Amortised cost is the measurement method used for certain financial assets and liabilities. To determine which assets or liabilities specifically, refer to the page on classification.

The components of amortised cost include:

- The initial recognition amount,

- Subsequent recognition of interest income or expense,

- Repayments, and

- Credit losses (relevant only to financial assets).

The amortised cost is determined using the effective interest rate (EIR). This rate perfectly discounts projected future cash flows to the present carrying amount of a financial asset or liability. Let’s illustrate this concept with two worked examples presented below.

Entity A purchases a bond on a stock exchange for $900. The relevant data for this scenario is provided below:

- Face value: $1,000

- Transaction price (including coupon accrued to date): $900

- Transaction fee: $10

- Coupon: 5%, equating to $50 (calculated on face value), paid annually on 31 December

- Acquisition date: 1 May 20X1

- Redemption date: 31 December 20X5

Given the above information, Entity A can create a cash flow schedule and calculate the effective interest rate (EIR) as demonstrated below. In spreadsheet programs like MS Excel, this can be done using the XIRR function. All calculations provided in this example can be downloaded from an accompanying Excel file.

The cash flows from the acquired bond yield an EIR of 7.8%:

| Date | Cash flow | |

|---|---|---|

| 20X1-05-01 | (900) | Transaction price |

| 20X1-05-01 | (10) | Fee |

| 20X1-12-31 | 50 | Coupon |

| 20X2-12-31 | 50 | Coupon |

| 20X3-12-31 | 50 | Coupon |

| 20X4-12-31 | 50 | Coupon |

| 20X5-12-31 | 50 | Coupon |

| 20X5-12-31 | 1,000 | Repayment of principal |

| EIR | 7.8% |

After calculating the EIR, Entity A can determine the interest income for each year. The accounting schedule for this bond is outlined as follows:

| Year | Opening balance | Interest in P/L | Cash flow | Closing balance |

|---|---|---|---|---|

| 20X1 | 910 | 47 | (50) | 907 |

| 20X2 | 907 | 71 | (50) | 928 |

| 20X3 | 928 | 72 | (50) | 950 |

| 20X4 | 950 | 74 | (50) | 974 |

| 20X5 | 974 | 76 | (1,050) | – |

--

Are you tired of the constant stream of IFRS updates? I know it's tough! That's why I created Reporting Period – a once-a-month summary for professional accountants. It consolidates all essential IFRS developments and Big 4 insights into one readable email. I personally curate every issue to ensure it's packed with the most relevant information, delivered straight to your inbox. It's free, with no spam, and you can unsubscribe with just one click. Ready to give it a try?

On 10 October 20X1, Entity B took out a $4,000 loan from a local bank. The loan has an annual interest rate of 5%, and interest is payable monthly. The principal will be repaid one year after the origination date, and there is also a one-time origination fee of 1.5%. Here’s a summary of the details:

- Loan principal: $4,000

- Origination fee: $60 ($4,000 x 1.5%)

- Interest p.a.: 5%

- Origination date: 10 October 20X1

- Repayment date: 10 October 20X2

Entity B has put together a cash flow schedule for the loan and computed the effective interest rate (EIR), as illustrated below. These calculations can be downloaded from an accompanying Excel file.

| Date | Cash flow | |

|---|---|---|

| 20X1-10-10 | (3,940) | Loan principal minus fee |

| 20X1-11-10 | 17.0 | Interest payment |

| 20X1-12-10 | 16.4 | Interest payment |

| 20X2-01-10 | 17.0 | Interest payment |

| 20X2-02-10 | 17.0 | Interest payment |

| 20X2-03-10 | 15.3 | Interest payment |

| 20X2-04-10 | 17.0 | Interest payment |

| 20X2-05-10 | 16.4 | Interest payment |

| 20X2-06-10 | 17.0 | Interest payment |

| 20X2-07-10 | 16.4 | Interest payment |

| 20X2-08-10 | 17.0 | Interest payment |

| 20X2-09-10 | 17.0 | Interest payment |

| 20X2-10-10 | 16.4 | Interest payment |

| 20X2-10-10 | 4,000 | Repayment of loan principal |

| EIR | 6.8% |

Further, Entity B has determined the monthly interest expense as well as the amortised cost of the loan at the close of the year 20X1. The accounting schedule for this loan is detailed as follows:

| Opening date | Opening balance | Interest in P/L | Cash flow | Closing balance | Closing date |

|---|---|---|---|---|---|

| 20X1-10-10 | 3,940 | 22 | (17) | 3,945 | 20X1-11-10 |

| 20X1-11-10 | 3,945 | 21 | (16) | 3,950 | 20X1-12-10 |

| 20X1-12-10 | 3,950 | 15 | – | 3,965 | 20X1-12-31 |

| 20X1-12-31 | 3,965 | 7 | (17) | 3,955 | 20X2-01-10 |

| 20X2-01-10 | 3,955 | 22 | (17) | 3,960 | 20X2-02-10 |

| 20X2-02-10 | 3,960 | 20 | (15) | 3,964 | 20X2-03-10 |

| 20X2-03-10 | 3,964 | 22 | (17) | 3,969 | 20X2-04-10 |

| 20X2-04-10 | 3,969 | 21 | (16) | 3,974 | 20X2-05-10 |

| 20X2-05-10 | 3,974 | 22 | (17) | 3,980 | 20X2-06-10 |

| 20X2-06-10 | 3,980 | 21 | (16) | 3,985 | 20X2-07-10 |

| 20X2-07-10 | 3,985 | 22 | (17) | 3,990 | 20X2-08-10 |

| 20X2-08-10 | 3,990 | 22 | (17) | 3,995 | 20X2-09-10 |

| 20X2-09-10 | 3,995 | 22 | (4,016) | – | 20X2-10-10 |

Expected cash flows

When determining the effective interest rate (EIR), an entity estimates the cash flows based on all the contractual terms of the financial instrument. These may include prepayment, extension, call, and similar options. For a full definition of EIR, refer to Appendix A of IFRS 9, and paragraphs IFRS 9.BCZ5.65+ for further discussion.

As stated above, the EIR is built on forecasted cash flows, assuming that the cash flows and the expected lifespan of a financial instrument (or a group of similar financial instruments) can be reliably estimated. However, in rare instances where reliable estimation of cash flows or the expected lifespan of a financial instrument is impossible, the entity uses the contractual cash flows over the entire contractual term of the financial instrument. Also, consider the impact of expected credit losses on interest calculation.

Revisions to and modifications of cash flows

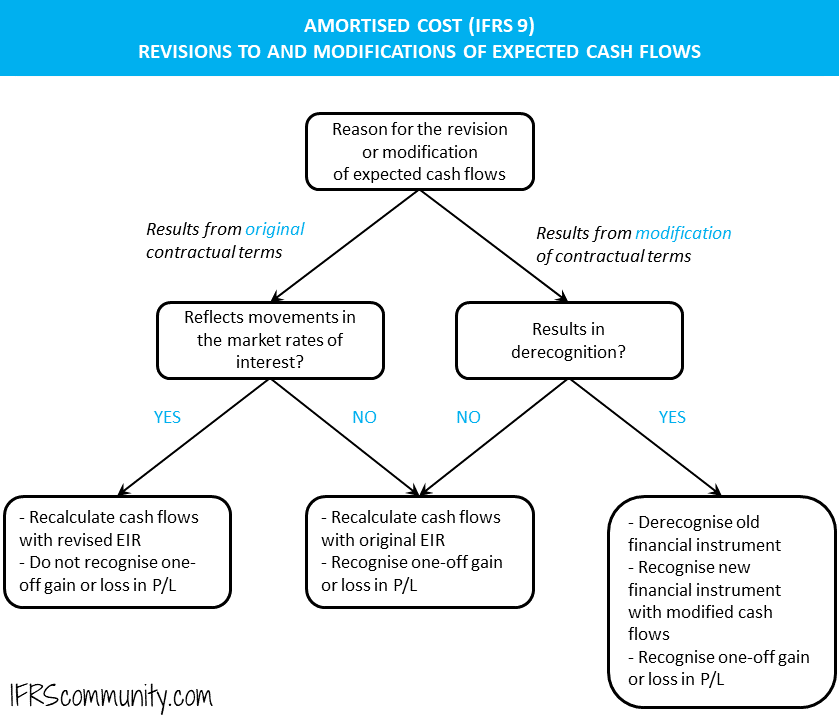

Decision tree

This decision tree outlines the accounting treatment for revisions to and modifications of cash flows in the calculation of amortised cost:

Movements in market interest rates

For floating-rate instruments, periodic re-estimation of cash flows affects EIR without causing a one-time gain or loss in P/L. It’s important to note that this approach applies solely to changes reflecting movements in market interest rates. Any other revisions to cash flow estimates, even those resulting from original contractual terms (for example, margin increases due to shifts in a borrower’s financial gearing ratio), will lead to different accounting treatment (IFRS 9.B5.4.5).

To illustrate, an example of accounting treatment for floating-rate instruments is provided below.

Example: Re-estimation of cash flows for floating-rate instruments

Consider a scenario where Entity A buys a bond on a stock exchange for $1,000. The relevant data for this scenario is as follows:

- Face value: $1,000

- Transaction price (excluding accrued interest): $1,000

- Transaction fee: $0

- Acquired interest: $25

- Coupon: 5% (LIBOR + 1 p.p., paid and reset annually)

- Original issuance date: 20X1-01-01

- Acquisition date: 20X1-07-01

- Redemption date: 20X5-12-31

Entity A computes EIR at 5.0% based on estimated cash flows (refer to this example for calculating EIR). All calculations provided in this example can be downloaded from an accompanying Excel file.

The calculation of EIR based on the current LIBOR is shown in the following table:

| Date | Cash flow | |

|---|---|---|

| 20X1-07-01 | (1,000) | Transaction price (excl. interest) |

| 20X1-07-01 | (25) | Interest acquired |

| 20X1-12-31 | 50 | Coupon at 5% |

| 20X2-12-31 | 50 | Coupon at 5% |

| 20X3-12-31 | 50 | Coupon at 5% |

| 20X4-12-31 | 50 | Coupon at 5% |

| 20X5-12-31 | 50 | Coupon at 5% |

| 20X5-12-31 | 1,000 | Repayment of principal |

| EIR | 5.0% |

Note that there is an alternative method where estimated cash flows are based on forward rates, although this is much less frequently used in practice (IFRS 9 does not specify the approach to be used).

The initial accounting schedule for the bond is as follows:

| Year | Opening balance | Interest in P/L | Cash flow | Closing balance |

|---|---|---|---|---|

| 20X1 | 1,025 | 25 | (50) | 1,000 |

| 20X2 | 1,000 | 50 | (50) | 1,000 |

| 20X3 | 1,000 | 50 | (50) | 1,000 |

| 20X4 | 1,000 | 50 | (50) | 1,000 |

| 20X5 | 1,000 | 50 | (1,050) | – |

Let’s assume that the annual coupon is reset to 6% on 1 January 20X4 following a LIBOR increase. As noted earlier, for floating-rate instruments, cash flow revisions reflecting market interest rate movements affect the EIR without a one-time gain or loss in P/L (IFRS 9.B5.4.5). Thus, Entity A calculates a new EIR on 1 January 20X4 based on an annual coupon of 6%:

| Date | Cash flow | |

|---|---|---|

| 20X4-12-31 | 60 | Coupon at 6% |

| 20X5-12-31 | 60 | Coupon at 6% |

| 20X5-12-31 | 1,000 | Repayment of principal |

| EIR | 6.0% |

The accounting schedule for the bond post-LIBOR increase is:

| Year | Opening balance | Interest in P/L | Cash flow | Closing balance |

|---|---|---|---|---|

| 20X4 | 1,000 | 60 | (60) | 1,000 |

| 20X5 | 1,000 | 60 | (1,060) | – |

Other reasons for changes in expected cash flows under original contractual terms

When modifications in projected cash flows align with the original contractual terms but do not arise from movements in market interest rates, the entity should recalculate the amortised cost using the financial instrument’s original effective interest rate (EIR). This process typically leads to a one-time gain or loss, which is recognised in P/L as per IFRS 9.B5.4.6. An illustration of this accounting treatment is provided below.

The initial data for this example is the same as in the previous one. Entity A calculated an EIR of 7.8% and compiled the following accounting schedule for the acquired bond:

| Year | Opening balance | Interest in P/L | Cash flow | Closing balance |

|---|---|---|---|---|

| 20X1 | 910 | 47 | (50) | 907 |

| 20X2 | 907 | 71 | (50) | 928 |

| 20X3 | 928 | 72 | (50) | 950 |

| 20X4 | 950 | 74 | (50) | 974 |

| 20X5 | 974 | 76 | (1,050) | – |

Assume now that on 1 January 20X4, the issuer of the bond decides to redeem it a year prior to its maturity, i.e., on 31 December 20X4 instead of 31 December 20X5. According to the above accounting schedule, the amortised cost of the bond is $950 as of 1 January 20X4 (the date when Entity A revises expected cash flows). Entity A now anticipates receiving $1,050 on 31 December 20X4, yielding a present value of $974 ($1,050 discounted at the original EIR of 7.8%). Consequently, Entity A increases the amortised cost of the acquired bond by $24 and recognises a one-time gain in P/L as per IFRS 9.B5.4.6. The updated accounting schedule for the bond, incorporating the revised cash flows, is as follows (note the additional column indicating the one-time gain due to the revision):

| Year | Opening balance | One-time revision in P/L | Interest in P/L | Cash flow | Closing balance |

|---|---|---|---|---|---|

| 20X1 | 910 | – | 47 | (50) | 907 |

| 20X2 | 907 | – | 71 | (50) | 928 |

| 20X3 | 928 | – | 72 | (50) | 950 |

| 20X4 | 950 | 24 | 76 | (1,050) | – |

The calculations in this example are downloadable in an Excel file.

Modification of contractual terms not resulting in derecognition

The methodology outlined above applies when the contractual cash flows of a financial asset are renegotiated or otherwise modified, but without leading to derecognition of the asset (IFRS 9.5.4.3; B5.4.6). Refer also to Example 11 accompanying IFRS 9.

While the phrasing of the cited paragraphs may not clearly indicate whether this rule also applies to financial liabilities, the IASB confirmed this in the basis for conclusions to IFRS 9 (refer to IFRS 9.BC4.252-3). Thus, when a financial liability measured at amortised cost is modified without this modification causing derecognition, a gain or loss should be recognised in P/L. See the example of a financial liability modification not resulting in derecognition.

Modification of contractual terms resulting in derecognition

In certain situations, the renegotiation or modification of contractual cash flows may trigger the derecognition of the existing financial asset or liability. When the modification of a financial asset leads to the derecognition of the existing asset and the subsequent recognition of the modified financial asset, this modified asset is treated as a ‘new’ financial asset. As such, the date of the modification should be viewed as the date of initial recognition of that asset, even when applying the impairment requirements (IFRS 9.B5.5.25-26).

Fees and other transaction costs

The calculation of effective interest rate includes:

- all fees and points paid or received between parties to the contract that are an integral part of the effective interest rate (IFRS 9.B5.4.1), and

- incremental transaction costs.

Fees that are an integral part of the EIR include origination fees received (or paid) by the entity relating to the creation or acquisition of a financial asset (or issuing a financial liability at amortised cost). These fees compensate for various activities, including the assessment of the borrower’s financial condition, the management of guarantees, collaterals, and security arrangements, as well as the negotiation of instrument terms, document preparation and processing, and finalising the transaction.

Similarly, commitment fees for loan origination are included in the EIR when the commitment is not measured at FVTPL, and the lender is likely to enter into the loan agreement. However, if the commitment lapses without a loan being made, the fee is recognised as revenue upon expiration (IFRS 9.B5.4.2).

Conversely, fees that are not considered a part of the EIR include charges for servicing loans, commitment fees when a loan agreement is unlikely, and loan syndication fees where the arranging entity does not retain a part of the loan, or does so at an EIR that mirrors the risk of other participants. Entities receiving such fees recognise them as revenue under IFRS 15 (IFRS 9.B5.4.3).

Fees associated with revolving credit facilities are not part of the effective interest rate. As highlighted in our forum discussion, such fees aren’t tied to the amount borrowed. Instead, they are recognised as an asset and amortised over the lifespan of the credit facility. This approach remains the same regardless of the borrower’s intent to drawdown.

If an exchange of debt instruments or modification of terms is accounted for as an extinguishment, any costs or fees incurred are recognised as part of the gain or loss on the extinguishment. Conversely, if the exchange or modification is not classified as an extinguishment, any costs or fees incurred adjust the carrying amount of the liability and are amortised over the remaining term of the modified liability (IFRS 9.B3.3.6A).

Amortisation of fees, premiums, discounts and similar items

Fees, premiums, discounts and similar items, which are part of the EIR calculation, are amortised over the expected lifespan of the financial instrument, unless they relate to a shorter period. For instance, if the premiums or discounts relate to a variable that’s repriced to market rates before the financial instrument’s maturity, the shorter period is used (IFRS 9.B5.4.4).

For financial instruments measured at fair value through profit or loss (FVTPL), fees are fully recognised in P/L at the initial recognition of the instrument (IFRS 9.B5.4.1).

VAT and other non-recoverable taxes

Most countries exempt financial instruments and services from VAT. However, if VAT is imposed on, for example, fees or interest, the first step is to determine if the entity can reclaim it from the tax authorities through some form of tax returns. If the VAT is reclaimable, it’s simply recognised as a receivable from, or payable to, tax authorities when the obligation arises.

When the VAT isn’t recoverable, neither IAS 32 nor IFRS 9 specifically address taxes on financial instruments. This might be because VAT is a government-imposed levy and falls under IFRIC 21. It implies that non-recoverable VAT should be expensed in P/L when the obligation arises. This means VAT should not be treated as part of a financial instrument’s cash flows, particularly because VAT payments are not contractually obligated between parties.

Credit-impaired financial assets

Purchased or originated credit-impaired financial assets are measured using a credit-adjusted EIR. This means that initial expected credit losses (ECL) are incorporated into the estimated cash flows when calculating EIR (IFRS 9.5.4.1(a); B5.4.7). More information on the impact of expected credit losses on interest calculation is available in the relevant section.

More about financial instruments

See other pages relating to financial instruments:

Scope of IAS 32

Financial Instruments: Definitions

Derivatives and Embedded Derivatives: Definitions and Characteristics

Classification of Financial Assets and Financial Liabilities

Measurement of Financial Instruments

Amortised Cost and Effective Interest Rate

Impairment of Financial Assets

Derecognition of Financial Assets

Derecognition of Financial Liabilities

Factoring

Interest-Free Loans or Loans at Below-Market Interest Rate

Offsetting of Financial Instruments

Hedge Accounting

Financial Liabilities vs Equity

IFRS 7 Financial Instruments: Disclosures