Deferred tax is a concept in accounting used to address the discrepancies arising from the different treatments of certain transactions by the tax law and IFRS. Essentially, it aims to account for the tax implications of future asset recovery and liability settlement, which are recognised in IFRS financial statements but are treated differently for tax purposes. It is helpful to view deferred tax as a ‘future’ tax, given its emphasis on upcoming tax effects. The total tax expense in the IFRS income statement is composed of deferred income tax and current income tax.

Let’s dive in.

Temporary differences

Understanding temporary differences is crucial for grasping the concept of deferred tax. These differences arise between the carrying amount of an asset or liability in the statement of financial position and its tax base (IAS 12.5). Temporary differences fundamentally represent timing variations regarding the recognition of transactions in IFRS financial statements and for tax purposes. They can either be taxable or deductible.

Differences that don’t have a tax effect when the associated asset or liability is recovered or settled are commonly referred to as ‘permanent’ differences. However, it’s noteworthy that IAS 12 does not use this term.

Tax base

The tax base is the amount attributed to an asset or liability for tax purposes. The specific calculation formulas for assets and liabilities are as follows:

- The tax base of an asset is the amount deductible for tax purposes against any taxable economic benefits flowing to an entity upon recovering the asset’s carrying amount. If these benefits aren’t taxable, the asset’s tax base equals its carrying amount, as outlined in IAS 12.7, with examples provided in the same paragraph.

- The tax base of a liability is its carrying amount, less any amount deductible for tax purposes concerning that liability in future periods. For revenue received in advance, the resulting liability’s tax base is its carrying amount, less any revenue amount not taxable in future, as detailed in IAS 12.8, with illustrative examples in the same paragraph.

IAS 12.9 clarifies that some items may have a tax base even if they aren’t recognised as assets and liabilities in the statement of financial position. An example of this would be research costs. According to IAS 38, these costs are recognised as an expense as soon as they are incurred. Nonetheless, they may require amortisation over a number of years for tax purposes. The difference between the tax base of the research costs, which is the amount tax authorities will allow as a deduction in future periods, and the carrying amount of nil, results in a deductible temporary difference, leading to a deferred tax asset.

--Are you tired of the constant stream of IFRS updates? I know it's tough! That's why I created Reporting Period – a once-a-month summary for professional accountants. It consolidates all essential IFRS developments and Big 4 insights into one readable email. I personally curate every issue to ensure it's packed with the most relevant information, delivered straight to your inbox. It's free, with no spam, and you can unsubscribe with just one click. Ready to give it a try?

Taxable temporary differences – deferred tax liabilities

Deferred tax liabilities are recognised for all taxable temporary differences (subject to initial recognition exemption) that arise when:

- The carrying amount of an asset exceeds its tax base, or

- The carrying amount of a liability is less than its tax base.

Examples of situations when taxable temporary differences arise, leading to the recognition of a deferred tax liability, include (IAS 12.17-18):

- Accrued revenue by an entity, taxable upon cash collection,

- Accelerated tax depreciation of a fixed asset compared to accounting depreciation,

- Capitalised expenditure for accounting, but treated as one-off expense for tax,

- Upward revaluation of assets ignored for taxation purposes (see IAS 12.20),

- Elimination of unrealised losses from intragroup transactions in consolidated financial statements.

Example: Illustration of the purpose of deferred tax

In 20X1, Entity A purchases a fixed asset for $1,000. With a useful life of 5 years, the annual depreciation charge under IAS 16 is $200. However, for tax purposes, Entity A can claim a $500 depreciation charge for the first 2 years. The entity generates an annual revenue of $800, taxable concurrently with IFRS recognition, at a 20% tax rate. All calculations in this example are available in the accompanying Excel file.

The income tax payable to authorities, calculated by Entity A, is presented in the following table:

| 20X1 | 20X2 | 20X3 | 20X4 | 20X5 | |

|---|---|---|---|---|---|

| Revenue | 800 | 800 | 800 | 800 | 800 |

| Depreciation charge (under tax law) | (500) | (500) | – | – | – |

| Taxable profit | 300 | 300 | 800 | 800 | 800 |

| Tax at 20% | 60 | 60 | 160 | 160 | 160 |

Subsequently, the deferred tax calculation at each year-end is as follows:

| 20X1 | 20X2 | 20X3 | 20X4 | 20X5 | |

|---|---|---|---|---|---|

| Carrying amount of fixed asset | 800 | 600 | 400 | 200 | – |

| Tax base | 500 | – | – | – | – |

| Deferred tax liability | 60 | 120 | 80 | 40 | – |

The IFRS financial statements appear as follows:

| 20X1 | 20X2 | 20X3 | 20X4 | 20X5 | |

|---|---|---|---|---|---|

| Revenue | 800 | 800 | 800 | 800 | 800 |

| Depreciation charge under IAS 16 | (200) | (200) | (200) | (200) | (200) |

| Profit before tax | 600 | 600 | 600 | 600 | 600 |

| Current income tax charge | (60) | (60) | (160) | (160) | (160) |

| Deferred income tax (charge)/credit | (60) | (60) | 40 | 40 | 40 |

| Total income tax charge | (120) | (120) | (120) | (120) | (120) |

| Net income | 480 | 480 | 480 | 480 | 480 |

| Effective tax rate* | 20% | 20% | 20% | 20% | 20% |

| Effective tax rate without deferred tax | 10% | 10% | 27% | 27% | 27% |

* The effective tax rate is determined by dividing the total income tax charge by the profit before tax.

As illustrated, recognising deferred tax allows Entity A to ‘accrue’ income tax when tax depreciation is inflated and subsequently utilise this ‘accrual’ when tax depreciation is deflated, enabling a more accurate representation of the tax expense in the income statement.

Deductible temporary differences – deferred tax assets

Deferred tax assets are recognised for all deductible temporary differences, subject to initial recognition exemption, to the extent that it is probable future taxable profit will be available against which these differences can be utilised. This contrasts significantly with deferred tax liabilities, where recognition isn’t contingent on estimates of future taxable profits (see Recoverability requirement below).

Taxable temporary differences arise when:

- The carrying amount of an asset is less than its tax base, or

- The carrying amount of a liability exceeds its tax base.

Situations leading to the recognition of deferred tax assets include (IAS 12.17-18):

- Provisions recognised under IAS 37, deductible from future taxable income on a cash basis,

- Liabilities for long-term employee benefits recognised under IAS 19, deductible from future taxable income on a cash basis,

- Recognised impairment losses for assets other than goodwill, not affecting the tax base of related assets,

- Elimination of unrealised gains from intragroup transactions in the consolidated financial statements.

Recoverability requirement

Deferred tax assets are recognised only to the extent that it is probable that sufficient taxable profit will be available against which the deductible temporary difference can be utilised (IAS 12.27). ‘Probable’ is not explicitly defined in IAS 12, but it is commonly interpreted as more likely than not (>50%), aligning with the meaning in IAS 37 and the IFRS glossary of terms. The assessment of future taxable profit should:

- Be conducted at the level of a taxable entity and taxation authority,

- Exclude the effects of the reversal of deductible temporary differences and future temporary differences (read more in IAS 12.BC55-BC56), and

- Consider tax planning opportunities (see IAS 12.30).

See Estimating future taxable profits for further discussion.

IAS 12 does not impose a time limit for the utilisation of deferred tax assets. Given that deferred tax is not discounted as per IAS 12.53, entities sometimes recognise deferred tax assets expected to be utilised many years into the future.

Taxable profit is deemed probable when there are sufficient taxable temporary differences, i.e., deferred tax liabilities, related to the same taxation authority and taxable entity. These differences should be expected to reverse in the same period as the expected reversal of the deductible temporary difference or in periods when a tax loss arising from the deferred tax asset can be carried back or forward (IAS 12.28).

Estimating future taxable profits

Estimating future taxable profits is to some extent analogous to forecasting future cash flows for impairment tests, with adjustments made for tax law provisions and tax planning opportunities (IAS 12.29-31).

The UK Financial Reporting Council has compiled a useful list detailing major differences in forecast preparation, stemming from the varying requirements of IAS 12 and IAS 36. These include:

- CGUs identified under IAS 36 may not align with taxable companies for IAS 12 purposes;

- Pre-tax cash flows used for impairment tests might differ from taxable profits, as the former may exclude certain elements, such as finance costs;

- IAS 36 mandates that future cash flows used for impairment purposes need to be discounted. In contrast, IAS 12 does not allow discounting, though the risk and uncertainty inherent in future events should be reflected in the expected future taxable profits; and

- While companies should not anticipate or consider highly uncertain future events outside their control when forecasting taxable profit, IAS 12 permits the consideration of tax planning opportunities. Consequently, it may be possible to incorporate the benefit of future restructuring plans for IAS 12 purposes that would not be reflected in corresponding IAS 36 value in use forecasts.

Unused tax losses and unused tax credits

Deferred tax assets are also recognised for the carryforward of unused tax losses and credits (IAS 12.34), subject to recoverability considerations. IAS 12.35 emphasises that the existence of unused tax losses is strong evidence that future taxable profit may not be available. Thus, an entity with recent losses recognises a deferred tax asset from unused tax losses or credits only if there are sufficient taxable temporary differences or convincing evidence of available future taxable profit (IAS 12.36).

Entities that have recognised deferred tax assets for unused tax losses and incurred a tax loss in the current or preceding period in the same tax jurisdiction are subject to additional disclosure requirements mandated by IAS 12.82.

The European Securities and Markets Authority (ESMA) has released a public statement detailing considerations regarding the recognition of deferred tax assets that arise from the carry forward of unused tax losses. This document sets out best practices for evaluating the availability of future taxable profits and the existence of convincing evidence supporting it. Notably, ESMA’s analysis holds relevance for all entities reporting under IFRS, regardless of their geographical location within or outside the EU.

Initial recognition exemption

Deferred tax is not recognised to the extent it arises from (IAS 12.15/24):

a. The initial recognition of goodwill (refer to Business combinations and goodwill); or

b. The initial recognition of an asset or liability in a transaction which:

(i) is not a business combination;

(ii) does not affect accounting profit or taxable profit at the time of the transaction; and

(iii) does not give rise to equal taxable and deductible temporary differences at the time of the transaction.

This exemption is commonly known as the Initial Recognition Exemption (IRE). While some accountants might use the term ‘exception’ instead of ‘exemption’, we won’t delve into this semantic difference here.

It’s crucial to clarify that IRE is only applicable to temporary differences arising on the initial recognition of an asset or liability. It does not apply to new temporary differences that may arise on the same asset or liability post-initial recognition. To illustrate this distinction, consider the following example:

Example: Initial recognition exemption

Entity A purchases an intangible asset for $10 million. Amortisation of this asset is not tax-deductible. Nevertheless, its recovery (i.e., revenue generated) will be taxed at 20%. Consequently, the tax base of the asset is zero, resulting in a temporary difference of $10 million upon its initial recognition. However, under the initial recognition exemption, deferred tax is not recognised. This is because recognising a deferred tax liability in this instance would simply lead to unnecessary inflation of assets as illustrated below:

Entry #1: Recognise fixed asset at cost:

DR Fixed asset: $10 million

CR Cash: $10 million

Entry #2: Recognise deferred tax liability (assuming a tax rate at 20%):

DR (? – Fixed asset?): $2 million

CR Deferred tax liability: $2 million

Since the asset’s initial recognition was exempt from deferred tax under IRE, subsequent depreciation of its initial carrying value will not trigger any deferred tax recognition as it pertains to the original temporary difference. If this asset is later revalued to a fair value of $12 million, the revaluation gain is due to subsequent accounting and, thus, does not fall under the initial recognition exemption. Consequently, a deferred tax liability would be recognised for the portion of the carrying amount representing the revaluation gain (i.e., $2 million). The subsequent depreciation of the carrying amount corresponding to the revaluation gain would ‘utilise’ this deferred tax liability.

Equal taxable and deductible temporary differences

Transactions that result in equal taxable and deductible temporary differences at the time of the transaction are not subject to the initial recognition exemption. Common examples of these transactions include leases and decommissioning provisions. However, it’s crucial to highlight that there’s no condition requiring the resulting deferred tax assets and liabilities to be equal too.

There are two primary scenarios where equal taxable and deductible temporary differences may lead to unequal deferred tax assets and liabilities. The first scenario is influenced by the recoverability requirement, applicable only to deferred tax assets. This criterion can lead to situations where, despite equal taxable and deductible temporary differences, only a deferred tax liability is recognised. The second scenario arises when different tax rates are applied in the measurement of deferred tax assets and liabilities, resulting in their unequal values.

It’s worth highlighting that the Exposure Draft for the amendments to IAS 12 Deferred Tax related to Assets and Liabilities arising from a Single Transaction included a ‘capping proposal.’ This suggested that the initial recognition exemption should continue to apply to the extent that an entity would otherwise recognise unequal amounts of deferred tax assets and liabilities. However, this proposal was not adopted in the final amendments issued by the IASB which became effective from 2023. For further details, please refer to the basis for conclusions paragraphs IAS 12.BC82 – BC88.

When recognised deferred tax assets and liabilities are unequal, this difference is recognised in profit or loss in line with IAS 12.22(b). This paragraph mandates that if a transaction leads to equal taxable and deductible temporary differences, an entity is required to recognise the corresponding deferred tax expense or income in profit or loss.

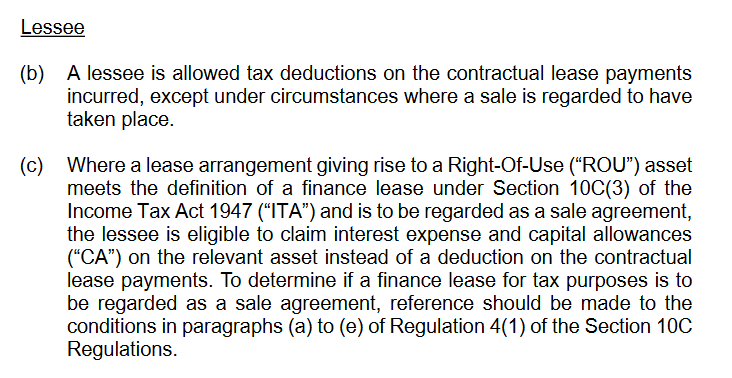

For leases, a key judgement is deciding if tax deductions are associated with the lease asset or liability. IAS 12.BC74 clarifies that although entities may receive tax deductions for lease payments on a cash basis, these could still be allocated to either the lease asset or the lease liability.

The attribution of tax deductions has pivotal implications because temporary differences only arise on initial recognition if tax deductions are assigned to the lease liability. When deductions are associated with the lease asset, the tax bases of the lease asset and lease liability equal their carrying amounts, reflecting that the entity will receive tax deductions equal to the carrying amount of the lease asset and no deductions in respect of the lease liability. In such cases, no temporary differences arise on initial recognition of the lease contract and the initial recognition exemption is not applicable (IAS 12.BC76).

Entities attributing deductions to lease liabilities will record gross amounts of deferred tax assets and liabilities. This comes with a risk of deferred tax assets becoming irrecoverable, requiring a write-off against profit or loss. Furthermore, disclosures in the notes should explain the gross amounts of deferred tax assets and liabilities, highlighting the importance of tax deduction allocation.

Regrettably, the IASB chose not to provide application guidance or examples for determining tax deduction allocation to lease assets or liabilities, fearing ‘unintended consequences’ and additional complexity. For more information, refer to the sections ‘Attribution of tax deductions to the lease asset or lease liability’ and ‘Providing application guidance on attribution of tax deductions’ on pages 10 and 24 of the IFRS staff paper.

In some tax jurisdictions, tax authorities may dictate tax deduction attribution. For instance, the Singaporean tax office has issued guidance specifying that tax deductions are attributed to the leased asset if the lease contract is considered a finance lease under tax law, and to the lease liability in other cases:

Example: Deferred tax arising on initial recognition of leases

Suppose Entity A enters into a five-year lease of an asset on 1 January 20X1, making annual upfront payments of $50,000. The tax law recognises the expense on a cash basis and tax deduction is attributed to lease liability. Assume Entity A generates an annual revenue of $70,000.

In this scenario, the applicable discount rate is 5%, and the tax rate is 20%. The present value of the lease liability is $227,292, which also represents the initial cost of the right-of-use (RoU) asset.

The subsequent accounting schedules for the lease liability and right-of-use asset are presented below. All relevant calculations are available in the accompanying Excel file. However, familiarity with the accounting for leases under IFRS 16 would be beneficial before delving into this example.

Right-of-use asset:

| Year | NBV: opening balance | Depreciation | NBV: closing balance |

|---|---|---|---|

| 20X1 | 227,292 | (45,458) | 181,834 |

| 20X2 | 181,834 | (45,458) | 136,375 |

| 20X3 | 136,375 | (45,458) | 90,917 |

| 20X4 | 90,917 | (45,458) | 45,458 |

| 20X5 | 45,458 | (45,458) | – |

Lease liability:

| Year | Opening | Payment | Discount | Closing |

|---|---|---|---|---|

| 20X1 | 227,292 | (50,000) | 8,865 | 186,157 |

| 20X2 | 186,157 | (50,000) | 6,808 | 142,964 |

| 20X3 | 142,964 | (50,000) | 4,648 | 97,613 |

| 20X4 | 97,613 | (50,000) | 2,387 | 50,000 |

| 20X5 | 50,000 | (50,000) | – | – |

Since the transaction results in equal taxable and deductible temporary differences, the initial recognition exemption is not applicable. Therefore, deferred tax is recognised for both the RoU asset and the lease liability. The statement of financial position and the income statement are presented in the tables below:

| 20X1 YE | 20X2 YE | 20X3 YE | 20X4 YE | 20X5 YE | |

|---|---|---|---|---|---|

| Statement of financial position | |||||

| Right-of-use asset | 181,834 | 136,375 | 90,917 | 45,458 | – |

| Lease liability | 186,157 | 142,964 | 97,613 | 50,000 | – |

| Deferred tax asset | 865 | 1,318 | 1,339 | 908 | – |

| Income statement | |||||

| Revenue | 70,000 | 70,000 | 70,000 | 70,000 | 70,000 |

| Depreciation expense | (45,458) | (45,458) | (45,458) | (45,458) | (45,458) |

| Discounting expense | (8,865) | (6,808) | (4,648) | (2,387) | – |

| Gross profit | 15,677 | 17,734 | 19,893 | 22,154 | 24,542 |

| Current income tax charge | (4,000) | (4,000) | (4,000) | (4,000) | (4,000) |

| Deferred income tax (charge)/credit | 865 | 453 | 21 | (431) | (908) |

| Net income | 12,542 | 14,187 | 15,915 | 17,723 | 19,633 |

| Effective tax rate | 20% | 20% | 20% | 20% | 20% |

Investments in subsidiaries, associates, and interests in joint arrangements

IAS 12 outlines specific provisions regarding the recognition of deferred tax associated with investments in subsidiaries, associates, and interests in joint arrangements (IAS 12.38-45). These provisions address the so-called ‘outside’ basis differences, which are differences between the carrying amount of parent’s investment (in consolidated financial statements represented by underlying assets and liabilities) and the investment’s tax base (in the parent’s tax jurisdiction). In contrast, ‘inside’ basis differences relate to individual assets or liabilities held by investees (i.e., inside the investee), such as intangible assets and provisions, and arise in the subsidiary’s tax jurisdiction.

The exception in IAS 12.39/44 applies only to the ‘outside’ basis differences. Such differences are common because the tax base of the investment usually corresponds to its original cost, while the carrying amount can be influenced by various factors such as undistributed profits, impairment losses, or translation differences emerging during consolidation.

Deferred tax liabilities are recognised for ‘outside’ basis differences arising on the aforementioned investments, unless (IAS 12.39):

- The investor can control the timing of the reversal of the temporary difference; and

- It is probable that the temporary difference will not reverse in the foreseeable future.

For a more detailed discussion on these criteria, see paragraphs IAS 12.40-43. Due to varying positions of investors, the application of this exception can differ concerning different types of investments.

Deferred tax assets, on the other hand, are recognised for ‘outside’ basis differences only when it is probable that (IAS 12.44):

- The temporary difference will reverse in the foreseeable future; and

- Taxable profit will be available against which the temporary difference can be utilised.

In practice, these criteria often allow entities not to recognise deferred tax for the ‘outside’ basis differences arising on most of their investments in subsidiaries. However, deferred tax is typically recognised when:

- The distribution of retained profits is probable and has tax effects;

- A sale of an investment becomes probable.

Example: ‘Outside’ basis differences arising on an investment in a subsidiary

On 1 January 20X1, Entity A acquires Entity B for EUR 100m. Entity A operates in Germany with EUR as its functional currency, while Entity B operates in Australia, using AUD. The tax rate in Germany is 20% and 30% in Australia. The table below displays the assets and liabilities of Entity B translated to EUR:

| Fair value | Tax base | Temporary difference |

|

|---|---|---|---|

| PP&E | 150 | 100 | 50 (taxable) |

| Trade receivables | 80 | 80 | – |

| Total Assets | 230 | 180 | 50 (taxable) |

| Provisions | 20 | – | 20 (deductible) |

| Trade payables | 120 | 120 | – |

| Total liabilities | 140 | 120 | 20 (deductible) |

To calculate the net assets of Entity B in the consolidated financial statements of Entity A, we must calculate the deferred tax on temporary differences and recognise goodwill arising on this business combination:

A: Net assets of Entity B excluding deferred tax and goodwill (EUR 230m – EUR 140m): EUR 90m

B: Deferred tax liability arising on temporary differences at B’s tax rate [(EUR 50m – EUR 20m)] x 30%: EUR 9m

C: Net assets of Entity B including deferred tax, excluding goodwill (A-B): EUR 81m

D: Goodwill (consideration of EUR 100m less net assets acquired of EUR 81m): EUR 19m

E: Net assets of Entity B in consolidated financial statement of Entity A (C+D): EUR 100m

From the above, the net assets of Entity B in the consolidated financial statements of Entity A total EUR 100 million. The tax base of the investment in B from A’s perspective is also EUR 100 million, equalling the cost. Hence, no ‘outside’ basis difference exists in either the separate or consolidated financial statements at the date of acquisition.

Assume that during the year 20X1, the following occurs:

- Entity B incurs a net loss of EUR 10 million;

- Entity A recognises in consolidated OCI a EUR 5 million of translation differences (gain) relating to Entity B;

- Entity A recognises EUR 15 million of goodwill impairment in consolidated financial statements and EUR 15 million of impairment of investment in B, carried at cost in separate financial statements.

Consequently, at the end of 20X1, the net assets of Entity B in the consolidated financial statements of Entity A amount to EUR 80 million:

| 100 | Opening balance of net assets |

| (10) | Net loss for 20X1 |

| 5 | Translation gain |

| (15) | Goodwill impairment |

| 80 | Net assets at 31 December 20X1 |

|---|

The tax base remains constant at EUR 100 million, giving rise to a deductible ‘outside’ basis difference of EUR 20 million in A’s consolidated financial statements. In the separate financial statements of A, the investment in B is valued at EUR 85 million (original cost minus impairment), thus the deductible ‘outside’ basis difference amounts to EUR 15 million. If there were no exception for the recognition of deferred tax arising on investments in subsidiaries, as discussed earlier, Entity A would be obligated to recognise deferred tax on ‘outside’ basis differences related to its investment in Entity B in both consolidated and separate financial statements.

Applicable tax rate

Different tax rates often apply to dividends received from an investment and to gains on the disposal of an investment. The measurement principle in IAS 12 stipulates that the measurement of deferred tax assets and liabilities should reflect the tax consequences ensuing from the manner in which the entity anticipates recovering the carrying amount of its assets. Consequently, if an entity deems it necessary to recognise deferred tax, it must ascertain which part of the investment will be recovered through dividends or other forms of capital distributions, and which through disposal. This perspective was confirmed by the IFRS Interpretations Committee.

Single asset entities

Certain assets, predominantly properties, are held by single asset entities, usually for legal and/or tax reasons. The IFRS Interpretations Committee deliberated whether deferred tax relating to such entities should be evaluated with reference to both ‘outside’ and ‘inside’ temporary differences, i.e., differences relating to the investment in the entity and the asset held by the entity. The conclusion reached is that deferred tax should be assessed regarding both ‘outside’ and ‘inside’ temporary differences, as IAS 12 currently does not offer any exceptions specifically applicable to single asset entities.

Measurement of deferred tax

Deferred tax assets and liabilities are measured at the tax rates expected to be applicable during the period when the asset is realised or the liability is settled, based on tax rates (and tax laws) enacted or substantively enacted by the end of the reporting period (IAS 12.47).

The measurement of deferred tax should incorporate tax consequences that would result from the manner in which the entity, at the end of the reporting period, anticipates recovering or settling the carrying amount of its assets and liabilities (IAS 12.51). For additional discussion and examples, refer to paragraphs IAS 12.51A-51E.

The measurement of deferred tax is based on the carrying amount of the entity’s assets and liabilities (IAS 12.55), and therefore, cannot be based on an asset’s fair value if the asset is measured at cost. It is also noteworthy that deferred tax assets and liabilities are not discounted (IAS 12.53-54).

Tax laws enacted or substantively enacted

IAS 12 does not provide specific guidance on the enactment or substantive enactment of a tax law as it is contingent on local legislative processes. However, there is usually a consensus among accounting professionals regarding its interpretation in each tax jurisdiction. Importantly, a law enacted or substantively enacted after the end of the reporting period is considered a non-adjusting event (IAS 10.22(h)).

Uncertain tax treatments

IFRIC 23, issued by the IASB, addresses uncertain tax treatments, defining them as treatments where uncertainty exists regarding their acceptance by the relevant taxation authority (IFRIC 23.3). According to IFRIC 23, an entity:

- Considers uncertain tax treatments separately or collectively, depending on which approach better predicts the resolution of the uncertainty (IFRIC 23.6-7),

- Assumes that a taxation authority will scrutinise amounts it is entitled to and will possess complete knowledge of all pertinent information, a concept referred to as ‘full detection risk’ (IFRIC 23.8),

- Assesses whether it is probable (>50%) that a taxation authority will accept an uncertain tax treatment. If so, the measurement is based on the tax treatment utilised or intended for use in its income tax filings (IFRIC 23.9-10),

- If acceptance by a taxation authority is not probable, the uncertainty in measurement is reflected using the most likely amount or the expected value, depending on which method better predicts the resolution of the uncertainty (IFRIC 23.11-12 and Examples 1 and 2 accompanying IFRIC 23),

- Reassesses judgements or estimates if there is a change in facts and circumstances (IFRIC 23.13-14, A1-A3).

Business combinations and goodwill

A deferred tax asset is also recognised for fair value adjustments made in accounting for business combinations, as such adjustments generally do not affect the tax base of the related assets and liabilities. Typically, deferred tax arising from a business combination affects the amount of goodwill or the gain on bargain purchase (IAS 12.66). If the target company possesses unrecognised unused tax losses carried forward, these can be recognised as deferred tax assets as part of the business combination accounting. Reassessing unrecognised deferred tax assets of the target is advisable, as inclusion in the new group may offer a different perspective regarding tax planning opportunities.

Should the deferred tax of the target company be adjusted within the measurement period due to new information about facts and circumstances existing at the acquisition date, the corresponding impact is treated as an adjustment to goodwill (IAS 12.68). A business combination may also influence the pre-acquisition deferred tax of the acquiring entity, for instance, through the emergence of new tax planning opportunities. If so, the impact of such deferred tax is not recognised as part of business combination accounting. Instead, it typically affects P/L for the current period (IAS 12.67). This method is adhered to even if tax effects were considered during business combination negotiations (IFRS 3.BC286).

Goodwill arising in a business combination falls under the initial recognition exemption and thus does not lead to a deferred tax liability. This is due to goodwill being measured as a residual, and the recognition of the deferred tax liability would increase the carrying amount of goodwill. Subsequent reductions in the unrecognised deferred tax liability, for instance, through the recognition of an impairment loss, are also considered as arising from the initial recognition of goodwill and are therefore not recognised. However, if goodwill is amortised for tax purposes under local tax law, the taxable temporary differences arising subsequent to initial recognition are recognised as deferred tax liabilities (IAS 12:21-21B).

Refer also to the section on deferred tax arising on investments in subsidiaries.

Share-based payment transactions

The accounting for current and deferred tax arising from share-based payment transactions is outlined in paragraphs IAS 12.68A-68C and Example 5 accompanying IAS 12.

Reassessment and review of deferred tax

Deferred tax assets and liabilities should be reassessed and reviewed at the end of each reporting period. This review may result in the recognition of previously unrecognised deferred tax or a reduction in the carrying amount of previously recognised deferred tax (IAS 12.37,56). When the anticipated manner of recovering or settling the carrying amount of assets and liabilities at the end of the reporting period changes, the tax consequences should be accounted for concurrently with the expectation change. This might lead to the tax effect being accounted for in an earlier period than the underlying transaction itself.

Presentation

The prevailing rule is that the accounting for deferred (and current) tax effects of a transaction or other event aligns with the accounting for the transaction or event itself. This implies that current and deferred tax effects are recognised in P/L, OCI, equity or affect goodwill, according to the impact of the corresponding item (IAS 12.57-62A). When an item is recycled from OCI to P/L, the tax impact is recycled likewise, a practice that is widely accepted though not explicitly covered in IAS 12.

Tax consequences of exchange differences

Exchange differences on deferred foreign tax liabilities or assets may be classified as deferred tax expense (IAS 12.78).

The IFRS Interpretations Committee has examined the issue of recognising deferred taxes when the tax bases of an entity’s non-monetary assets and liabilities are determined in a currency that is different from its functional currency. They concluded that deferred taxes resulting from exchange rate changes on the tax bases of non-current assets are recognised in profit or loss under IAS 12.41. This is applicable even when the carrying amount of the asset remains unchanged as, under IAS 21, non-monetary assets are not retranslated subsequent to their initial recognition.

Tax consequences of dividends

Income tax consequences of dividends are linked more directly to past transactions or events that generated distributable profits, rather than to distributions to owners (IAS 12.57A). As a result, entities should recognise the income tax consequences of dividends in P/L, OCI or directly in equity, depending on where the entity originally recognised the transactions or events that generated distributed profits. Furthermore, IAS 12.52A includes an example illustrating the presentation and measurement of income tax consequences of dividends paid.

Pro rata allocation

In some instances, allocating the tax impact between P/L and OCI may prove challenging. In such cases, IAS 12 permits a reasonable pro-rata allocation (IAS 12.63). One scenario illustrating this challenge pertains to long-term and post-employment employee benefits, where actuarial gains or losses are recognised through OCI. Tax deductions are typically available when actual payments (contributions) are made, and it is generally unfeasible to allocate such tax deductions between components that previously arose through P/L (e.g., current service cost) and OCI (e.g., actuarial losses).

Offsetting deferred tax assets and liabilities

Deferred tax assets and deferred tax liabilities are offset only if (IAS 12.74):

1. The entity has a legally enforceable right to set off current tax assets against current tax liabilities; and

2. The deferred tax assets and the deferred tax liabilities pertain to income taxes imposed by the same taxation authority on either:

a. The same taxable entity; or

b. Different taxable entities that intend either to settle current tax liabilities and assets on a net basis, or to realise the assets and settle the liabilities simultaneously, in each future period in which significant amounts of deferred tax liabilities or assets are expected to be settled or recovered.

Pillar Two tax reform

In December 2021, the OECD released its Pillar Two model rules, a component of a broader initiative aimed at addressing tax challenges arising from the digitalisation of the economy. These rules, agreed upon by over 135 countries and jurisdictions, accounting for more than 90% of the world’s GDP, form part of a dual-pillar strategy. Pillar Two’s focus is distinct from Pillar One, which primarily concerns the redistribution of tax-paying locations for companies.

Key aspects of Pillar Two:

- Pillar Two targets large multinational corporations with consolidated revenues exceeding EUR 750 million in at least two of the past four years. These corporations must compute their effective tax rate (ETR) for each jurisdiction where they operate.

- The gross income for ETR calculation will align with the accounting framework used in the consolidated financial statements, such as IFRS.

- If the ETR falls below the minimum threshold of 15%, the corporation must pay a top-up tax to cover the shortfall.

Countries are given discretion on how they choose to implement these regulations through the designated Pillar Two mechanisms.

Responding to Pillar Two reforms, the IASB has introduced a temporary, mandatory exception in IAS 12.4A. This exception relates to the accounting of deferred taxes arising from the adoption of these global tax rules. Under this exception, entities are not required to recognise or disclose deferred tax assets and liabilities associated with Pillar Two income taxes.

Disclosure requirements once Pillar Two legislation is (substantively) enacted but not yet in effect:

Entities must disclose relevant information to clarify their exposure to Pillar Two income taxes at the reporting date:

- Qualitative data: Description of how Pillar Two taxes impact the company, including jurisdictions of exposure, and where the top-up tax may be applicable.

- Quantitative data: Proportion of profits subject to Pillar Two taxes and the average effective tax rate, or potential changes to this rate under Pillar Two legislation.

Disclosure requirements after Pillar Two legislation is effective:

The only required disclosure is the current income tax expense related to the top-up tax (IAS 12.88A-88D).

More about IAS 12

See other pages relating to IAS 12: