Under IFRS 5, a non-current asset or a disposal group is classified as ‘held for sale’ if its carrying amount will be recovered primarily through sale instead of continuing use. This classification arises when the following conditions (outlined in IFRS 5.6-7) are satisfied:

- The asset or disposal group is ready for immediate sale in its present condition.

- The sale is highly probable.

Being classified as ‘held for sale’ leads to specific presentation, measurement, and disclosure consequences.

Let’s delve deeper.

Availability for immediate sale

An asset or disposal group, as per IFRS 5.7, should be ready for immediate sale in its current condition subject only to terms that are usual and customary for sales of such assets (IFRS 5.7). Refer to Examples 1-3 in IFRS 5 for illustration.

Sale being highly probable

For a sale to be deemed highly probable, the criteria detailed in IFRS 5.8 must be fulfilled:

- The appropriate management level must be committed to selling the asset or disposal group.

- An active search for a buyer and steps to finalise the sale should be underway.

- The asset or disposal group must be on the market at a price that’s fair compared to its current value.

- The sale must be expected to be completed within a year from the classification.

- Actions related to the sale plan should signify a low chance of significant alterations or the plan’s cancellation.

Exceptions to the one-year sale requirement

If an asset or disposal group’s sale is extended due to unforeseen events or circumstances beyond the entity’s control, it can still be classified as ‘held for sale’, provided the entity remains committed to the sale (IFRS 5.9, B1). Exceptions to the one-year sale completion requirement include:

- Anticipated external conditions on the asset’s transfer which can only be addressed post a firm purchase commitment.

- Unexpected conditions imposed after securing a firm purchase, provided the entity has taken prompt actions and expects a positive resolution.

- Unforeseen delays within the first year, where the entity has actively marketed the asset at a reasonable price and meets specific criteria.

See also Examples 5-7 in IFRS 5.

--Are you tired of the constant stream of IFRS updates? I know it's tough! That's why I created Reporting Period – a once-a-month summary for professional accountants. It consolidates all essential IFRS developments and Big 4 insights into one readable email. I personally curate every issue to ensure it's packed with the most relevant information, delivered straight to your inbox. It's free, with no spam, and you can unsubscribe with just one click. Ready to give it a try?

Assets acquired for resale

Assets (like properties) typically seen as non-current, when bought exclusively for resale, cannot be classified as current (or held for sale) unless they meet the criteria below (IFRS 5.3, 11):

- The sale is anticipated to finalise within a year (unless an exception to this timeframe applies).

- It’s highly likely that the previously mentioned criteria for a sale being highly probable will be met shortly, usually within three months post-acquisition.

This rule also pertains to subsidiaries acquired for resale. Refer to Example 13 in IFRS 5.

Impact of events after the reporting period

If the criteria from IFRS 5 are met after the end of the reporting period, the asset or disposal group can’t be classified as ‘held for sale’ within that reporting period. Nonetheless, entities should provide disclosures outlined in IFRS 5.41(a)(b)(d) in the explanatory notes (IFRS 5.12).

Assets held for distribution to owners

IFRS 5’s classification, presentation, and measurement requirements also apply to non-current assets and disposal groups held for distribution to owners (IFRS 5.5A). An asset or disposal group is classified as ‘held for distribution to owners’ when (IFRS 5.12A):

- They’re available for immediate distribution in their existing condition.

- The distribution is highly probable.

The distribution is considered highly probable when:

- Steps towards the distribution’s completion have begun.

- The distribution’s completion is projected within a year from the classification.

- Significant modifications to the distribution plan or its withdrawal are deemed improbable.

Abandoned assets

Assets destined for abandonment could be those used until their economic useful life concludes or those meant for closure rather than sale. Since their value won’t be recovered through sale, they aren’t classified as ‘held for sale’. However, a group of assets (possibly with related liabilities) marked for abandonment might qualify as a discontinued operation (IFRS 5.13).

Disposal groups

A disposal group refers to a set of assets intended for disposal, either through sale or another method, together in a singular transaction. This also encompasses liabilities directly tied to those assets that will be transferred in the same transaction. Notably, if the group qualifies as a CGU to which goodwill has been allocated or operates within such a unit, it includes goodwill (IFRS 5 Appendix A). Consequently, if a non-current asset within the scope of IFRS 5 is part of a disposal group, the remaining assets and liabilities are a part of that disposal group classified as held for sale, even if some are exempt from IFRS 5’s measurement provisions (IFRS 5.4).

It’s worth noting that when a subsidiary is classified as ‘held for sale’, all its assets and liabilities fall under the ‘disposal group’, even if the parent company plans to maintain a non-controlling interest after the sale (IFRS 5.8A).

Measurement

Measurement framework

Assets or disposal groups classified as ‘held for sale’ are measured at the lower of (IFRS 5.15):

- The carrying amount measured immediately before the reclassification (see IFRS 5.18) and

- The fair value less costs to sell (FVLCTS).

Costs to sell

These are incremental costs directly attributable to disposing of an asset or disposal group, excluding finance costs and income tax expenses (IFRS 5 Appendix A). In simpler terms, they are the costs that wouldn’t exist if there were no transaction.

Typically, if a sale is projected to finalise after a year, these costs are discounted to their present value. Any rise in the present value of the sales costs, which inherently reduces an asset’s carrying value, is recognised in profit or loss as a financing expense (IFRS 5.17).

Fair value remeasurement of a disposal group

For assets or liabilities in a disposal group not within the scope of IFRS 5 (i.e., current assets), their carrying amount is remeasured under the relevant IFRSs first. This is done before determining the disposal group’s FVLCTS (IFRS 5.19). For example, even if liabilities are part of the disposal group, interest expenses are still recognised (IFRS 5.25).

Measurement of assets held for distribution to owners

Non-current assets or disposal groups held for distribution to owners are measured at the lower of:

- The carrying amount.

- The fair value less costs to distribute, with these costs being incremental and directly related to the distribution, excluding finance costs and income tax expense (IFRS 5.15A).

Depreciation

Non-current assets classified as ‘held for sale’ or those in a disposal group are not subject to depreciation (IFRS 5.25).

Impairment losses

Any decline in the fair value of a non-current asset or disposal group below the carrying amount is recognised as an impairment loss. An impairment loss isn’t recognised if the reduction in value has been previously accounted for under another relevant IFRS (IFRS 5.20). This loss is initially allocated to goodwill, then distributed proportionally to other non-current assets that are within the scope of IFRS 5’s measurement provisions (IFRS 5.23).

If the fair value increases, the impairment losses can be reversed, but only up to the amount of previously recognised losses under IFRS 5 or IAS 36 (IFRS 5.21-22). While IFRS 5 doesn’t expressly state whether impairment losses allocated to goodwill in a disposal group can be reversed, IAS 36 generally prohibits this. However, IFRS 5 sees a disposal group as a singular unit of account for impairment considerations, suggesting either approach could be valid.

Example 10 in IFRS 5 illustrates how an impairment loss on a disposal group is allocated. If an impairment loss recognised under IFRS 5 surpasses the carrying amount of non-current assets within its scope, the entity should allocate the remaining impairment to other assets (refer to this agenda decision).

Investments in associates and joint ventures

IFRS 5 applies to an investment, or part of one, in an associate or joint venture if it qualifies as ‘held for sale’. If any portion of an investment in an associate or joint venture isn’t deemed as ‘held for sale’, it continues to be accounted for using the equity method (IAS 28.20-21).

Exceptions to IFRS 5 measurement provisions

The measurement requirements of IFRS 5 don’t apply to assets listed in IFRS 5.5.

Changes to a plan of sale

When a non-current asset or disposal group no longer qualifies as ‘held for sale’ or ‘held for distribution to owners’, its value should be the lesser of (IFRS 5.27):

- Its original carrying amount before being classified as ‘held for sale’, adjusted for potential depreciation, amortisation, or revaluations that would’ve been applicable if it hadn’t been so classified.

- Its recoverable amount as of the date the decision against selling or distributing was made.

Pre-classification carrying amount

The carrying amount, prior to the asset’s ‘held for sale’ classification, should be adjusted to reflect any depreciation, amortisation, or revaluations that would’ve been applicable if the asset or disposal group hadn’t received such classification. These adjustments to the carrying value should be reflected in the current year’s income statement and presented under continuing operations (IFRS 5.28).

Comparative information

For assets or disposal groups that are a subsidiary, joint operation, joint venture, associate, or part of an interest in a joint venture or associate and no longer fall under the ‘held for sale’ category, comparative information in financial statements should be retrospectively adjusted. This isn’t overtly stated, but one can infer this from IFRS 5.28, which notes that financial statements, from when the classification as ‘held for sale’ started, should be ‘amended accordingly’. Furthermore, IAS 28.21 explicitly calls for retrospective adjustments. Although IFRS 10 or IFRS 11 lack a direct equivalent to IAS 28.21, interpreting IFRS 5.28 alongside IAS 28.21 clarifies the intended meaning of amending financial statements ‘accordingly’ as mentioned in IFRS 5.28.

Recoverable amount

Should a non-current asset be part of a CGU, its recoverable amount is the value that would’ve been identified post the allocation of any impairment loss on that CGU (as footnoted in IFRS 5.27).

Transfers between ‘held for sale’ and ‘held for distribution’

IFRS 5.26A offers detailed guidance on accounting for the reclassification of an asset or disposal group from ‘held for sale’ to ‘held for distribution’, and vice versa.

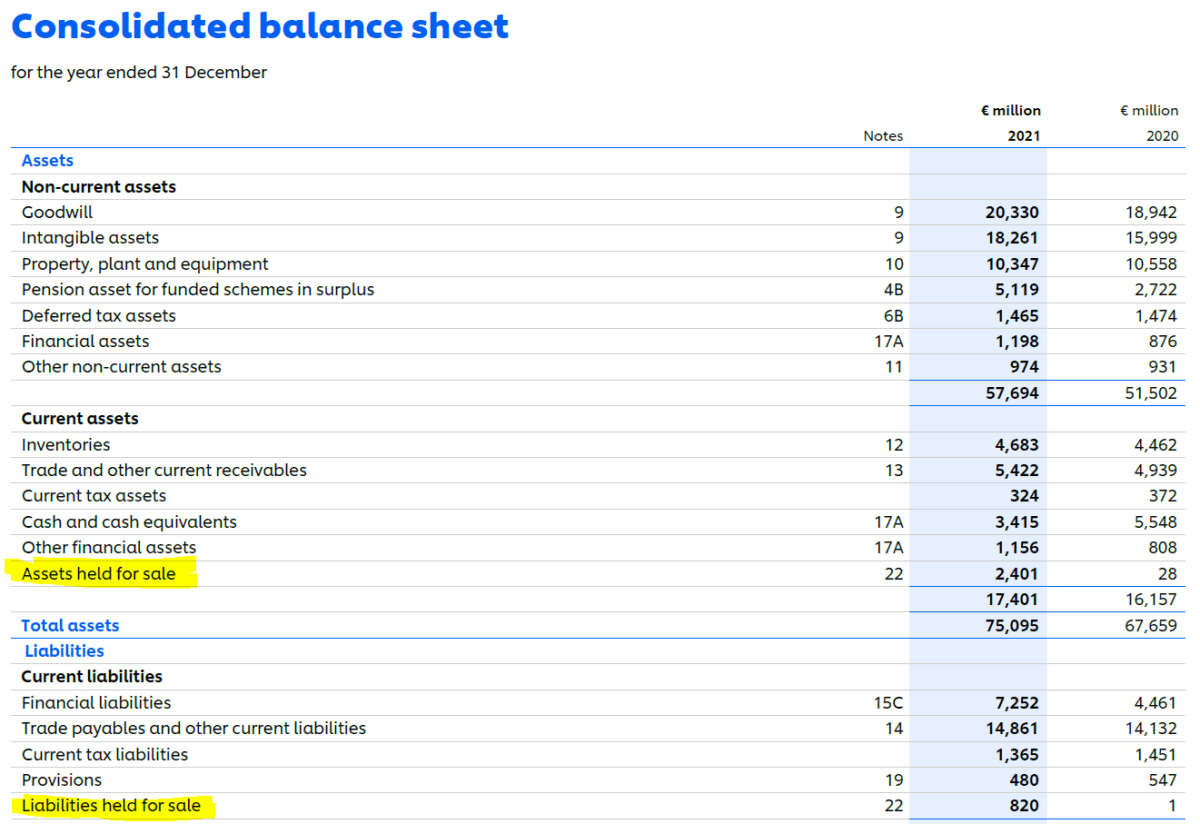

Presentation

Assets classified as ‘held for sale’, as well as the assets and liabilities within a disposal group, should be presented separately in the statement of financial position, without being netted against each other.

Typically, entities will show one line that consolidates all assets within the disposal group and another that consolidates liabilities. If this approach is taken, the major classes of assets and liabilities involved should be detailed in the accompanying notes (IFRS 5.38). The only exception to this is if a newly acquired subsidiary qualifies to be classified as ‘held for sale’ upon acquisition (IFRS 5.39). The presentation requirements apply prospectively, meaning past data or comparative information doesn’t need to be restated (IFRS 5.40).

Furthermore, any cumulative income or expense recognised in OCI associated with a non-current asset or disposal group classified as ‘held for sale’ should also be distinctly displayed within equity (IFRS 5.38). An instance of this could foreign currency translation adjustment under IAS 21. It’s noteworthy that IFRS 5 doesn’t mandate the disclosure of a non-controlling interest for a subsidiary regarded as a disposal group.

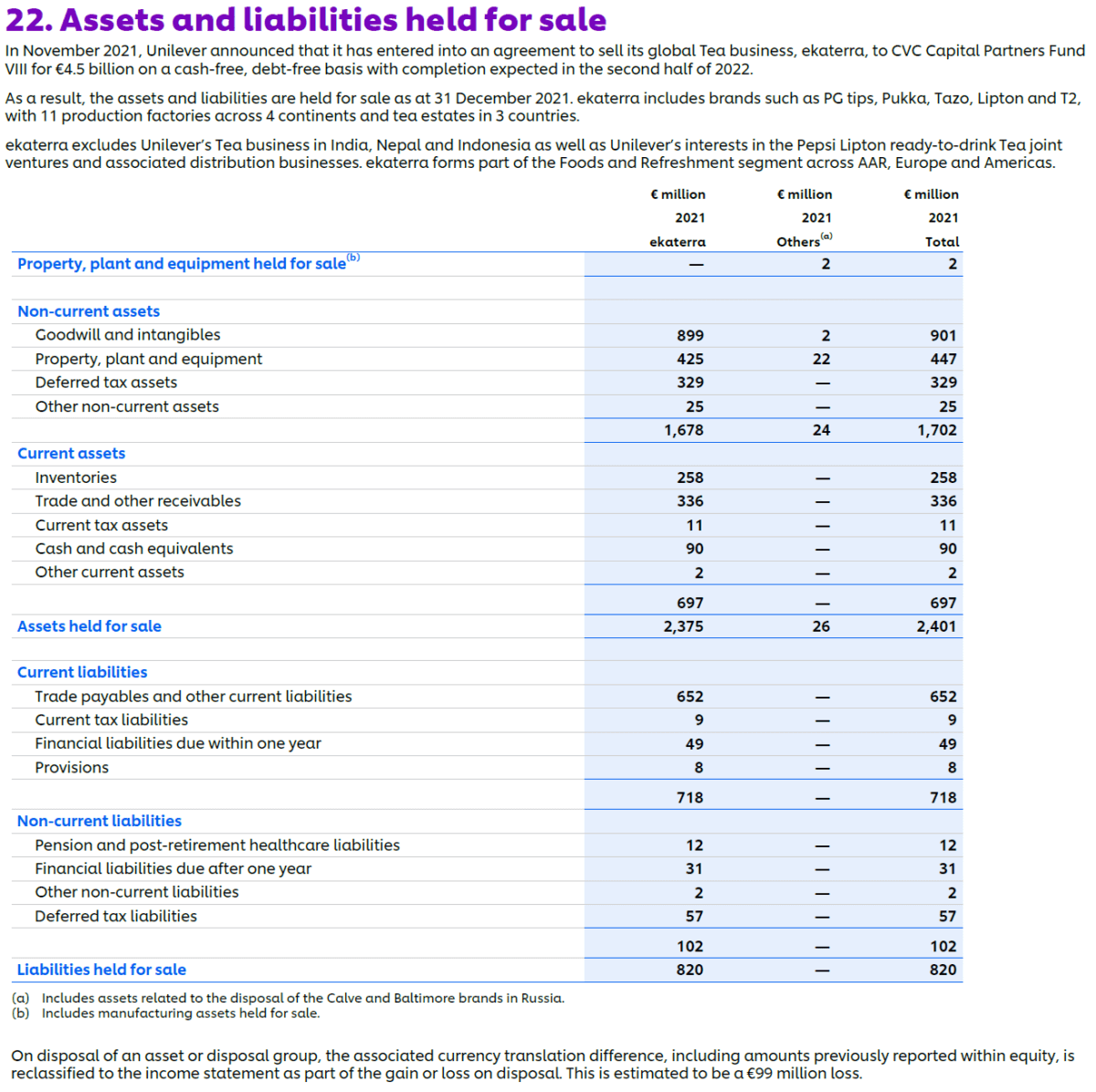

The extracts below demonstrate application of these requirements by Unilever plc:

Refer also to Examples 11-12 that accompany IFRS 5, as they illustrate how assets and disposal groups held for sale should be presented.

Disclosure

Specific disclosure requirements concerning assets held for sale and disposal groups are outlined in IFRS 5.41-42. It’s crucial to understand that assets and disposal groups within the scope of IFRS 5 aren’t bound by disclosure requirements of other IFRS standards, unless stated otherwise (IFRS 5.5B). An example of such a specific requirement can be found in the treatment of interests in other entities. Even if these interests are classified as ‘held for sale’ (or as discontinued operations), they remain within the scope of IFRS 12 (IFRS 12.5A).