Determining the lease term is a crucial judgment under IFRS 16 as it directly affects the size of recognised lease liabilities and the corresponding right-of-use assets. Furthermore, it determines whether a lease qualifies for the ‘short-term’ recognition exemption.

The process of establishing the lease term involves more judgement than many accountants typically assume. In 2019, the IFRS Interpretations Committee published a landmark agenda decision, accompanied by a staff paper. This decision concluded that when determining the lease term, ‘broader economics of the contract’ should be taken into account, as opposed to solely focusing on contractual termination payments.

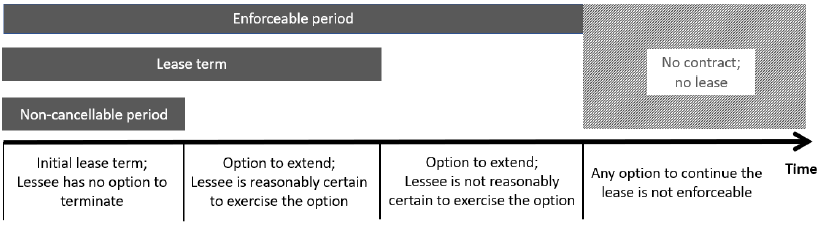

As summarised in the staff paper, to determine the lease term, an entity must first identify the enforceable period and the non-cancellable period of the contract. The next step is to determine where, within the range between the non-cancellable period and the enforceable period, the lease term falls:

Are you tired of the constant stream of IFRS updates? I know it's tough! That's why I created Reporting Period – a once-a-month summary for professional accountants. It consolidates all essential IFRS developments and Big 4 insights into one readable email. I personally curate every issue to ensure it's packed with the most relevant information, delivered straight to your inbox. It's free, with no spam, and you can unsubscribe with just one click. Ready to give it a try?

Non-cancellable period

The first step in assessing the lease term is to determine the non-cancellable period. This period is defined as the time during which neither party has the right to terminate the lease, or only the lessor retains such a right (IFRS 16.B34-B35).

The lease term can never be shorter than the non-cancellable period. For instance, if both parties to a lease contract have the unilateral right to terminate the lease for any reason, provided they give three months’ notice, then the non-cancellable period of the lease is three months. However, the lease term is often longer than the non-cancellable period.

Enforceable period

The enforceable period is the maximum potential length of the lease term. A lease is no longer enforceable when both the lessee and lessor have the right to terminate it without the other party’s consent and with no more than an insignificant penalty. Options for lease termination held by lessors are not considered in determining the lease term (IFRS 16.B34, BC127-128).

Understanding what constitutes a ‘penalty’ is vital when assessing the enforceable period. The IFRS Interpretations Committee has stated that lessees should not limit their understanding of ‘penalties’ solely to contractual termination payments. Instead, the ‘broader economics of the contract’ should be considered. This could encompass:

- Costs of relocating to a new leased space, such as finding another suitable asset, negotiation expenses, transportation costs, and the effects of disrupted operations.

- Impact on customer relationships and revenue generation.

- Consequences on the entity’s supply chain.

- Economic benefits of leasehold improvements extending beyond the non-cancellable period.

- Costs of dismantling leasehold improvements and restoring the leased asset to its original state.

As highlighted in IFRS 16.B40, the entity’s previous practices related to how long it typically uses certain types of assets (whether leased or owned), and its economic reasons for doing so, can provide useful insights for determining the lease term.

A lease contract may offer the lessee explicit options to extend or terminate the lease for a defined period. If such an option exists, the lessee should assess the likelihood of exercising that option. If it’s reasonably certain to do so, this should be factored into the lease term. The term ‘reasonably certain’ is not defined in IFRS, but it implies a high probability. IFRS 16.B37-B40 provides examples of considerations to be taken into account during such an assessment.

Moreover, the legal framework of a country plays an important role in evaluating the lease term and extension or termination options. Laws governing lease contracts can sometimes supersede contractual provisions, necessitating careful examination of lessees’ and lessors’ rights and obligations.

Identifying the enforceable lease term can be particularly difficult for cancellable, renewable, evergreen, and similar leases with no fixed term but a continuous contract until either party chooses to terminate it with a usually short notice period. In such cases, the Committee advises that lessees should also consider the ‘broader economics of the contract’.

Example: Lease of head office

Entity A, a software development company, operates from a leased head office in the city centre. The lease contract allows either Entity A or the lessor to terminate the lease unilaterally, given six months’ notice. Consequently, Entity A determines the non-cancellable lease term as six months. However, Entity A identifies significant economic incentives to occupy the space for a longer period. These include:

- Substantial leasehold improvements and customisations of the leased space.

- An advantageous location that gives Entity A a competitive edge in attracting and retaining skilled software developers.

- A competitive real estate market with few suitable alternative vacant properties.

As a result, Entity A concludes that only the lessor has the right to terminate the lease in six months without significant penalty. After considering all these factors, Entity A determines the lease term to be five years. This duration aligns with the period for which Entity A prepares strategic forecasts, as it does not anticipate substantial changes to its operations that would necessitate relocating the head office.

Practical approaches to lease term

Here are examples of practical approaches to determining the lease term, where the ‘broader economics of the contract’ need to be considered:

- For strategic buildings, such as a head office or logistics centre, the lease term is equal to the time horizon for which the lessee carries out detailed strategic planning, assuming the strategic plans anticipate continuing operations with these assets.

- For points of sale, the lease term depends on their classification. Leases can be grouped into categories like strategic location, mid-tier location, and low-tier location. A different lease term (e.g., 3/5/10 years) is assigned to each group, although it remains highly judgemental.

- For property leases where other significant assets are located, the lease term can correspond to the remaining useful life of those owned assets.

- When an entity recognises decommissioning provisions relating to leased assets, the lease term must align with the timeframe used when discounting these provisions.

- For leased assets used together, a consistent lease term should be applied (e.g., a parking lot next to a leased office building should have the same lease term as the building).

Reassessment

As per IFRS 16.21, both lessors and lessees need to reassess the lease term if changes occur in the non-cancellable period of a lease. This can happen when, for example, the lessee either exercises an option not previously included in the lease term determination or refrains from exercising an option previously included in the lease term.

IFRS 16.20 further requires the reassessment of options by lessees (but not lessors). However, this is only required when a significant event or substantial change in circumstances arises that:

- falls under the control of the lessee, and

- influences the likelihood of the lessee exercising an option not previously included in its lease term determination, or conversely, not exercising an option that was previously included.

Significant events or changes in circumstances could encompass a business decision by the lessee or the implementation of unplanned leasehold improvements or modifications to the leased asset (IFRS 16.B41). Lessees are not mandated to reassess their options at each reporting date or in response to purely market-driven events or other changes in circumstances beyond their control (IFRS 16.BC184-BC187).

The reassessment of a lease term results in the remeasurement of the lease liability.

Short-term leases

According to IFRS 16.5(a), lessees may choose not to apply IFRS 16 recognition and measurement requirements to short-term leases. A short-term lease is defined in Appendix A as a lease that, at the commencement date, has a lease term of 12 months or less and does not contain a purchase option.

It is crucial to note that entities should apply IFRS 16 when assessing the lease term for applying this short-term exemption (IFRS 16.BC93-94). As such, lease contracts with notice periods of less than 12 months might not qualify for the short-term exemption. This often happens if the enforceable period extends beyond the non-cancellable term, especially when we factor in the ‘broader economics of the contract’.

When the short-term exemption is applied, lease payments are recognised as an expense over the lease term on a straight-line basis or another systematic method (IFRS 16.6). The election for short-term leases should be made by class of underlying asset to which the right of use is related (IFRS 16.8).

A lease accounted for under the short-term exemption should be treated as a new lease if any lease modification occurs or if there are changes in the assessment of the lease term (IFRS 16.7).

Additional resources

Lease term: How long is the lease? by KPMG serves as an excellent guide for determining the lease term.

More about IFRS 16

See other pages relating to IFRS 16: