, P eliminates its 20% share (the intercompany part) in the revenue and expenses recognised on consulting services:

| DR | CR | |

| Revenue | 20 | |

| Share of profit/loss of associates | 20 |

In conclusion, the alternative approach has the following impact on P’s consolidated financial statements:

| DR | CR | |

| Receivable | 100 | |

| Revenue | 80 | |

| Investments in associates | 20 | |

| Share of profit/loss of associates | – | – |

Upstream and downstream transactions involving assets

IAS 28.28 stipulates that gains and losses from ‘upstream’ (i.e., sales from an associate or joint venture to the investor) and ‘downstream’ (i.e., sales from the investor to the associate or joint venture) transactions involving assets must be recognised only to the extent of unrelated investors’ interests. When applying the equity method, the investor’s share in the investee’s gains or losses from these transactions is eliminated. This principle is illustrated in the subsequent examples.

Entity A holds a 20% interest in Entity B and accounts for it using the equity method. In the year 20X0, Entity A sold an item of inventory to Entity B for $1m, which was carried at a cost of $0.7m in A’s books. During the year 20X1, Entity B sold this inventory to its client for $1.5 million. Deferred tax has been ignored in this example. Please note that an Excel file for this example can be downloaded.

Year 20X0

Entity A recognises the sale to Entity B in its books:

| $m | DR | CR |

| Revenue | 1 | |

| Cost of sales | 0.7 | |

| Cash | 1 | |

| Inventory | 0.7 |

Simultaneously, Entity B recognises the purchase in its books:

| $m | DR | CR |

| Cash | 1 | |

| Inventory | 1 |

In the consolidated financial statements, Entity A recognises an adjustment to eliminate the gain on the sale of inventory with regard to its 20% interest in Entity B:

| $m | DR | CR |

| Revenue | 0.2 | |

| Cost of sales | 0.14 | |

| Investment in Entity B | 0.06* |

* Entity A adjusts the value of its investment in B, as the asset subject to elimination is held by B.

Year 20X1

Entity B recognises the sale to a client:

| $m | DR | CR |

| Revenue | 1.5 | |

| Cost of sales | 1 | |

| Cash | 1.5 | |

| Inventory | 1 |

In the consolidated financial statements, Entity A reverses the previous entry and recognises a 20% portion of revenue and cost of sales:

| $m | DR | CR |

| Revenue | 0.2 | |

| Cost of sales | 0.14 | |

| Investment in Entity B | 0.06 |

In addition, Entity A recognises its share in the gain made by Entity B:

| $m | DR | CR |

| Investment in Entity B | 0.1 | |

| Share of profit of associates | 0.1 |

Example: Accounting for an upstream transaction

Entity A holds a 20% interest in Entity B and accounts for it using the equity method. In the year 20X0, Entity B sold an item of inventory to Entity A for $1m, which was carried at a cost of $0.7m in B’s books. During the year 20X1, Entity A sold this inventory to its client for $1.5 million. Deferred tax has been ignored in this example.

Year 20X0

Entity B recognises the sale to Entity A in its books:

| $m | DR | CR |

| Revenue | 1 | |

| Cost of sales | 0.7 | |

| Cash | 1 | |

| Inventory | 0.7 |

Simultaneously, Entity A recognises the purchase in its books:

| $m | DR | CR |

| Cash | 1 | |

| Inventory | 1 |

In the consolidated financial statements, Entity A recognises its share in the gain made by Entity B:

| $m | DR | CR |

| Investment in Entity B | 0.06 | |

| Share of profit of associates | 0.06 |

At the same time, Entity A eliminates the effect of the upstream transaction concerning its 20% interest in the consolidated financial statements. There are two acceptable approaches to this step, both commonly used in practice:

| Approach 1: | ||

| $m | DR | CR |

| Inventory | 0.06 | |

| Share of profit of associates | 0.06 | |

| Approach 2: | ||

| $m | DR | CR |

| Investment in Entity B | 0.06 | |

| Share of profit of associates | 0.06 |

Year 20X1

Entity A recognises the sale to a client:

| $m | DR | CR |

| Revenue | 1.5 | |

| Cost of sales | 1 | |

| Cash | 1.5 | |

| Inventory | 1 |

Additionally, Entity A reverses the consolidation entry made in year 20X0 and includes the profit that B made on the sale to A.

This approach should also be applied to the contribution of non-monetary assets to an associate or joint venture (IAS 28.30).

Associate or joint venture as a parent

The share of an investee’s profit or loss and OCI is determined based on its consolidated financial statements. This includes the investee’s consolidated subsidiaries and other investments accounted for using the equity method (IAS 28.10). While IAS 28 doesn’t provide specific guidance on how to treat non-controlling interest in the investee’s group, it is most logical for the investor to account only for the controlling interest’s share of P/L and OCI. This is because the net income attributable to non-controlling interest of the investee’s group will never accrue to the investor.

For further information, refer to the forums discussion on reciprocal equity interests (‘cross-holdings’) between parent and associate.

Dividends and other capital distributions

Dividends and other capital distributions received from an investee reduce the carrying amount of the investment (IAS 28.10).

Exchange differences on translation

Exchange differences that arise when translating an investee’s financial statements into the investor’s presentation currency are recognised in OCI (IAS 21.44).

Equity transactions of associate or joint venture

IAS 28 does not provide guidance on how to account for equity transactions carried out by an associate or joint venture – those which have no impact on P/L or OCI (apart from dividends paid). According to the definition of the equity method in IAS 28.3, adjustments are required for the post-acquisition change in the investor’s share of the investee’s net assets. However, IAS 28.10 refers solely to the investor’s share of P/L and OCI. Practice varies widely, as shown below.

Example: Equity transactions of associate accounted for as deemed disposal

On 1 January 20X0, Entity A acquires a 25% stake in Entity B for $150m and applies the equity method. Entity B’s net assets, according to its financial statements, total $350m, approximating their fair value. Moreover, Entity B owns an internally generated brand with an indefinite useful life, valued at $100m. This example does not consider deferred tax. Note that an Excel file for this example is available for download.

Entity A recognises its investment in Entity B at cost of $150m on 1 January 20X0:

| $m | |

| 87.5 | 25% share in B’s net assets as per its financial statements |

| 25 | 25% share in fair value of brand (unrecognised by B) |

| 37.5 | Goodwill (not presented separately) |

| 150 | Investment in Entity B at cost |

|---|

The calculated goodwill is shown below:

| $m | |

| 600 | Implicit consideration for 100% interest, given $150m paid for 25% ($150m/25%) |

| 350 | Entity B’s net assets as per its financial statements |

| 100 | Fair value of brand (unrecognised by B) |

| 150 | Total implicit goodwill of Entity B ($600m-$350m-$100m) |

| 37.5 | 25% interest in implicit goodwill held by Entity A ($150m x 25%) |

|---|

On 2 January 20X0, Entity B issues additional shares not subscribed by Entity A, bringing in total proceeds of $170m. This issuance decreases Entity A’s interest in B to 20%, yet significant influence remains. Such circumstances are often referred to as ‘deemed disposals’ in practice, despite not being explicitly covered in IFRS Standards. When an investor loses part of its interest in an associate or joint venture, it is generally agreed that such an investor needs to account for this ‘deemed disposal’ with an associated gain or loss recognised in P/L. This is because the investment in associate or joint venture should be ‘adjusted for the post-acquisition change in the investor’s share of the investee’s net assets.’

Entity A calculates the gain on disposal of its part interest in B as follows:

| 30 | Cost of investment disposed of ($150m x 5%/25%) |

| 34 | A’s share in proceeds from share issue (based on interest after the share issue) ($170m x 20%) |

| 4 | Gain on deemed disposal |

|---|

Example: Equity transactions of associate that is a parent with non-controlling interest in its consolidated financial statements

Entity A, holding a 20% interest in Entity B with a carrying amount of $100m, appplies the equity method. Entity B has a subsidiary in which it holds a 70% interest. Entity B’s consolidated financial statements report $500m of equity attributable to owners of parent and a $200m non-controlling interest. In 20X1, Entity B acquires the remaining 30% interest in its subsidiary for $300m. The effect of this transaction in Entity B’s consolidated financial statements is presented below:

| $m | DR | CR |

| Cash | 300 | |

| Non-controlling interest | 200 | |

| Retained earnings | 100 |

Following the transaction, Entity B reports $400m of equity attributable to owners of the parent and $0 to the non-controlling interest. While Entity A still holds a 20% interest, it only translates to $80m of equity/net assets (20% x $400m), as opposed to the pre-transaction $100m (20% x $500m). Entity A must account for this change as the investment in associate/joint venture should be ‘adjusted for the post-acquisition change in the investor’s share of the investee’s net assets.’ There are two viable approaches:

Approach #1

Entity A recognises the change directly in equity as its share in changes in the equity of associates using the equity method. This approach is based on the idea that the equity method procedures align closely with the consolidation procedures described in IFRS 10, as indicated by IAS 28.26.

Approach #2

Entity A recognises the change in net assets attributed to its holding in its P/L. This approach is supported by the argument that holders of the non-controlling interest in Entity B were not shareholders in Entity A (Group A), thus, transactions with them cannot be accounted for directly in equity without impacting P/L or OCI, as mandated by IAS 1.109.

Loss making associate or joint venture

An investor recognises losses in an associate or joint venture up to the total amount of its investment. This means that when the value of an investment falls to zero, the investor stops recognition of further losses under the equity method, unless there is a legal or constructive obligation necessitating the recognition of a liability. Subsequent profits from such an investee are only recognised once the previously unrecognised losses have been recovered (IAS 28.38-39).

Crucially, an investment in an associate is not limited to ordinary shares held. It also encompasses all long-term interests (e.g., long-term financing) that substantively make up the entity’s net investment in an associate or joint venture. If such interests exist, cumulative losses exceeding the (equity-accounted) carrying amount of ordinary shares held by the investor are allocated to other components of the entity’s interest in reverse order of their seniority (i.e., priority in liquidation). Financial assets like preference shares and long-term receivables or loans without adequate collateral are examples of assets that form part of the net investment (IAS 28.38). See the example prepared by the IASB for further clarification.

Impairment

Impairment requirements for investments accounted for using the equity method are outlined in IAS 28.40-43. Impairment losses recognised by an associate or joint venture may not always be incorporated into the investor’s financial statements in the same amount. This discrepancy is primarily due to fair value adjustments and goodwill recognised by the investor. Nevertheless, as goodwill is not recognised as a separate asset, impairment losses recognised on an investment in an associate or joint venture can be completely reversed in subsequent periods (IAS 28.42).

Net investment in an associate or joint venture

Impairment testing pertains to the total net investment in an associate or joint venture. This includes all long-term interests (e.g., long-term financing) that, in substance, form part of the entity’s net investment. Refer to the section on loss-making associate or joint venture for more information.

The introduction of paragraph IAS 28.14A in 2017 with an accompanying illustrative example Long-term Interests in Associates and Joint Ventures clarified the interaction between IAS 28 and IFRS 9 regarding financial assets that form part of the entity’s net investment:

- An entity applies IFRS 9 to account for long-term interests, including the impairment requirements.

- When allocating any losses of the associate or joint venture in accordance with IAS 28.38, the entity includes the carrying amount of those long-term interests (determined applying IFRS 9) as part of the net investment to which the losses are allocated.

- The entity then assesses for impairment the net investment in the associate or joint venture, of which the long-term interests form a part, by applying the requirements in paragraphs 40 and 41A–43 of IAS 28.

- If an entity allocates losses or recognises impairment in steps 2 and 3 above, the entity omits those losses or that impairment when accounting for long-term interests under IFRS 9 in subsequent periods.

Financial assets that, in substance, form part of the entity’s net investment in an associate or joint venture are accounted for under IFRS 9 and are not included in the line presenting investments accounted for using the equity method (though there is no explicit guidance in IFRS).

The equity method requirement

The equity method is mandatory when accounting for investments in joint ventures and associates in all financial statements, with the exception of separate financial statements prepared under IAS 27 (IAS 28.16). Nevertheless, there are conditions set out in IAS 28.17-19 which, if met, allow an entity to be exempt from using the equity method.

When an investor doesn’t have any subsidiaries but holds interests in associates or joint ventures, it’s essential to determine whether the exemptions in IAS 28.17-19 are applicable. If not, the investor is obliged to prepare financial statements using the equity method. Interestingly, these wouldn’t be referred to as ‘consolidated financial statements’, since there aren’t any subsidiaries to consolidate. Such statements are often labelled as ‘economic interest’ financial statements.

Furthermore, entities have the choice to adopt the equity method voluntarily in separate financial statements as outlined in IAS 27.10(c).

Discontinuing the use of the equity method

IAS 28.22-24 provides guidance on the discontinuation of the equity method, typically occurring when an associate or joint venture is disposed of. However, such an investment is often classified as ‘held for sale‘ before disposal, thereby suspending equity accounting prior to actual disposal. IAS 28.20-21 provides specific requirements for classifying an investment in an associate or joint venture as an asset held for sale under IFRS 5.

IAS 28.21 additionally mandates that financial statements must be ‘amended accordingly’ if an equity-accounted investment, once classified as ‘held for sale’, no longer meets the ‘held for sale’ criteria. Yet, it remains unclear whether this stipulation applies solely to the investment’s measurement or its presentation too. The IFRS Interpretations Committee has considered this issue but, having declined to add it to their agenda, they did not provide a conclusive comment in their published agenda decision. In my opinion, the following approach would be the most suitable:

- If the investment no longer meets the ‘held for sale’ criteria during the reporting period, comparative amounts should be represented as if the equity method had been continuously applied.

- The opening balance of equity for the earliest comparative period should be restated to the extent that the retrospective application of the equity method impacts periods not included in the current financial statements.

- If the impact on the opening equity balance for the earliest comparative period is significant, a third statement of financial position should be provided under IAS 1:40A.

- Previously authorised financial statements should not be reissued.

When an associate or joint venture transitions into a subsidiary, full consolidation begins under IFRS 10. The previously held interest is remeasured to its fair value, with any gain or loss recognised in the profit or loss. IFRS 3 generally applies in such scenarios.

In contrast, when a change in ownership reduces interest to the point where the investment becomes a ‘regular’ financial asset, it is accounted at fair value under IFRS 9. The difference between the fair value of retained interest, the disposal proceeds, and the investment’s carrying amount when the equity method was discontinued, is recognised in P/L. Any items previously accumulated in OCI are recycled to P/L in the same manner as if the investee had directly disposed of the associated assets or liabilities.

Presentation in financial statements

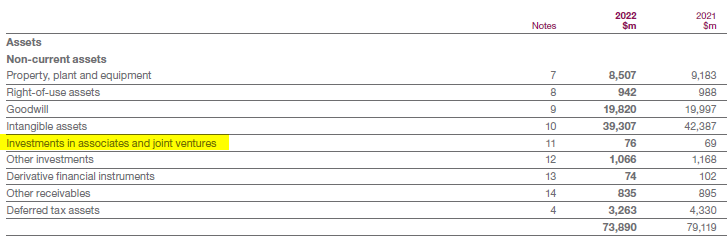

Investments accounted for using the equity method should be presented as non-current assets (IAS 28.15) in a separate line within the statement of financial position (IAS 1.54(e)). Similarly, the share of the profit or loss of associates and joint ventures accounted for using the equity method should be presented separately in P/L and OCI (IAS 1.82(c)).

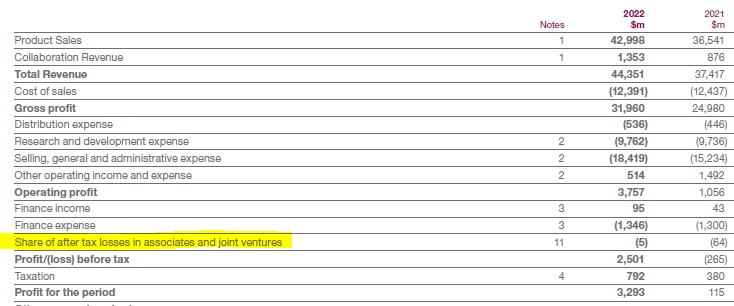

These excerpts from the financial statements of AstraZeneca may serve as an example of a common approach to the presentation of equity-accounted investees in primary financial statements:

Notably, there’s no explicit guidance regarding which section of the P/L should include the share of profit or loss from equity-accounted investments. Consequently, different entities have adopted varying methods (e.g., within operating income, just before the income tax charge, etc.). The IASB plans to standardise these divergent approaches as part of its Primary Financial Statements project.