IAS 24 mandates specific disclosures regarding related parties with the aim of alerting users to the potential impact of these relationships on an entity’s financial position and profit or loss. Generally, IAS 24 and other IFRSs adopt a disclosure-only approach towards transactions involving related parties, meaning there are no distinct recognition rules for such transactions. This viewpoint is reaffirmed by this agenda decision which states that, unless a particular IFRS standard explicitly excludes common control transactions, an entity should apply the relevant requirements of IFRSs to such transactions. Nevertheless, recognising and measuring certain related party transactions can involve significant judgement, as explored in Accounting for Intra-group Transactions in Separate Financial Statements.

Let’s delve deeper into the definition of a related party and understand the disclosure requirements.

Definition of a related party

The definition of a related party is outlined in IAS 24.9, which we’ll explore further below.

An entity as a related party

An entity is deemed related to a reporting entity if any of the following conditions are met (IAS 24.9).

- The entity and the reporting entity are members of the same group.

- One entity is an associate or joint venture of the other entity.

- Both entities are joint ventures of the same third party.

- One entity is a joint venture of a third entity, and the other entity is an associate of the third entity.

- The entity is a post-employment benefit plan for the benefit of employees of either the reporting entity or an entity related to the reporting entity. If the reporting entity itself is such a plan, the sponsoring employers are also considered related to the reporting entity.

- The entity is controlled or jointly controlled by a person identified as a related party in the previous section.

- A person who controls or jointly controls the reporting entity (or his close family member) has significant influence over the entity in question or is a member of the key management personnel of this entity (or of a parent of this entity).

- The entity, or any member of a group of which it is a part, provides key management personnel services to the reporting entity or to the parent of the reporting entity.

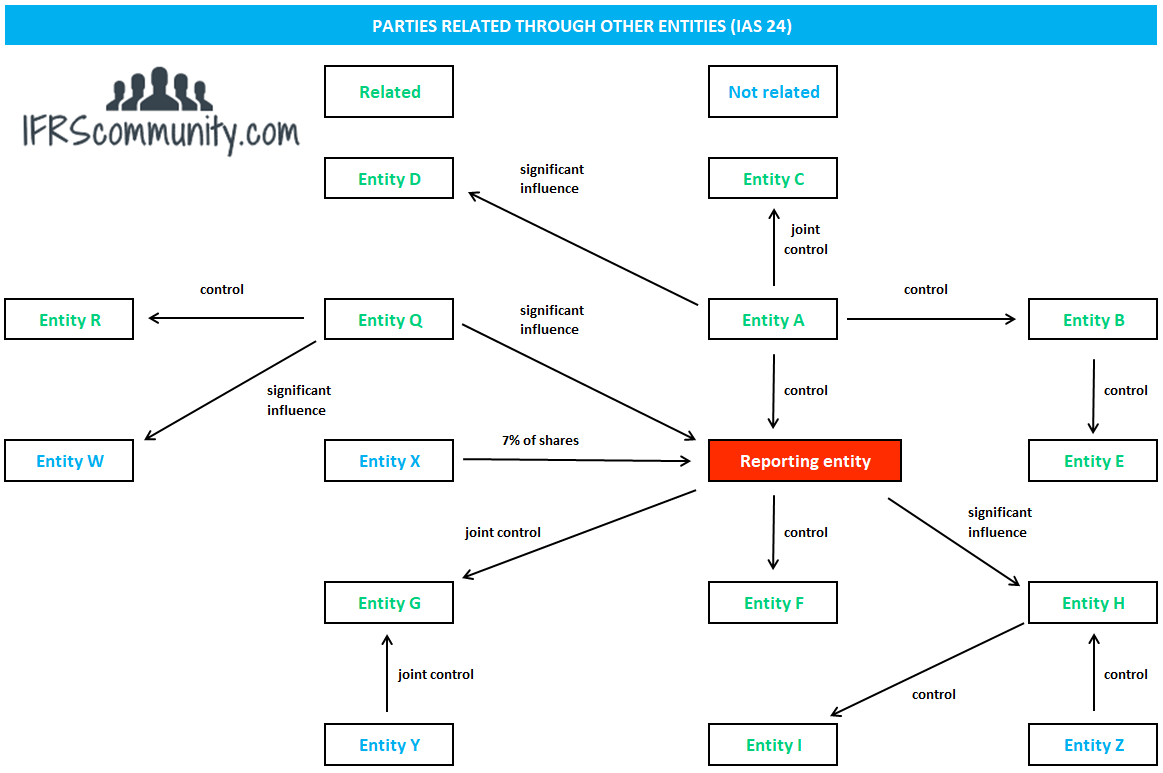

Example: Parties related through other entities

The diagram below illustrates an example of a related party network, drawn based on capital relationships:

--

Are you tired of the constant stream of IFRS updates? I know it's tough! That's why I created Reporting Period – a once-a-month summary for professional accountants. It consolidates all essential IFRS developments and Big 4 insights into one readable email. I personally curate every issue to ensure it's packed with the most relevant information, delivered straight to your inbox. It's free, with no spam, and you can unsubscribe with just one click. Ready to give it a try?

A person as a related party

A person, or their close family member, is identified as related to a reporting entity if the person:

- exerts control, joint control or significant influence over the reporting entity, or

- is a member of the key management personnel of the reporting entity or a parent of the reporting entity.

Key management personnel are defined as individuals who have the authority and responsibility for planning, directing, and controlling the activities of the entity, either directly or indirectly. This includes any director of the entity, executive or otherwise (IAS 24.9). The application of this definition in practice strongly depends on local law and the specific organisational structure of the entity. All executive and non-executive directors should be considered as key management personnel, but the categorisation may also extend to others. For instance, an individual frequently mentioned in financial reports, such as management commentary, should likely also be considered a member of key management personnel. This individual does not necessarily need to be a ‘legal’ employee of the reporting entity. For example, the CEO of a significant subsidiary may also qualify, provided the aforementioned criteria are met.

If an individual is related to the entity based on the criteria stated above, all their close family members are also considered related parties. Close family members are defined as family members who are likely to influence, or be influenced by, that individual in their interactions with the entity (IAS 24.9). This includes:

- The individual’s children and spouse or domestic partner;

- Children of the individual’s spouse or domestic partner; and

- Dependents of the individual or the individual’s spouse or domestic partner.

It’s apparent that the network of related parties, based on ‘personal’ relationships, can be extensive. In practical terms, the only person capable of accurately identifying close family members is the individual in question. Hence, these individuals are typically asked by the reporting entity to disclose whether their close family members, as defined by IAS 24, engaged in any transactions with the reporting entity. Furthermore, the above list is not exhaustive, and an entity may identify, for example, a director’s brother as a related party.

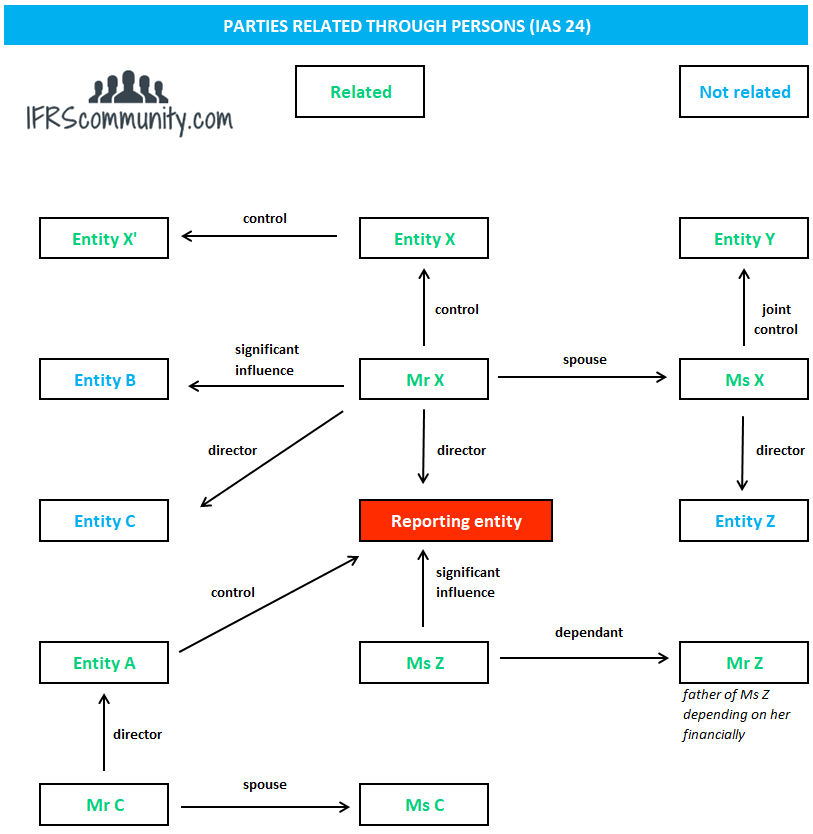

Example: Parties related through individuals

The following diagram demonstrates an example of a related party network based on personal relationships:

Disclosures

Relationships

Regardless of whether transactions have occurred between them, the relationships between a parent and its subsidiaries must be disclosed. An entity should disclose the name of its parent, and if different, the ultimate controlling party. If neither the entity’s parent nor the ultimate controlling party publishes consolidated financial statements available for public use, the name of the next most senior parent that does should also be disclosed (IAS 24.13-16).

Compensation of key management personnel

A reporting entity must disclose the total compensation of key management personnel and the breakdown for each significant category of employee benefits, as defined by IAS 19, and share-based payments (IAS 24.17). Employee benefits encompass all forms of remuneration paid, payable, or provided by the entity, or on its behalf, in exchange for services rendered. As per IAS 24.9, compensation includes:

- Short-term employee benefits, such as wages, salaries, social security contributions, paid annual leave, paid sick leave, profit-sharing, bonuses and non-monetary benefits like medical care, housing, cars and subsidised goods or services.

- Post-employment benefits, including pensions, other retirement benefits, post-employment life insurance and medical care.

- Other long-term employee benefits, including long-service leave, sabbatical leave, jubilee or other long-service benefits, and long-term disability benefits.

- Termination benefits.

- Share-based payments.

In addition to obvious items like salaries and bonuses, this disclosure should incorporate benefits in kind (medical care, housing etc.), holiday accrual and actuarial costs for post-employment and other long-term benefits. The allocation of actuarial costs can be complex, thus a simplified approach is often adopted. Some entities either exclude such costs in their disclosure or only disclose them upon actual payment.

Share-based payment arrangements can sometimes result in negative compensation, e.g., when non-market vesting conditions apply. If this happens, it could be beneficial to provide an explanatory note clarifying why the share-based payment compensation is negative.

According to general IAS 24 requirements, outstanding balances and commitments for all related parties, including key management personnel, should be disclosed (IAS 24.18b). Outstanding balances could be a result of accrued bonuses or holiday pay.

It’s common for key management personnel of a parent entity to allocate some of their time to a subsidiary without additional remuneration, for instance, as a non-executive director. Technically, a subsidiary should disclose this as a related party transaction, perhaps by assigning a notional expense based on the director’s estimated time. Alternatively, a narrative disclosure could be provided stating that a director of a parent also works as a non-executive director at the reporting entity without additional compensation.

Local law often requires further disclosures regarding key management personnel, like individual disclosures for each person. Many entities also publish a remuneration report, typically separate from financial statements.

Finally, IAS 24.17A-18A addresses instances where an entity obtains key management services from a management entity.

Transactions

Entities should disclose sufficient information about transactions with related parties to enable users to understand the potential impact on the financial statements. This includes the nature of the relationship, the transaction amount, outstanding balances (including off-balance sheet commitments), guarantees, and doubtful debts (IAS 24.18). A related party transaction, as per IAS 24.9, is a transfer of resources, services or obligations between a reporting entity and a related party, irrespective of whether a price is charged. These disclosures should be separately made for different categories of related parties as specified in IAS 24.19. Items of similar nature can be aggregated as per IAS 24.24. However, individual disclosure of each significant transaction isn’t mandatory (other than for government-controlled entities in IAS 24.26b(i)).

Even transactions that do not involve any charge (like use of facilities or brand name permissions) should be disclosed. A transaction might be material, despite its low value, especially in the context of key management compensation or transactions made without payment (or on above/below market terms). Always consult your tax department before disclosing transactions carried out on non-market terms, as these may violate local tax laws relating to transfer pricing.

Intragroup transactions within a group are eliminated on consolidation, thus they need not be disclosed under IAS 24 in the consolidated financial statements (IAS 27.4). However, consolidated financial statements of a sub-group should include disclosures relating to related parties outside the sub-group.

If a related party relationship changes during the current or comparative period, the disclosure of transactions only pertains to the period when the relationship existed (though this isn’t specifically addressed in IAS 24).

Off-balance sheet commitments

IAS 24.18(b) mandates the disclosure of commitments associated with related party transactions. Regrettably, the term ‘commitment’ is not defined in IAS 24. Moreover, IAS 24.21(i) requires the disclosure of ‘commitments to do something if a particular event occurs or does not occur in the future, including executory contracts (recognised and unrecognised).’

IFRS 12, which refers to IAS 24, requires the disclosure of commitments related to joint ventures (IFRS 12.23(a)). Paragraph IFRS 12.B19 offers examples of such commitments, and IFRS 12.B20 indicates that these instances exemplify some of the disclosure types required by paragraph IAS 24.18. Furthermore, IAS 16.74(c) and IAS 38.122(e) mandate the disclosure of commitments to purchase fixed assets. Although there is no reference to IAS 24, considering previous references, entities can infer that these are also needed as part of related party disclosures. In summary, comprehensive related party disclosure requirements also pertain to off-balance sheet items, so these should not be ignored.

Government-related entities

Paragraphs IAS 24.25-26 offer practical relief for entities controlled, jointly controlled, or significantly influenced by the government. For transactions with the government or another entity related through the same government control, the entity must provide a qualitative or quantitative indication of the extent of transactions that are collectively significant. Only individually significant transactions require disclosure of their nature and amount. IAS 24.27 outlines factors to consider when determining the significance of transactions.

Examples of related party disclosures

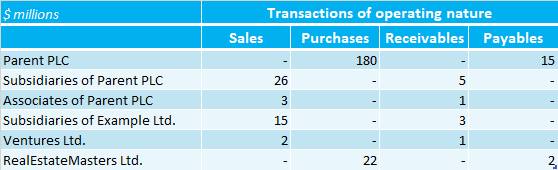

Here is an illustrative example of related party disclosures:

Related party relationships

Example Ltd. is controlled by Parent PLC, which also acts as the ultimate controlling party. Additionally, Lexa PLC holds significant influence over Example Ltd. Example Ltd. is a venturer in Ventures Ltd. and has multiple subsidiaries listed in note 2 to these separate financial statements. RealEstateMasters Ltd. is also considered a related party as it is under the control of Mr John Smith, CEO of Example Ltd.

Transactions and commitments

The table below discloses the amount of transactions Example Ltd. conducted with its related parties:

Note that transactions with subsidiaries of Example Ltd will not be shown in consolidated financial statements of Example Ltd, as they are eliminated on consolidation and hence do not impact consolidated accounts; and identical table for comparative period should be provided as well.

Purchases from Parent PLC primarily consist of a royalty fee for using the Parent brand. Example Ltd. pays 1.5% of revenue generated under the Parent brand. Sales to subsidiaries and associates of Parent PLC primarily consist of shared accounting services charged on a cost-plus-margin basis.

Sales to subsidiaries of Example Ltd. and Ventures Ltd. mainly involve consulting services. Charges are set on a per-hour basis, based on a cost-plus-margin rate.

Purchases from RealEstateMasters Ltd. consist of property rental fees. Rental charges are per square metre and comparable to market fees.

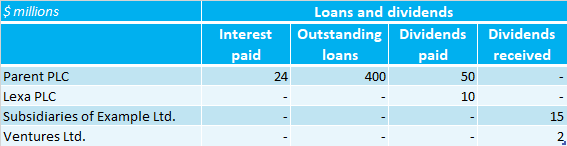

Loans and dividends are presented below:

The loan from Parent PLC incurs an interest of 6% p.a. and is repayable on 30 June 20X5.

Example Ltd. also has contractual commitments totalling $5 million for the acquisition of property, plant and equipment from Parent PLC.

Key management personnel compensation

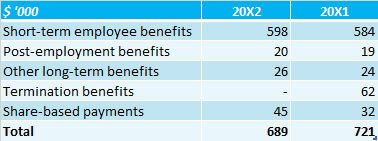

Example Ltd. maintains an executive committee of four members and a non-executive committee of six members. Members of both committees are deemed key management personnel. The table below discloses key management personnel compensation.

The remuneration policy for key management personnel is detailed in the annual report. (Please note: while not mandated by IFRS, remuneration policy is often a requirement of local law.)