IFRS 9 mandates recognition of impairment losses on a forward-looking basis, thereby recognising impairment loss prior to any credit event occurring. These losses are known as expected credit losses (ECL).

Impairment losses are typically recognised on receivables, loan commitments, and financial guarantee contracts (please refer to the detailed list).

Let’s dive in.

Three approaches to impairment

IFRS 9 sets out three distinctive approaches to recognising impairment:

- General approach.

- Simplified approach applicable to certain trade receivables, contract assets and lease receivables.

- Specific approach for purchased or originated credit-impaired financial assets.

General approach

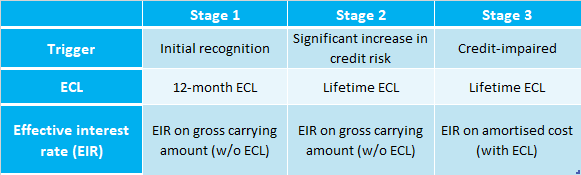

The general IFRS 9 approach for recognising impairment follows a three-stage model, also known as the three-bucket model:

In this approach, an entity recognises either 12-month ECL or lifetime ECL, based on whether there has been a significant increase in credit risk (IFRS 9.5.5.3).

Any changes in the loss allowance are recognised in P/L as impairment gains or losses (IFRS 9.5.5.8).

--Are you tired of the constant stream of IFRS updates? I know it's tough! That's why I created Reporting Period – a once-a-month summary for professional accountants. It consolidates all essential IFRS developments and Big 4 insights into one readable email. I personally curate every issue to ensure it's packed with the most relevant information, delivered straight to your inbox. It's free, with no spam, and you can unsubscribe with just one click. Ready to give it a try?

Simplified approach

IFRS 9 introduced a simplified approach to aid entities with less sophisticated credit risk management systems. In this approach, entities aren’t required to monitor changes in the credit risk of financial assets (IFRS 9.BC5.104). Instead, lifetime ECL are recognised from the date of initial recognition of a financial asset (IFRS 9.5.5.15).

The simplified approach is mandatory for trade receivables or contract assets resulting from transactions that fall within the scope of IFRS 15 and do not contain a significant financing component. It’s the entity’s discretion to apply the simplified approach for trade receivables or contract assets with a significant financing component. Likewise, the entity can choose to apply the simplified approach to lease receivables accounted for under IFRS 16 (IFRS 9.5.5.15). For further details, please refer to the practical approach to the simplified loss rate approach (provision matrix).

Specific approach for purchased or originated credit-impaired financial assets

Finally, IFRS 9 establishes a specific approach for purchased or originated credit-impaired financial assets (often abbreviated as ‘POCI’ assets). For such assets, an entity only recognises the cumulative changes in lifetime ECL since the initial recognition of the asset (IFRS 9.5.5.13-14). A purchased or originated credit-impaired financial asset is an asset that is credit-impaired at the time of initial recognition (IFRS 9 Appendix A).

It is important to note that an asset isn’t considered credit impaired merely because it has high credit risk at the time of initial recognition (IFRS 9.B5.4.7).

Measurement of expected credit losses (ECL)

Defining credit losses

A credit loss refers to the difference between all due contractual cash flows to an entity in accordance with the contract and all the cash flows the entity expects to receive. This amount is discounted at the original effective interest rate (EIR) or credit-adjusted EIR (IFRS 9 Appendix A).

Cash flows in ECL measurement

When estimating cash flows for ECL measurement, the entity considers (IFRS 9 Appendix A):

- Expected life of a financial instrument,

- All contractual terms of the financial instrument (e.g. prepayment, extension, call and similar options),

- Collaterals held,

- Other credit enhancements that are integral to the contractual terms.

Lifetime expected credit losses (ECL)

Lifetime ECL are the ECL that arise from all possible default events over the expected life of a financial instrument (IFRS 9 Appendix A). Consequently, lifetime ECL are the present value of the difference between (IFRS 9.B5.5.29):

- Contractual cash flows due to an entity under the contract, and

- Cash flows the entity expects to receive.

Please see this example.

12-month expected credit losses (ECL)

12-month ECL are a portion of lifetime ECL, representing the credit losses that will be incurred due to a default occurring within the 12 months after the reporting date, adjusted by the likelihood of that default happening. For financial assets with an expected life of less than 12 months, a shorter period should be used (IFRS 9.B5.5.43).

IFRS 9 specifies that 12-month ECL are neither the lifetime ECL that an entity will incur on financial instruments it predicts will default in the upcoming 12 months, nor the anticipated cash shortfalls over the next 12 months (IFRS 9.B5.5.43). This is due to 12-month ECL being weighted by the probability of default (PD). Therefore, 12-month ECL are recognised even if PD is very small.

The following example demonstrates the calculation of lifetime ECL and 12-month ECL for a loan.

Example: Illustrative calculation of lifetime ECL and 12-month ECL for a loan

On 31 December 20X1, Entity A loans Entity B $100,000. Entity B will repay the loan in 5 annual instalments amounting to $25,000 (totalling $125,000). The calculation of ECL will be based on the PD/LGD/EAD model:

- PD – probability of default

- EAD – expected exposure at the time of default

- LGD – loss given default (what percentage of EAD will not be recovered at default, considering any collaterals held)

The calculations of 12-month ECL and lifetime ECL are shown below. All the calculations in this example are available in an Excel file.

| Reporting date | EAD | PD (marginal) | PD (cumulative) | LGD | EIR | Marginal ECL |

|---|---|---|---|---|---|---|

| 20X1-12-31 | 100,000 | 3% | 3% | 80% | 7.9% | 2,224 |

| 20X2-12-31 | 82,926 | 3% | 6% | 80% | 7.9% | 1,709 |

| 20X3-12-31 | 64,500 | 3% | 9% | 80% | 7.9% | 1,231 |

| 20X4-12-31 | 44,627 | 4% | 13% | 80% | 7.9% | 1,053 |

| 20X5-12-31 | 23,164 | 4% | 17% | 80% | 7.9% | 506 |

| Total: | 6,722 |

The table above shows that as of 31 December 20X1, the 12-month ECL amount to $2,224, while the lifetime ECL total $6,722.

Measurement methodology

IFRS 9 does not stipulate specific methodology requirements for ECL measurement, but offers general guidance that the measurement of ECL should reflect (IFRS 9.5.5.17):

- Unbiased and probability-weighted amount, determined by evaluating a range of possible outcomes,

- Time value of money, and

- Reasonable and supportable information that is available without undue cost or effort at the reporting date about past events, current conditions, and forecasts of future economic conditions.

Two common approaches to ECL measurement applied in practice include:

Significant increase in credit risk

The notion of a significant increase in credit risk (SICR) is central to the general approach to ECL calculation. If a financial asset exhibits SICR since initial recognition, it is moved from Stage 1 and 12-month ECL to Stage 2 and lifetime ECL. The assessment of a significant increase in credit risk involves determining the change in the possibility of a default over the financial instrument’s expected lifespan, not the change in the amount of ECL. To accomplish this, entities compare the default risk on the financial instrument at the reporting date with the same risk at the date of initial recognition (IFRS 9.5.5.9).

Defining ‘significant’

IFRS 9 does not provide a specific definition of ‘significant’, and the rationale behind this is explained in paragraph IFRS 9.BC5.171 of the basis for conclusions. Consequently, entities are expected to use judgement and establish their own criteria. IFRS 9.B5.5.7 explicitly states that a significant increase in credit risk usually occurs prior to a financial asset becoming credit-impaired or an actual default taking place. Paragraph IFRS 9.B5.5.17 provides a list of information that will be useful in assessing changes in credit risk.

Definition of default

IFRS 9 does not offer a definition of ‘default’. Instead, the standard mandates an entity to apply a default definition that aligns with the one used for internal credit risk management. Qualitative indicators such as breaching financial covenants should also be considered when appropriate. However, IFRS 9 does introduce a rebuttable presumption that default does not occur later than when a financial asset is 90 days past due, unless an entity can provide reliable evidence supporting that a more delayed default criterion is more suitable. The definition of default should be consistent across all financial instruments unless an entity can demonstrate that another definition is more suitable for a specific financial instrument (IFRS 9.B5.5.37). The 90-day threshold also aligns with Basel regulatory capital requirements for banks.

The role of past due information

Many entities rely on past due information, such as data on payments not made when due, when evaluating changes in credit risk. While IFRS 9 advises using more forward-looking information when available without excessive cost or effort, past due information is also permissible. IFRS 9 also introduces a rebuttable presumption that the credit risk on a financial asset has significantly increased since its initial recognition when contractual payments are over 30 days past due. This is the latest point at which lifetime ECL should be recognised, even when adjusted for forward-looking information (IFRS 9.5.5.11; B5.5.19-20).

Collective and individual assessment

Information on an individual asset level may not always be available and a collective assessment for groups of financial assets might be required to ensure that significant increases in credit risk are recognised in a timely fashion, and not only after the instrument has become past due (IFRS 9.B5.5.1-6). A collective assessment is commonly used for homogeneous, individually insignificant, financial assets. This often represents the only feasible way to implement a forward-looking ECL model. Paragraph IFRS 9.B5.5.5 provides examples of grouping financial assets for the purpose of impairment assessment on a collective basis.

See also Illustrative Example 5 accompanying IFRS 9 (section ‘Collective assessment’).

Practical expedient for assets with low credit risk

An entity may presume that the credit risk on a financial instrument has not significantly increased since its initial recognition if the financial instrument is deemed to have a low credit risk at the reporting date (IFRS 9.5.5.10).

In assessing the low credit risk of a financial instrument, several factors are considered: the default risk, the borrower’s ability to meet short-term cash flow obligations, and resilience to long-term economic fluctuations. An instrument’s low credit risk is not solely based on collateral value – it must inherently possess low credit risk without such support. Additionally, an instrument isn’t deemed low risk merely due to a lower default risk relative to other instruments of the entity or within the entity’s jurisdiction. An ‘investment grade’ external rating is a sign that a financial instrument might have low credit risk. However, external ratings are not mandatory for an instrument to be classified as low credit risk (IFRS 9.B5.5.22‒24).

Credit-impaired financial assets

A financial asset becomes credit-impaired when one or more events that negatively affect its estimated future cash flows have occurred. Such events, outlined in Appendix A to IFRS 9, may include significant financial difficulty of the borrower or breach of contract terms (for instance, a past-due event or default).

The process of calculating interest income on credit-impaired financial assets is discussed in a separate section.

Simplified approach to lifetime ECL using a provision matrix

The loss rate approach, especially beneficial for non-financial entities, doesn’t necessitate sophisticated credit risk management systems. This approach uses a provision matrix to calculate lifetime ECL by following these steps:

- Segment receivables based on different credit loss patterns (for example, customer type, product type, geographical region, collateral, etc.).

- Prepare an ageing schedule of receivables (e.g., not past due, past due 1-30 days, 31-60 days, 90+ days).

- Calculate historical loss patterns as a starting point for estimating expected loss rate.

- Adjust historical data to accommodate reasonable and supportable information about current circumstances and future economic condition forecasts.

Paragraph IFRS 9.B5.5.35 and Example 12 (IFRS 9.IE74-77) specifically cite the provision matrix as a simplified approach to ECL measurement for trade receivables, contract assets, and lease receivables. Refer also to the basis for conclusions in IFRS 9.BC5.225.

Example: Lifetime ECL for trade receivables using a provision matrix

Let’s consider Entity A, a service provider with two types of customers: individual customers (B2C) and business customers (B2B). Entity A finds that B2C / B2B segmentation accurately represents credit loss patterns. Typically, sales are made on credit, leaving Entity A with a substantial balance of outstanding trade receivables at each reporting date. With no significant financing component, Entity A recognises lifetime ECL for all its trade receivables.

In this example, we calculate the loss rate based on sales made in January of a given year. In reality, the loss rate should encompass data from several months, but this data shouldn’t be outdated as it could produce irrelevant results. The illustrative calculation of the loss rate for B2C customers is presented below. All calculations presented in this example are available in an Excel file.

| Payments | Receivables outstanding | Ageing | Actual loss rate |

|

|---|---|---|---|---|

| Sales in January | 100,000 | Not overdue | 2.0% | |

| Paid on time | 50,000 | 50,000 | Overdue 1-30 days | 4.0% |

| Paid 1-30 days after due date | 27,000 | 23,000 | Overdue 31-60 days | 8.7% |

| Paid 31-60 days after due date | 15,000 | 8,000 | Overdue 61-90 days | 25.0% |

| Paid 61-90 days after due date | 6,000 | 2,000 | Not paid at all | 100.0% |

Furthermore, Entity A considered forward-looking information (such as GDP forecasts, changes in the unemployment rate, changes in the law) and concluded that no evidence suggests the historical loss rate needs adjustment (refer to IFRS 9.B5.5.52-53).

At the reporting date, Entity A prepared an ageing schedule of its B2C trade receivables and calculated lifetime ECL as demonstrated in the following table.

| Receivables outstanding | Ageing | Expected loss rate | ECL allowance |

|---|---|---|---|

| 300,000 | Not overdue | 2.0% | 6,000 |

| 140,000 | Overdue 1-30 days | 4.0% | 5,600 |

| 60,000 | Overdue 31-60 days | 8.7% | 5,217 |

| 23,000 | Overdue 61-90 days | 25.0% | 5,750 |

| 5,000 | Overdue 91+ days | 100.0% | 5,000 |

| Total ECL allowance | 27,567 | ||

Adjusted Basel PD/LGD/EAD approach

Financial institutions commonly employ the Basel PD/LGD/EAD approach as a basis for ECL calculation, making adjustments as necessary to comply with IFRS 9 requirements. A simplified example of this approach is provided here.

Reasonable and supportable information

Reasonable and supportable information includes data that is readily available without undue cost or effort and encompasses past events, current conditions, and future economic forecasts. As the prediction period lengthens, detailed data becomes limited and the judgement needed for estimating ECL increases. Detailed estimates for distant future periods are not required – entities may rely on extrapolation from available, detailed data. Information used should include borrower-specific factors, general economic conditions, and both current and forecasted conditions. Entities can utilise a mix of internal and external data sources, such as historical credit loss experience, internal ratings, and external reports and statistics. In cases of insufficient entity-specific data, peer group experiences for similar financial instruments should be employed.

Historical data serves as an important baseline for measuring ECL, but entities must adjust this data to reflect current conditions and future forecasts that were not present during the historical period, as well as to exclude non-relevant past conditions. Sometimes, unaltered historical data may be the best reasonable and supportable information, depending on its nature, timing, and the specifics of the financial instrument under consideration. Changes in ECL estimates should align with and reflect observable data shifts over time, such as variations in unemployment rates, property prices, and other indicators of credit losses. When using historical credit loss data, it’s crucial to apply this information to groups defined similarly to those observed historically, ensuring each group of financial assets correlates with past credit loss experience in similar risk-characteristic groups (IFRS 9.B5.5.49-54).

Probability-weighted amount

As discussed previously, ECL must represent an unbiased and probability-weighted amount, determined by evaluating a range of possible outcomes (IFRS 9.5.5.17). Consequently, an ECL allowance will be recognised for a financial asset even if the most likely scenario does not entail any actual credit loss (IFRS 9.B5.5.41). Helpfully, IFRS 9.B5.5.42 explains that this exercise may not require complex analysis. In some instances, basic modelling might suffice, eliminating the need for detailed simulations of various scenarios. For instance, the average credit losses of a large collection of financial instruments with similar risk attributes might offer a fair estimate of the probability-weighted amount. However, in other instances, determining scenarios that specify the amount and timing of cash flows for specific outcomes and the estimated probability of those outcomes may be necessary. In such cases, the expected credit losses should consider at least two outcomes in line with paragraph IFRS 9.5.5.18.

This clarification simplifies matters since a strict interpretation of paragraph IFRS 9.5.5.17 might have necessitated the creation of multiple scenarios. For example, a bank with mortgage credit exposures could begin predicting catastrophic scenarios, like an economic recession leading to job losses and a decrease in house prices. More insights on this topic can be found in the Meeting Summary (11 December 2015) of the Transition Resource Group for Impairment of Financial Instruments, under the agenda item ‘Incorporation of forward-looking scenarios’.

When accounting for trade receivables, contract assets, and lease receivables using a simplified approach, it’s commonly agreed that a basic provision matrix is adequate.

Time horizon

When measuring ECL, the furthest time horizon to consider is the maximum contractual period (including extension options) in which the entity faces credit risk, rather than any longer period, even if such a longer period aligns with business practice (IFRS 9.5.5.19). Hence, the ECL measurement horizon should not extend beyond the point where further extension options are at the lender’s discretion, but should consider extension and prepayment options at the borrower’s discretion.

See also this discussion on ECL on bank accounts.

Time value of money

ECL should be discounted to the reporting date (IFRS 9.B5.5.44). As ECL consider the amount and timing of payments, a credit loss is incurred even if the entity expects to be paid in full, but later than contractually due (IFRS 9.B5.5.28).

The discount rate for ECL calculation should be (IFRS 9.B5.5.44):

- Effective interest rate determined at the initial recognition or an approximation of it for fixed-rate assets, or

- Current effective interest rate for variable interest rate assets.

The ‘approximation’ of the effective interest rate above is likely a practical relief for banks, making it easier for them to reconcile IFRS 9 with Basel models, which only account for the time value of money between the default event and subsequent recoveries (e.g., sale of collateral).

As mentioned earlier, it’s generally accepted that a basic provision matrix is sufficient when determining ECL for trade receivables, contract assets and lease receivables.

Collateral and credit enhancements

When measuring ECL, collateral and other credit enhancements should be considered (IFRS 9.B5.5.55). Although IFRS 9 doesn’t explicitly prescribe how to measure the proceeds from collateral, the fair value appears to be the most logical option.

Revolving credit facilities

IFRS 9 offers a specific exemption regarding the time horizon for ECL measurement for revolving credit facilities. These facilities typically don’t have a set term or repayment structure and usually have a short contractual cancellation period. For such financial instruments, ECL are calculated over the period in which the entity is exposed to credit risk, even if this period extends beyond the maximum contractual period (IFRS 9.5.5.20;B5.5.39-40). Example 10 accompanying IFRS 9 illustrates this exemption.

Cash flows expected from sale of a defaulted receivable

The cash flows expected from the sale of a defaulted receivable should be taken into account when measuring ECL. Although not directly addressed in IFRS 9, this issue was discussed at the December 2015 meeting of the Transition Resource Group for Impairment of Financial Instruments (agenda item ‘Inclusion of cash flows expected from the sale on default of a loan in the measurement of expected credit losses’). The ITG noted that cash flows expected from the sale on default of a loan should be included in the ECL calculation if:

- Selling the loan is one of the recovery strategies the entity plans to implement in a default scenario;

- There are no legal or practical obstacles preventing the entity from executing that recovery strategy; and

- Entity possesses reasonable and supportable information to base its expectations and assumptions on.

Incorporating the expected proceeds from recovery sales into the ECL measurement is appropriate for assets in all three stages of the ECL model.

The Basel Committee

In 2015, the Basel Committee issued guidance on Credit Risk and Accounting for Expected Credit Losses. This guidance, which aims to supplement and broaden the ECL IFRS 9 model for larger banks, mainly focuses on systems and the control environment but also offers additional guidance on ECL models for banks.

Impact of expected credit losses on interest calculation

IFRS 9 adopts a ‘decoupled’ approach to ECL and interest revenue, whereby interest is recognised on the gross carrying amount without consideration of the ECL. An exception applies to assets that are credit-impaired at acquisition or become credit-impaired later (IFRS 9.5.4.1; BC5.72).

Purchased or originated credit-impaired financial asset and credit adjusted EIR

For purchased or originated credit-impaired financial assets, interest is calculated using a credit-adjusted effective interest rate (EIR). This entails that initial ECL are factored into the estimated cash flows when calculating EIR (IFRS 9.5.4.1(a); B5.4.7).

Under certain circumstances, such as a significant modification of a distressed asset resulting in the derecognition of the original financial asset, there may be indications that the modified financial asset is credit-impaired at initial recognition (IFRS 9.B5.5.26).

Example: Purchased credit-impaired financial asset and credit adjusted EIR

On 1 January 20X1, Entity X issued a bond with a face value of $10,000 and a fixed annual coupon of $600 (equivalent to 6%). This amount was payable on 31 December each year until the bond’s maturity date on 31 December 20X6. However, Entity X experienced financial difficulties in 20X2 and failed to pay the coupon due on 31 December 20X2. This led to a significant decrease in the bond’s market prices. Believing that Entity X would be capable of partial repayment of the face value at the redemption date, Entity A purchased the bond for $5,000 on 1 January 20X3. Entity A expects to receive $8,000 on 31 December 20X6, although it does not expect to receive any coupon payments.

All calculations presented in this example can be accessed in an Excel file.

On 1 January 20X3, Entity A computed the credit-adjusted EIR taking into account initial expected credit losses (ECL):

| Date | Cash flow |

|---|---|

| 20X3-01-01 | (5,000) |

| 20X3-12-31 | – |

| 20X4-12-31 | – |

| 20X5-12-31 | – |

| 20X6-12-31 | 8,000 |

| Credit-adjusted EIR | 12.5% |

Note that the EIR based on contractual cash flows would amount to 33.3%:

| Date | Cash flow |

|---|---|

| 20X3-01-01 | (5,000) |

| 20X3-01-01 | 600* |

| 20X3-12-31 | 600 |

| 20X4-12-31 | 600 |

| 20X5-12-31 | 600 |

| 20X6-12-31 | 10,600 |

| Contractual EIR | 33.3% |

* Past due coupon.

The bond’s accounting scheme, utilising the credit-adjusted EIR, is as follows:

| Year | Opening balance | Interest in P/L | Cash flow | Closing balance |

|---|---|---|---|---|

| 20X3 | 5,000 | 622 | – | 5,622 |

| 20X4 | 5,622 | 703 | – | 6,325 |

| 20X5 | 6,325 | 789 | – | 7,113 |

| 20X6 | 7,113 | 887 | (8,000) | – |

Suppose that on 1 January 20X6, Entity A revises its estimates and expects to receive $8,500, which it indeed collects on 31 December 20X6. By using the original credit-adjusted EIR for discounting, the present value of $8,500 to be received on 31 December 20X6 would be $7,558. According to the original accounting schedule above, the bond’s carrying value on 1 January 20X6 is $7,113. Consequently, Entity A recognises an impairment gain of $445. The accounting schedule for this bond is thus updated as follows:

| Year | Opening balance | Impairment gain | Interest in P/L | Cash flow | Closing balance |

|---|---|---|---|---|---|

| 20X3 | 5,000 | – | 622 | – | 5,622 |

| 20X4 | 5,622 | – | 703 | – | 6,325 |

| 20X5 | 6,325 | – | 789 | – | 7,113 |

| 20X6 | 7,113 | 445 | 942 | (8,500) | – |

Financial assets that became credit-impaired after initial recognition

For financial assets that were not purchased or originated as credit-impaired but have subsequently become credit-impaired (stage 3 in the general ECL model), interest is recognised through the application of the original EIR to the amortised cost of the asset, i.e., after deducting ECL from the gross amount. Consider the following example:

Example: Asset that has become credit-impaired after initial recognition

On 1 January 20X1, Entity A lends $1 million to Entity B, with repayment of $1.5 million due on 31 December 20X4. No payments are required between these dates, resulting in an effective interest rate (EIR) of 10.7%. At initial recognition, Entity A estimated the 12-month ECL at $20,000.

However, on 1 January 20X2, Entity B’s financial situation significantly deteriorated, leading Entity A to classify its loan to Entity B as credit-impaired (stage 3). Entity A anticipated receiving only $0.5 million on 31 December 20X4 (same repayment date). Therefore, the expected credit loss at the repayment date is $1 million, which when discounted using the original EIR of 10.7%, equates to a present value of $737,788 as of 1 January 20X2. The bond’s updated accounting schedule is presented below.

All calculations presented in this example are available for download in an Excel file.

| Year | Gross carrying amount (opening balance) | ECL allowance (opening balance) | Amortised cost (opening balance) | Interest on loan (interest in P/L) | Unwinding of ECL discount (interest in P/L) | Total interest in P/L | Impairment in P/L | Cash flow | Gross carrying amount (closing balance) | ECL allowance (closing balance) | Amortised cost (closing balance) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 20X1 | 1,000,000 | (20,000) | 980,000 | 106,682 | (2,134) | 104,548 | (20,000) | – | 1,106,682 | (22,134) | 1,084,548 |

| 20X2 | 1,106,682 | (737,788) | 368,894 | 118,063 | (78,709) | 39,354 | (715,654) | – | 1,224,745 | (816,497) | 408,248 |

| 20X3 | 1,224,745 | (816,497) | 408,248 | 130,658 | (87,105) | 43,553 | – | – | 1,355,403 | (903,602) | 451,801 |

| 20X4 | 1,355,403 | (903,602) | 451,801 | 144,597 | (96,398) | 48,199 | – | (500,000) | – | – | – |

| Total | 235,654 | (735,654) |

Consequently, Entity A recognises a total interest income of $235,654 and credit losses amounting to $735,654, resulting in a net loss of $500,000.

Credit-impaired financial asset that is subsequently cured

When a financial asset is fully repaid or no longer considered credit-impaired (‘cured’), the difference between:

- interest calculated by applying the effective interest rate to the gross carrying amount of the credit-impaired financial asset, and

- interest recognised by applying the effective interest rate to the asset’s amortised cost, i.e., after subtracting the expected credit losses from the gross amount

is recognised as a reversal of impairment loss. This method might result in a net reversal if impairment losses were recognised on a given asset to date. For further detail, please refer to the relevant agenda decision.

Loan commitments and financial guarantee contracts

Typically, ECL must be recognised for loan commitments and financial guarantee contracts that are not measured at fair value through profit or loss (FVTPL). The date at which the entity becomes a party to the irrevocable commitment is considered as the initial recognition date for applying the IFRS 9 impairment requirements (IFRS 9.5.5.6).

Cash shortfalls

For a financial guarantee contract, the entity is required to make payments only if the debtor defaults per the terms of the guaranteed instrument. Consequently, cash shortfalls for ECL measurement are defined as the expected payments made to compensate the holder for a credit loss incurred, less any amounts that the entity expects to receive from the holder, the debtor, or any other party. If the asset is fully guaranteed, the estimation of cash shortfalls for a financial guarantee contract would align with the cash shortfall estimations for the guaranteed asset (IFRS 9.B5.5.32).

Discount rate

ECL on loan commitments should be discounted using the effective interest rate, or a close approximation, which will be applied when recognising the financial asset resulting from the loan commitment. ECL on financial guarantee contracts, or on loan commitments for which the EIR cannot be determined, should be discounted using a rate reflecting the current market assessment of the time value of money and specific cash flow risks, as long as these risks are accounted for by adjusting the discount rate rather than the cash shortfalls being discounted (IFRS 9.B5.5.47-48).

Initial recognition of financial assets following a drawdown on a loan commitment

When applying the impairment requirements of IFRS 9, a financial asset recognised following a drawdown on a loan commitment should be viewed as a continuation of that commitment, rather than a new financial instrument. Thus, the ECL on the financial asset should be measured considering the initial credit risk of the loan commitment from the date that the entity became party to the irrevocable commitment (IFRS 9.B5.5.47).

Presentation and use of loss allowance

Assets at amortised cost

A loss allowance reduces the amortised cost of an asset and, as such, is not presented as a liability.

Assets at FVOCI with recycling

ECL are also recognised for assets carried at FVOCI. However, the loss allowance does not lower the asset’s carrying amount below its fair value in the statement of financial position. Instead, the recognition of ECL affects profit or loss, and any change in fair value recognised through OCI is considered after accounting for ECL (IFRS 9.5.5.2). An example of relevant journal entries can be found in Example 13 accompanying IFRS 9.

Loan commitments and financial guarantees

The part of the loss allowance linked to undrawn loan commitments or financial guarantees is presented as a provision because there’s no asset to offset the loss allowance. However, if a financial instrument consists of both a financial asset and an undrawn commitment component, and the entity cannot separately identify the ECL on those components, the ECL on the loan commitment should be recognised along with the loss allowance for the financial asset. If the combined ECL exceed the gross carrying amount of the financial asset, they should be presented as a provision (IFRS 7.B8E).

Use of loss allowance

The IFRS 9 exposure draft initially stated that all write-offs must go through the use of loss allowance, thus forbidding direct write-offs against the contractual amount of financial assets without using an allowance account (IFRS 9 ED 2009/12 par.B29). The final version of IFRS 9 doesn’t contain such a requirement, but the approach outlined in the exposure draft appears most logical. The significance of this distinction lies in the fact that impairment losses need to be presented in a separate line in the P/L (IAS 1.82(ba)), and IFRS 7 mandates a reconciliation from the opening balance to the closing balance of the loss allowance (IFRS 7.35H).

Scope of IFRS 9 impairment requirements

The IFRS 9 impairment requirements apply to (IFRS 9.5.5.1):

- Assets measured at amortised cost,

- Assets measured at FVOCI with recycling,

- Loan commitments (not at FVTPL),

- Financial guarantee contracts (not at FVTPL),

- Lease receivables (IFRS 16), and

- Contract assets (IFRS 15).

However, the IFRS 9 impairment requirements do not apply to (IFRS 9.5.5.1):

- Assets measured at FVTPL,

- Assets measured at FVOCI without recycling,

- Loan commitments at FVTPL, and

- Financial guarantee contracts at FVTPL.

For further details, see the classification of financial assets and financial liabilities.

Disclosure

The disclosure requirements relating to impairment and credit risk are detailed in paragraphs IFRS 7.35A-38.

More about financial instruments

See other pages relating to financial instruments:

Scope of IAS 32

Financial Instruments: Definitions

Derivatives and Embedded Derivatives: Definitions and Characteristics

Classification of Financial Assets and Financial Liabilities

Measurement of Financial Instruments

Amortised Cost and Effective Interest Rate

Impairment of Financial Assets

Derecognition of Financial Assets

Derecognition of Financial Liabilities

Factoring

Interest-Free Loans or Loans at Below-Market Interest Rate

Offsetting of Financial Instruments

Hedge Accounting

Financial Liabilities vs Equity

IFRS 7 Financial Instruments: Disclosures