Derecognition refers to the removal of a previously recognised financial asset from an entity’s statement of financial position. In essence, the criteria under IFRS 9 for derecognising a financial asset aim to determine whether an asset has effectively been ‘sold’ and therefore should be derecognised, or if an entity has merely obtained some form of financing against this asset, thus necessitating the recognition of an additional financial liability. Another scenario requiring the assessment against the derecognition criteria is when a financial instrument is modified or restructured and entities need to determine whether this represents the expiry of the original cash flow rights.

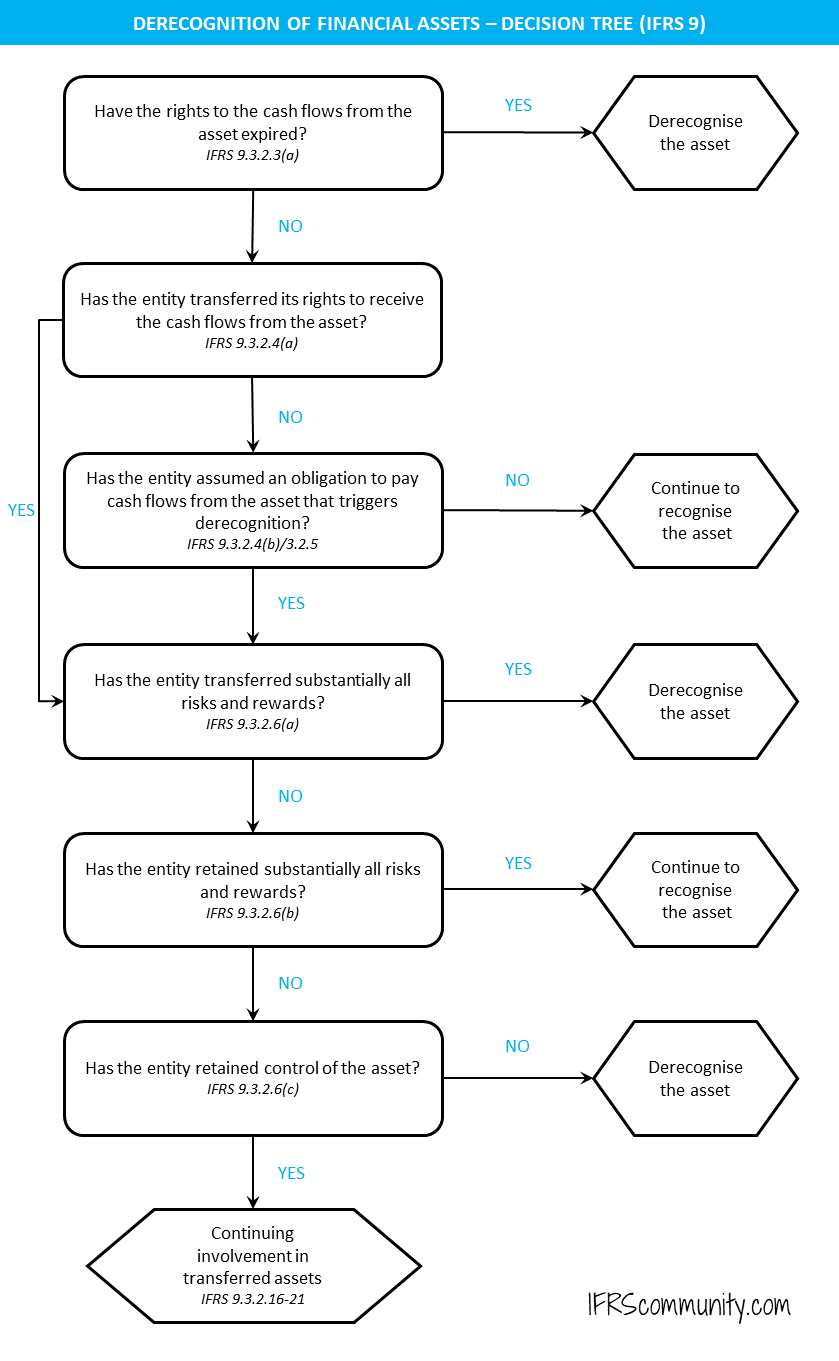

The criteria for derecognising financial assets are outlined in the following decision tree, which serves as a valuable framework that guides the subsequent discussion.

Are you tired of the constant stream of IFRS updates? I know it's tough! That's why I created Reporting Period – a once-a-month summary for professional accountants. It consolidates all essential IFRS developments and Big 4 insights into one readable email. I personally curate every issue to ensure it's packed with the most relevant information, delivered straight to your inbox. It's free, with no spam, and you can unsubscribe with just one click. Ready to give it a try?

Have the rights to the cash flows from the asset expired?

The first question to address is: ‘Have the rights to the cash flows from the asset expired?’. This question forms the first step in the derecognition decision tree and is detailed in paragraph IFRS 9.3.2.3(a). Common examples of situations where the contractual rights to cash flows from the financial asset expire include the repayment of a financial asset or the expiry of an option. Less obvious circumstances are discussed below.

Renegotiation and modification of a financial asset

Certain modifications of contractual cash flows lead to the derecognition of a financial instrument and the recognition of a new one (IFRS 9.B5.5.25-27). Although the criteria for derecognition in the context of renegotiations and modifications of contractual terms are well-defined for financial liabilities, they are not as clear-cut for financial assets. The IFRS Interpretations Committee attempted to address this lack of specificity but ultimately decided it could not provide a satisfactory solution and decided not to pursue such a project further, as explained in this agenda decision.

A specific discussion on this topic is found in another agenda decision, framed within the context of the restructuring of Greek government bonds following the 2007/2008 financial crisis. The Committee suggested that the most effective approach to determine if a debt restructuring results in the derecognition of a financial asset is to compare it, following the IAS 8 hierarchy, with the derecognition criteria for financial liabilities. This involves assessing whether there has been an exchange between a borrower and lender of debt instruments with substantially different terms. However, the Committee’s deliberations focused on a particular scenario involving the exchange of a part of the original bonds’ principal amount for new bonds with varied maturities and interest rates. Consequently, applying this outcome to different scenarios might not be straightforward.

Additionally, IFRS 9’s illustrative Example 11 presents a loan modification case where the modified asset’s gross carrying amount is 30% less than the original loan, yet this modification does not lead to derecognition. This implies that both qualitative and quantitative factors are critical in assessing whether the cash flows of the original and modified or replacement financial assets are significantly different, as IFRS 9.B5.5.26 suggests when it refers to a ‘substantial’ modification of a financial asset.

This is particularly relevant when a borrower, facing financial difficulties, negotiates with a financial institution or other creditors to restructure their debt. Such restructurings can include reducing interest rates or postponing interest and/or principal payments, a process often termed ‘forbearance’. In forbearance scenarios, financial assets are frequently not derecognised as the primary aim of the modification is to maximize the recovery of the original contractual cash flows, rather than to originate a new asset on market terms. This rationale aligns with the approach in Example 11 of IFRS 9.

In contrast, significant qualitative changes, such as changes in the underlying currency or interest calculation method (for example, switching from fixed to floating interest rates or linking interest to business performance), would likely result in the derecognition of the original asset and the recognition of a new one.

When considering forbearance, if an entity intends to modify a financial asset in a manner that includes forgiving part of the existing contractual cash flows, it should evaluate whether a portion of the asset needs to be written off prior to the modification. If the forgiven cash flows are written off beforehand, this will impact the quantitative assessment of whether derecognising the financial asset is appropriate.

It’s worth highlighting that even if a renegotiated asset is not derecognised, a one-time modification gain or loss should still be recognised.

Write-offs

Write-offs may apply to an entire financial asset or just a portion of it. For instance, if an entity plans to enforce a collateral on a financial asset and anticipates recovering no more than 30% of the financial asset through the collateral, and if there are no reasonable prospects of recovering additional cash flows from the financial asset, the entity should write off the remaining 70% of the financial asset (IFRS 9.5.4.4 and B5.4.9).

Transfers

Subsequent steps in the derecognition decision tree pertain to the transfers of financial assets. A financial asset should be derecognised if it is transferred and if the transfer qualifies for derecognition (IFRS 9.3.2.3(b)). As specified in IFRS 9.3.2.4, an entity conducts a transfer of a financial asset if it either:

- Transfers the contractual rights to receive the cash flows of the financial asset, or

- Retains the contractual rights to receive the cash flows of the financial asset but assumes a contractual obligation to pay the cash flows to one or more recipients. This is referred to as ‘pass through‘ transfers.

The disclosure requirements relating to transfers of financial assets are outlined in paragraphs IFRS 7.42A-42G; B29-B39.

Has the entity transferred its rights to receive the cash flows from the asset?

The question, ‘has the entity transferred its rights to receive the cash flows from the asset?’ is a next step in the decision tree and is detailed in paragraph IFRS 9.3.2.4(a). There is limited guidance on this point as it is self-explanatory in most cases. A transfer of an asset is typically achieved by transferring legal title to it. Furthermore, the Interpretations Committee noted that the retention of the role of agent for the collection and distribution of cash flows by the transferor does not influence the determination of whether an entity transfers the contractual rights to receive the cash flows from a financial asset.

It is also noteworthy that this condition for derecognition can also be met even when a legal title is not transferred. As indicated in the September 2006 IASB update, a transaction where an entity transfers all the contractual rights to receive the cash flows (without necessarily transferring legal ownership of the financial asset) would not be classified as a pass-through transfer. In other words, such a transaction is also covered by paragraph IFRS 9.3.2.4(a), rendering the assessment against the ‘pass-through’ criteria not applicable.

Conditional transfers

Transfers can be conditional, and the conditions associated with a transfer can be divided into two broad categories:

- Contractual provisions guaranteeing the existence and quality of transferred cash flows at the date of transfer, or

- Conditions related to the future performance of the asset.

The IASB expressed its views on conditional transfers in the September 2006 update, stating that the conditions outlined above do not affect whether the entity has transferred the contractual rights to receive cash flows as per IFRS 9.3.2.4(a). However, the existence of conditions relating to the future performance of the asset (as per point 2 above) can impact the conclusion regarding the transfer of all risks and rewards.

Pass through transfers

The question ‘has the entity assumed an obligation to pay the cash flows from the asset that meets the condition for derecognition’ is a further step in the decision tree and is addressed in IFRS 9.3.2.4(b) and IFRS 9.3.2.5. A ‘pass through’ transfer occurs when an entity retains the legal title and cash flow rights of a financial asset (hence, the condition in IFRS 9.3.2.4(a) is not fulfilled), but commits to pass those cash flows to a third party. Securitisation is a common example of a ‘pass through’ transfer. Such an arrangement is treated as a transfer of the original asset only if all the following three conditions are met (IFRS 9.3.2.5):

- The entity has no obligation to pay the eventual recipients unless it collects equivalent amounts from the original asset.

- The transfer contract restricts the entity from selling or pledging the original asset other than as security for the obligation to pay the cash flows to the eventual recipients.

- The entity is obliged to remit any cash flows it collects on behalf of the eventual recipients without material delay.

These conditions are discussed further below.

The entity’s obligation to pay the eventual recipients

The first condition implies that any transactions where cash flows are passed to a third party, and that party can seek recourse from the transferor, do not qualify as transfers under IFRS 9. IFRS 9.3.2.5(a) clarifies that short-term advances made by the entity, with the right to fully recover the amount lent along with market rate interest, do not breach this condition.

The entity’s obligation to remit collected cash flows without material delay

‘Pass through’ transfers frequently involve groups of financial assets, making it impractical to remit cash flows on a daily basis from every individual asset. While IFRS 9 does not permit a ‘material delay’, the exact period is unspecified, but monthly or even quarterly payments are typically considered not to constitute a material delay in practice.

Furthermore, to meet this criterion, the entity cannot be entitled to reinvest cash flows received from the financial assets in question, except for investments in cash or cash equivalents during the brief settlement period from the collection date to the required remittance date. Additionally, any interest earned from such investments should be passed on to the eventual recipients.

Has the entity transferred or retained substantially all risks and rewards?

If an entity has transferred a financial asset based on the criteria from previous stages, the following steps in the decision tree relate pertain to risks and rewards, as outlined in IFRS 9.3.2.6(a)-(b). If the entity transfers substantially all risks and rewards, it proceeds to derecognise the asset. Conversely, if the entity retains substantially all risks and rewards, it continues to recognise the asset. In instances where the entity neither transfers nor retains substantially all risks and rewards, an assessment is made regarding whether it has maintained control of the asset (the ensuing step).

Any rights and obligations that are either created or retained in the transfer should be independently recognised as assets or liabilities (IFRS 9.3.2.6(a)). The transfer of risks and rewards is evaluated by comparing the entity’s exposure before and after the transfer to the variability in the amount and timing of the transferred asset’s net cash flows. Frequently, it will be clear whether the entity has transferred or retained substantially all risks and rewards of ownership, eliminating the need for any calculations. In other instances, computations are necessary to compare the entity’s exposure to variability in future net cash flows before and after the transfer. These computations and comparisons are made using a suitable current market interest rate as the discount rate. All reasonable potential variability in net cash flows is considered, with greater emphasis placed on those outcomes that are more likely to occur (IFRS 9.3.2.7-8). IFRS 9 does not establish any threshold representing ‘substantially’ all risks and rewards.

Examples of when an entity has or has not transferred substantially all the risks and rewards of ownership are given in IFRS 9.B3.2.4-5. Furthermore, examples of when an entity has neither retained nor transferred substantially all the risks and rewards are provided in IFRS 9.B3.2.16(h)-(i) and IFRS9.B3.2.17.

Retention of substantially all the risks and rewards

When an entity has transferred an asset but retained substantially all the risks and rewards, the asset is not derecognised. Instead, any proceeds received are recognised as a financial liability. In subsequent periods, the entity recognises income on the transferred asset and expenses incurred on the financial liability as though they were separate financial instruments (IFRS 9.3.2.15). It’s important to note that this differs from continuing involvement in transferred assets.

Variability in the amounts and timing of the net cash flows of the transferred asset

This factoring example offers an analysis illustrating whether an entity has transferred substantially all risks and rewards of its trade receivables. This is achieved by comparing the entity’s exposure, before and after the transfer, to the variability in the amounts and timing of the net cash flows of the transferred assets.

Has the entity retained control of the asset?

This question concludes the derecognition decision tree. It applies when an entity has transferred an asset but has not retained or transferred substantially all the risks and rewards. If the entity hasn’t retained control, it should derecognise the financial asset and separately recognise any rights and obligations that were created or retained during the transfer as assets or liabilities. Conversely, if the entity has retained control, it continues to recognise the financial asset in proportion to its continuing involvement in the asset (IFRS 9.3.2.6(c)).

The question of whether the entity has retained control over the transferred asset depends on the transferee’s (i.e. the party the asset was transferred to) ability to sell the asset. The entity is considered to have not retained control if the transferee can practically sell the asset in its entirety to an unrelated third party, can do so unilaterally and without needing to impose additional restrictions on the transfer. In all other circumstances, the entity is considered to have retained control (IFRS 9.3.2.9).

Paragraphs IFRS 9.B3.2.7-9 provide clarification on the meaning of the transferee’s practical ability to sell the asset. The explanation begins by stating that ‘the transferee has the practical ability to sell the transferred asset if it is traded in an active market because the transferee could repurchase the transferred asset in the market if it needs to return the asset to the entity’. This statement is sometimes interpreted to mean that the asset must always be traded in an active market. However, this interpretation is not always valid. The explanation further elaborates that an active market is necessary only when the transferee may need to repurchase the transferred asset from the market in order to return it to the entity. If the transferee is never obligated to repurchase a transferred asset, an active market isn’t necessary to conclude that control has been transferred. In any case, the accounting consequence will often be essentially the same. Retaining control implies accounting for continuing involvement in the asset, which is often similar to the recognition of any assets or liabilities resulting from rights and obligations created or retained in the transfer under paragraph IFRS 9.3.2.6(c).

Continuing involvement in transferred assets

The rules for accounting for continued involvement in transferred assets apply when an entity:

- Neither transfers nor retains substantially all the risks and rewards of ownership of a transferred asset, and

- Retains control of the transferred asset.

Further details can be found in IFRS 9.3.2.16-21 and the Basis for Conclusions paragraphs IFRS 9.BCZ3.27-28.

Transfers with guarantees

In situations where an entity’s guarantee to cover credit losses on a transferred asset prevents the derecognition of the transferred asset to the extent of continuing involvement, the transferred asset is measured at the lower of (IFRS 9.3.2.16(a); B3.2.13(a)):

- Carrying amount of the asset, or

- Guaranteed amount.

An example of this is given in paragraph IFRS 9.B3.2.17.

Put and call options on assets measured at amortised cost

If a put or call option prevents the derecognition of a transferred asset and the entity measures the transferred asset at amortised cost, the associated liability is measured at the received consideration, adjusted for the amortisation of any difference between that cost and the gross carrying amount of the transferred asset at the expiration date of the option (IFRS 9.B3.2.13(b)).

Put and call options on assets measured at fair value

Put and call options on assets measured at fair value are dealt with in IFRS 9.B3.2.13(c)-(e).

Continuing involvement in a part of a financial asset

Paragraph IFRS 9.B3.2.17 illustrates accounting for continuing involvement in a part of a financial asset.

Derecognition criteria applied to a part or all of an asset

The criteria for derecognition as stipulated in IFRS 9 are applied to a part of an asset only if the part under consideration for derecognition fulfils one of the following three conditions (IFRS 9.3.2.2):

- The part comprises only specified cash flows from a financial asset or a group of similar financial assets.

- The part comprises only a fully proportionate (pro rata) share of the cash flows from a financial asset or a group of similar financial assets.

- The part comprises only a fully proportionate (pro rata) share of specified cash flows from a financial asset or a group of similar financial assets.

These conditions are strictly applied as illustrated in examples provided in IFRS 9.3.2.2(b). If none of these conditions are met, the derecognition criteria are applied to the financial asset as a whole.

The discussion on derecognition on this page pertains to ‘a financial asset’, but it’s crucial to remember that ‘a financial asset’ could refer to a part of an asset if the above criteria are fulfilled.

Defining ‘a group of similar financial assets’

The decision on whether to apply the derecognition criteria to the entire financial asset or to a portion of it also refers to ‘a group of similar financial assets’. However, IFRS 9 does not further explain what is meant by a group of similar financial assets, and the IASB acknowledges that there is diversity in determining what constitutes such a group. It’s fairly common for non-derivative assets (e.g., loans) to be transferred along with derivative financial instruments (e.g., interest rate swaps). The IASB’s September 2006 update indicated that derecognition tests in IAS 39 (now in IFRS 9) should be applied separately to non-derivative financial assets (or groups of similar non-derivative financial assets) and derivative financial assets (or groups of similar derivative financial assets), even if they are transferred simultaneously. The IASB also noted that transferred derivatives that could be assets or liabilities (such as interest rate swaps) would have to pass both the financial asset and the financial liability derecognition tests. Nevertheless, as there is no binding interpretation addressing this issue, entities are free to develop their own accounting policies regarding this matter.

Consolidate all subsidiaries

It is worth mentioning that the derecognition decision tree starts with a reminder to consolidate all subsidiaries. While this might sound trivial, it’s possible that an arrangement for transferring financial assets to a third party could necessitate its consolidation under IFRS 10, and therefore, financial assets would remain in the consolidated financial statements.

Other accounting consequences

Recognition in profit or loss

When a financial asset is derecognised entirely, the difference between:

- carrying amount at the date of derecognition, and

- the consideration received

is recognised in profit or loss (IFRS 9.3.2.12).

Transferred asset is part of a larger financial asset

IFRS 9.3.2.13-14 and B3.2.11 outline the accounting procedures for a transaction in which the transferred asset is a part of a larger financial asset (for instance, when an entity transfers interest cash flows that are part of a debt instrument), and the transferred portion qualifies for complete derecognition.

Recognition of servicing asset or liability

In some transfers that qualify for derecognition, an entity retains the right (or obligation) to service the asset, such as collecting payments. In these instances, a servicing asset or liability could recognised, depending on whether the servicing fee is expected to adequately compensate the entity for the servicing duties (IFRS 9.3.2.10; B3.2.10).

Offsetting

If a transferred asset continues to be recognised, the asset and the associated liability cannot be offset against each other. Similarly, the entity cannot offset any income arising from the transferred asset with any expense incurred on the related liability (IFRS 9.3.2.22).

Non-cash collateral

IFRS 9.3.2.22 governs the accounting for non-cash collaterals provided by the transferor to the transferee.

Reassessment of derecognition

If an entity finds that it has transferred substantially all the risks and rewards of ownership of the transferred asset as a result of the transaction, it does not recognise the transferred asset again in a future period unless it reacquires the asset in a new transaction (IFRS 9.B3.2.6).

Examples illustrating derecognition of financial assets

IFRS 9.B3.2.16 presents numerous examples that demonstrate the application of derecognition principles. While some of these examples are instructive, others merely reiterate the requirements. See also the example covering factoring of trade receivables.

More about financial instruments

See other pages relating to financial instruments:

Scope of IAS 32

Financial Instruments: Definitions

Derivatives and Embedded Derivatives: Definitions and Characteristics

Classification of Financial Assets and Financial Liabilities

Measurement of Financial Instruments

Amortised Cost and Effective Interest Rate

Impairment of Financial Assets

Derecognition of Financial Assets

Derecognition of Financial Liabilities

Factoring

Interest-Free Loans or Loans at Below-Market Interest Rate

Offsetting of Financial Instruments

Hedge Accounting

Financial Liabilities vs Equity

IFRS 7 Financial Instruments: Disclosures