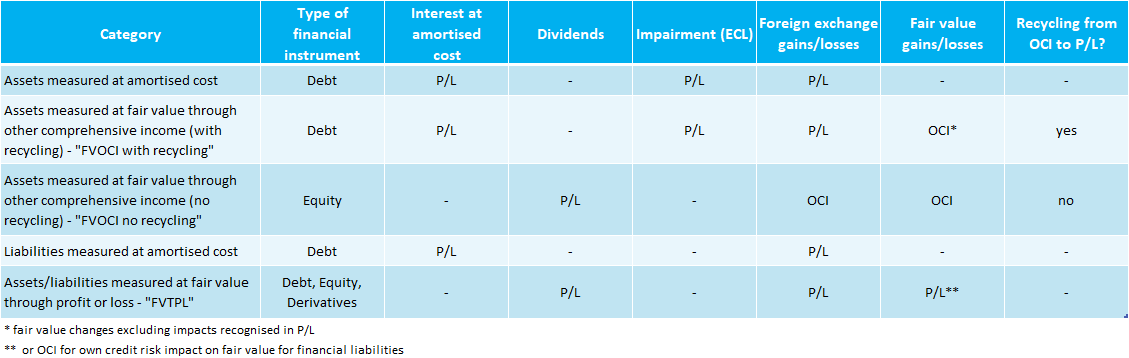

Following initial recognition, financial assets and liabilities are measured according to their classification. The table below summarises measurement requirements, which are elaborated further in the subsequent sections.

Assets measured at amortised cost

When assets are classified as measured at amortised cost, they’re accounted for using the effective interest method, with interest income recognised in P/L. These assets also undergo impairment losses which are recognised in P/L (IFRS 9.5.2.2) and are subjected to foreign currency translations, with gains or losses also recognised in P/L (IFRS 9.B5.7.2). Further information on the amortised cost and the effective interest method, complete with Excel examples, can be found in Amortised Cost and Effective Interest Rate.

Given that debt instruments are considered monetary items, they’re governed by the general provisions of IAS 21. First, the amortised cost is measured in the foreign currency of the item. This foreign currency amount is then converted to the functional currency, and any associated gains or losses are recognised in P/L (IFRS 9.B5.7.2; IFRS 9 IG.E.3.4).

--Are you tired of the constant stream of IFRS updates? I know it's tough! That's why I created Reporting Period – a once-a-month summary for professional accountants. It consolidates all essential IFRS developments and Big 4 insights into one readable email. I personally curate every issue to ensure it's packed with the most relevant information, delivered straight to your inbox. It's free, with no spam, and you can unsubscribe with just one click. Ready to give it a try?

Assets measured at fair value through other comprehensive income (with recycling) – ‘FVOCI with recycling’

As discussed in Classification, only debt investments qualify for the FVOCI with recycling category. For these instruments (IFRS 9.5.7.10-11):

- Interest, determined using the effective interest method, is recognised in P/L.

- Impairment losses (or gains) are recognised in P/L.

- Foreign exchange gains or losses (based on amortised cost) are recognised in P/L (IFRS 9.B5.7.2A).

- Fair value movements, excluding the impacts mentioned above, are recognised in OCI.

Interest and impairment calculations and their accounting are identical to those for assets measured at amortised cost. Therefore, the P/L impact for both categories is identical. However, assets in the FVOCI with recycling category additionally undergo remeasurements to fair value, with changes in fair value (excluding accrued interest, impairment, and foreign exchange effects) recognised in OCI (IFRS 9.5.7.10). Upon derecognition, cumulative gains or losses recognised in OCI are transferred to P/L as a reclassification adjustment.

For illustrative examples concerning the separation of currency components for assets measured at FVOCI with recycling, please see IFRS 9.IG.E.3.2.

Assets measured at fair value through other comprehensive income (no recycling) – ‘FVOCI (no recycling)’

As stated in Classification, this category pertains solely to equity investments. Fair value remeasurements are recognised in OCI and aren’t later recycled to P/L. Nevertheless, entities can transfer the cumulative gain or loss within equity (IFRS 9.5.7.5; B5.7.1). It’s noteworthy that there’s no P/L impact even upon disposal of the investment, as fair value remeasurement is mandated on the derecognition date as well (IFRS 9.3.2.12).

While IFRS 9 mandates that all equity instruments should be measured at fair value, there’s an acknowledgment that in certain scenarios, the cost might be a suitable estimate of fair value for unquoted equity instruments. This is particularly relevant when more recent information to measure fair value is unavailable, or when there is a broad range of potential fair value measurements, with cost representing the most accurate estimate within that spectrum. However, there are specific indicators suggesting that cost may not accurately reflect fair value. These include significant changes in the investee’s performance relative to budgets, plans, or milestones, substantial shifts in the market for the investee’s equity or its products, notable changes in the global economy or the economic environment impacting the investee, or internal issues within the investee. Importantly, it’s essential to note that cost is never the most accurate estimate of fair value for investments in quoted equity instruments (IFRS 9.B5.2.3-B5.2.6, BC5.18).

Dividends from equity investments designated at FVOCI are still recognised in P/L (IFRS 9.5.7.6), except when the dividend clearly represents a recovery of the investment’s cost (IFRS9.B5.7.1). Regrettably, IFRS 9 doesn’t provide further guidelines on how to discern this.

Given that equity investments are non-monetary items, foreign exchange impacts are factored into the fair value measurement and recognised in OCI (IFRS 9.B5.7.3; IFRS 9 IG.E.3.4).

Note that assets at FVOCI with no recycling aren’t subjected to the impairment requirements of IFRS 9 (IFRS 9.5.5.1).

Liabilities measured at amortised cost

Liabilities classified at amortised cost are measured using the effective interest method with interest expense and foreign exchange gains or losses recognised in P/L.

Assets and liabilities measured at fair value through profit or loss (‘FVTPL’)

As the name suggests, assets or liabilities at FVTPL are subsequently measured at fair value. Any gains or losses from such remeasurements are recognised in P/L (IFRS 9.5.7.1), with an exception pertaining to the impact of entity’s own credit risk on the fair value of liabilities (see below).

Changes in credit risk of a financial liability designated at FVTPL

If a financial liability designated at FVTPL undergoes changes in fair value due to the credit risk of that liability, these changes are recognised in OCI. These aren’t later transferred to P/L (IFRS 9.5.7.7(a); B5.7.9). However, should recognising in OCI cause or increase an accounting mismatch in P/L, all fair value adjustments are recognised directly in P/L (IFRS 9.5.7.8). A comprehensive explanation on accounting mismatch applicable to these requirements can be found in paragraphs IFRS 9.B5.7.5 -B5.7.7 and B5.7.10–B5.7.12 with an illustrative example in IFRS 9.B5.7.10.

Credit risk, as defined in Appendix A to IFRS 7, is essentially the risk of one party defaulting on their obligations, causing a financial loss for the other party. For a comprehensive discussion on credit risk of a liability, its effects, and how to determine changes in credit risk, refer to paragraphs IFRS 9.B5.7.13-20 and the illustrative examples in IFRS 9.IE1-IE5.

Loan commitments and financial guarantee contracts designated at FVTPL

For loan commitments and financial guarantee contracts designated at FVTPL, any change in their fair value is fully reflected in P/L, even if caused by changes in entity’s own credit risk (IFRS 9.5.7.9).

Interest income

The Interpretations Committee clarified that amortised cost accounting is not applicable to assets or liabilities at FVTPL. Thus, the line item comprising interest revenue calculated using the effective interest method presented under IAS 1.82(a) doesn’t include assets measured at FVTPL.

Dividend income

Dividends from financial assets at FVTPL are recognised in P/L as per IFRS 9.5.7.1A. It’s important to note that distribution of dividends might decrease the asset’s fair value. Entities must, therefore, re-evaluate their fair value measurements post dividend income recognition.

Impairment

Assets at FVTPL are exempt from the impairment requirements of IFRS 9 (IFRS 9.5.5.1).

Financial guarantee contracts

Financial guarantee contract is a contract that requires the issuer to make specified payments to reimburse the holder for a loss it incurs because a specified debtor fails to make payment when due in accordance with the original or modified terms of a debt instrument (IFRS 9.Appendix A). See also distinguishing financial guarantees from other guarantees and accounting for intra-group financial guarantees.

Financial guarantee contracts are subsequently measured by the issuer at the higher of (IFRS 9.4.2.1(c)):

- The amount of loss allowance as per IFRS 9’s impairment requirements.

- The initially recognised amount minus, if applicable, the cumulative amount of income recognised under IFRS 15.

This doesn’t apply if the financial guarantee is designated at FVTPL.

For a comprehensive guide on financial guarantee contracts, see this publication by KPMG.

Commitments to provide a loan at a below-market interest rate

Commitments to provide a loan at a below-market interest rate are subsequently measured by the issuer in the same way as financial guarantee contracts (IFRS 9.4.2.1(d)).

More about financial instruments

See other pages relating to financial instruments:

Scope of IAS 32

Financial Instruments: Definitions

Derivatives and Embedded Derivatives: Definitions and Characteristics

Classification of Financial Assets and Financial Liabilities

Measurement of Financial Instruments

Amortised Cost and Effective Interest Rate

Impairment of Financial Assets

Derecognition of Financial Assets

Derecognition of Financial Liabilities

Factoring

Interest-Free Loans or Loans at Below-Market Interest Rate

Offsetting of Financial Instruments

Hedge Accounting

Financial Liabilities vs Equity

IFRS 7 Financial Instruments: Disclosures